Hershey Company Holds Strong Against Mondelez’s Bid: What It Means for Investors

When you purchase a stock, you gain a partial ownership in a company. Though most people acquire small stakes, wealthy investors can buy enough shares to influence company decisions. Historical examples highlight how affluent individuals have taken control of major corporations.

However, for The Hershey Company (NYSE: HSY), the situation is unique. Ownership stakes are limited in influence due to the presence of the Hershey Trust Company, which retains control over the business. Recently, this trust told Mondelez International (NASDAQ: MDLZ) to withdraw its offer once again.

This week, Hershey’s stock price experienced notable fluctuations reminiscent of the popular Candymonium roller coaster at Hersheypark. Here’s an overview of the latest developments regarding Hershey’s share situation.

Hershey Rejects Mondelez Offer Again

On December 9, Hershey’s stock jumped after reports emerged that Mondelez had made a takeover proposal. Previously, in 2016, Mondelez attempted to acquire Hershey for $23 billion but faced rejection. Investors held out hope that negotiations might yield a different outcome this time; however, multiple reports indicated that Hershey once again rejected Mondelez’s interest, leading to a drop in its stock price.

Questions arose regarding the lack of a shareholder vote, a public statement from CEO Michele Buck, or the formation of a committee to examine the offer. It appears that Mondelez’s proposal did not advance sufficiently for any of these actions to take place, as approval from the Hershey Trust Company board was reportedly not secured.

Hershey has two classes of shares. The publicly traded Class A shares number around 200 million, currently priced at approximately $184 each. In contrast, there are nearly 55 million Class B shares that are not available for public trading. These Class B shares have ten votes each, while Class A shares only have one vote, giving control to the Hershey Trust Company.

Neither Mondelez nor Hershey provided official comments about the negotiations, so the specifics remain unclear. Ultimately, the Hershey Trust Company determined that Mondelez’s offer was insufficient.

Implication for Shareholders

While many may view Hershey favorably, Mondelez investors may be relieved that the acquisition did not materialize. Mergers and acquisitions can be quite complex, and when the price tag is substantial, such as Hershey’s market cap of around $36 billion, it complicates matters even further. This complexity would have made a successful acquisition difficult for Mondelez.

On December 11, Mondelez announced a new $9 billion stock buyback plan while shifting its focus to smaller acquisitions. For Hershey’s investors, the existence of the Hershey Trust Company serves as a source of stability. Business performance is rarely linear, and challenging times can attract opportunistic approaches.

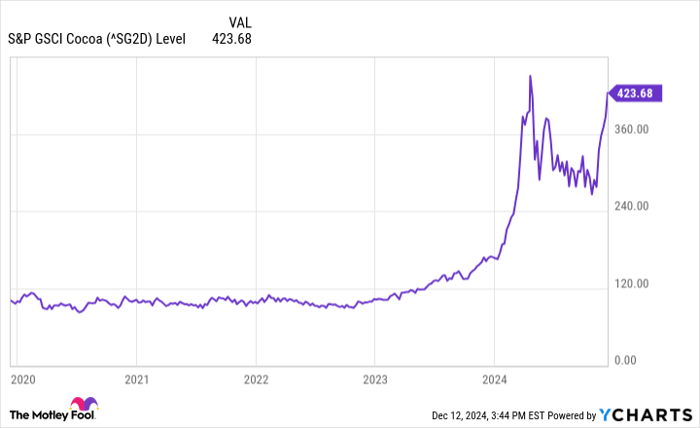

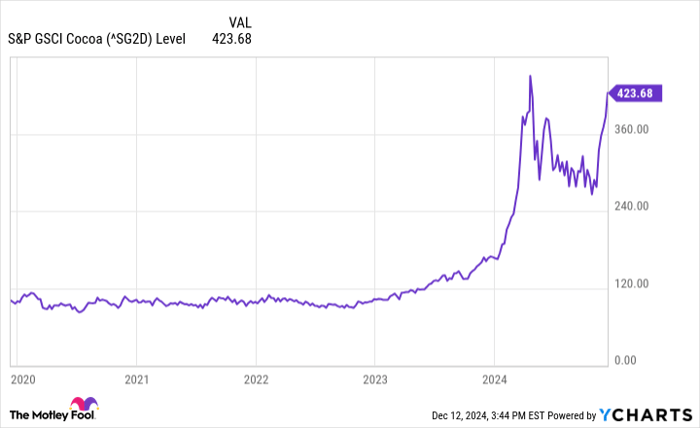

Currently, Hershey faces rising cocoa prices, a significant input cost for its products, alongside shifting consumer preferences due to the popularity of weight-loss medications and competition from new candy brands.

Data by YCharts.

Despite these challenges, Hershey maintains strong fundamentals, with annual sales of $11 billion and net income nearing $1.8 billion. The brand remains loved by consumers, although management may feel pressure to prioritize short-term gains during difficult times, which can affect long-term shareholder value.

Nevertheless, Hershey Trust Company’s role is to ensure a focus on long-term objectives. “Today, Hershey Trust Company stands alone as being the same company doing business in the same town for one hundred years. And their unique ownership structure virtually assures that they will continue doing business that way for the next 100 years,” the Trust noted.

While Hershey may not lead the stock market in performance by 2025, companies with a long-term perspective often achieve greater success. The Hershey Trust Company’s century-long outlook offers the company the necessary space to follow its strategic vision.

Don’t Miss This Investment Opportunity

Do you feel like you have missed opportunities to invest in successful stocks? You might want to pay attention to recent developments.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for firms they believe are poised for growth. If you’re concerned that you’ve missed your chance to invest, consider this your opportunity to make a move before it’s too late. The results are compelling:

- Nvidia: Investing $1,000 when we first recommended it in 2009 would now be worth $348,112!*

- Apple: A $1,000 investment from our 2008 recommendation would have grown to $46,992!*

- Netflix: A $1,000 investment from our 2004 recommendation would now be worth $495,539!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this may not be an opportunity you’ll encounter again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Hershey. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.