Shockwaves in AI Stocks as DeepSeek Unveils Game-Changing Model

Recent breakthroughs in artificial intelligence (AI) technology have significantly impacted tech stocks, setting the stage for a tense market. With hefty investments from leading tech firms, advancements in AI have promised productivity boosts. However, a Chinese startup named DeepSeek has disrupted this norm, leading to a sharp decline in key AI stocks.

Market Reaction to DeepSeek’s Disruption

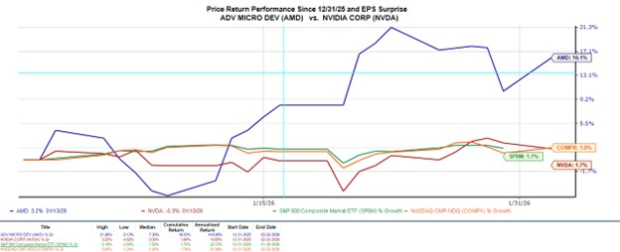

On Monday, the announcement from DeepSeek caused significant turbulence. Major AI-focused companies took a hit: chipmaker Nvidia (NASDAQ: NVDA) plummeted 17.3%, semiconductor firm Broadcom (NASDAQ: AVGO) fell 16.4%, while Microsoft (NASDAQ: MSFT) and Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) saw declines of 3.8% and 2.8%, respectively, as of 11:43 a.m. ET.

Introducing DeepSeek’s R1 Model

DeepSeek, a one-year-old company based in China, recently rolled out its new AI model named R1. This model has already earned recognition, reportedly ranking among the top 10 AI models globally. Its surprising success stems from utilizing older, less powerful processors at a significantly lower cost compared to its competitors.

The company’s innovative training method involves reinforcement learning, or reward-driven optimization, which may offer an advantage in refining problem-solving strategies compared to traditional methods. Unlike many AI systems that operate like “black boxes,” R1 provides transparency, showing the rationale behind its conclusions.

Marc Andreessen, a prominent venture capitalist, amplified the excitement over DeepSeek’s breakthrough by praising R1 on X (formerly Twitter), describing it as “one of the most amazing and impressive breakthroughs I’ve ever seen.” While industry experts acknowledge that R1’s capabilities still fall short of models from OpenAI and Alphabet, being able to use lower-cost chips has shaken the foundations of AI technology.

What This Means for the AI Industry

The fall of AI stocks highlights potential ramifications for the industry:

- Nvidia is highly regarded for its graphics processing units (GPUs), dominating approximately 98% of the data center GPU market, according to TechInsights. The emergence of successful AI models on cheaper chips could jeopardize Nvidia’s market leadership.

- Broadcom provides crucial networking products that support chips in data centers. If the high demand for powerful chips declines, Broadcom’s related sales could be affected.

- Microsoft, which significantly invested in AI through a $13 billion stake in OpenAI, recently committed $80 billion for data centers. A shift towards cheaper alternatives may lead to reduced sales from Microsoft’s offerings.

- Like Microsoft, Alphabet has heavily invested in next-gen AI models for Google Cloud. A move towards less expensive options could impact Alphabet’s financial outcomes.

Despite the downturn, Dan Ives, a seasoned analyst at Wedbush, termed the market’s response a “golden buying opportunity,” noting that many claims from DeepSeek remain unverified. He remarked that U.S. Global 2000 companies are unlikely to pivot to a Chinese startup for their AI needs, implying minimal threat to established companies.

Many of these stocks are facing heightened valuations; for instance, before the recent trading day, Nvidia, Broadcom, and Microsoft had price-to-earnings (P/E) ratios of 200, 56, and 37, respectively, while Alphabet was relatively cheaper at 27 times earnings. Following the declines, their forward valuations adjusted to 41, 33, 33, and 22 times earnings, indicating they’re not as costly as they seem.

The generative AI space is still in its early stages, and the abrupt market reaction serves as a reminder of the need for careful evaluation. These companies boast strong historical performances, and strategic investors will likely wait for more clarity before making hasty decisions.

Investment Considerations for Nvidia

Before purchasing Nvidia stock, it is wise to consider this:

The Motley Fool Stock Advisor team recently identified the 10 best stocks for investment opportunities, and Nvidia was not among them. The selected stocks are predicted to deliver strong returns in the upcoming years.

If you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, you would have seen your investment grow to approximately $874,051!

Stock Advisor offers a comprehensive strategy for investor success, featuring portfolio-building guidance, regular updates from analysts, and two new stock picks each month. Since its inception, the Stock Advisor service has notably outperformed the S&P 500 by more than quadrupling its returns since 2002.

Discover more about investment opportunities »

*Stock Advisor returns as of January 27, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Microsoft, and Nvidia. The Motley Fool recommends Broadcom and has specific options positions related to Microsoft. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.