Investors Race for SpaceX: Opportunities in Private Funds

SpaceX, a leading private aerospace company, has gained unprecedented attention from investors ready to capitalize on its promising ventures. Similar to other groundbreaking startups, SpaceX has opted to stay private, resulting in strong financial backing from institutional investors.

Investing in SpaceX shares is challenging for most retail investors as they do not trade on stock exchanges. As a result, individual investors are exploring other avenues to gain exposure to this high-profile company.

A relatively obscure ETF has seen its assets more than double after incorporating SpaceX, while a closed-end fund has experienced extreme fluctuations in its trading value, currently sitting at a significant premium over its underlying assets. This article examines the various fund options available to retail investors interested in SpaceX.

The Allure of SpaceX

Founded by Elon Musk in May 2002, prior to his involvement with Tesla, SpaceX has established a near-monopoly on rocket launches. According to The Wall Street Journal, the company delivers unmatched launch frequency and cost efficiency compared to its competitors.

SpaceX’s valuation soared to around $350 billion, up from about $210 billion in June 2024, following the remarkable achievement of catching a heavy booster rocket with sophisticated mechanical arms.

Starlink, SpaceX’s satellite-internet division, is thought to be a lucrative venture, although specific financial details remain unclear. Traders speculate that increased government contracts may be on the horizon due to Musk’s connections with President Trump, who has previously expressed ambitions to send astronauts to Mars.

Baron Mutual Funds Positioning Themselves

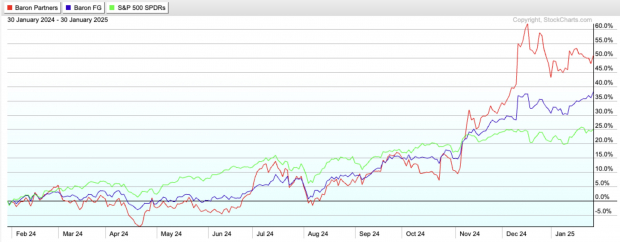

Renowned investor Ron Baron has shown unwavering support for Musk, consistently purchasing SpaceX shares for his mutual funds since 2017. As of December 31, 2024, the Baron Partners Fund (BPTRX) has invested 15% of its total assets in SpaceX, while the Baron Focused Growth Fund (BFGFX) holds 11% of its net assets in the company. Over the past year, these funds have returned 51% and 38%, respectively, far exceeding the S&P 500’s 25% growth.

Tesla ($TSLA) is the top holding in both funds, which have performed significantly better than their benchmarks since their inception.

Image Source: Stockcharts

Destiny Tech 100 Fund: A Risky Venture

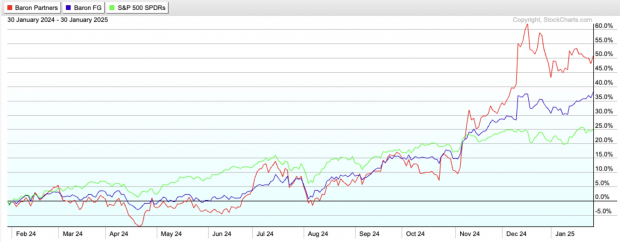

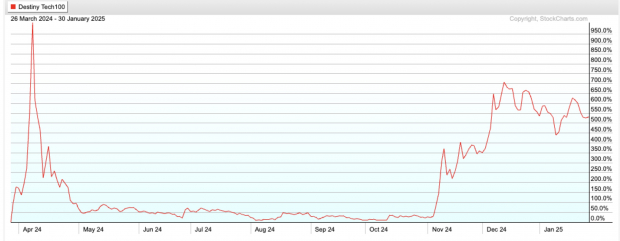

The Destiny Tech 100 (DXYZ) is a closed-end fund aiming to invest in leading venture-backed tech companies. SpaceX comprises a substantial 37% of its portfolio. While the fund has grown over 500% since launching in March last year, its performance has been highly volatile and it often trades at a substantial premium to its net asset value (NAV).

After an initial surge of over 1,000%, driven by investor speculation, the fund saw a sharp decline, losing much of its value. As of September 30, 2024, DXYZ reported an NAV of $5.32 per share, but it was trading at over $55 per share. The premium could still approach 1,000%, despite the recent fluctuations.

Investors should be aware that closed-end funds can deviate significantly from NAV based on market demand, unlike ETFs and traditional mutual funds.

Image Source: Stockcharts.com

ARK Venture Fund: Balancing Risks and Returns

Launched in September 2022, Cathie Wood’s ARK Venture Fund (ARKVX) is a closed-end interval fund focusing on both public and private enterprises. As of December 31, 2024, SpaceX represents about 16% of its assets. It also holds investments in well-known startups such as Epic Games and OpenAI, with private companies comprising around 83% of the total portfolio.

In the past year, the fund has risen about 11%. However, with an overall return of approximately 19% since inception, it has lagged behind the S&P 500, which earned a 26% return.

As with other closed-end interval funds, ARKVX allows investors to redeem a limited number of shares each quarter during specified windows.

XOVR ETF: A New Approach to Private Investments

The Entrepreneur Private-Public Crossover ETF (XOVR) is the inaugural ETF to include a private company in its holdings. After a strategy shift in August, the fund added SpaceX through a special-purpose vehicle (SPV). However, the costs associated with these SPVs can be high, potentially impacting the ETF’s position in SpaceX.

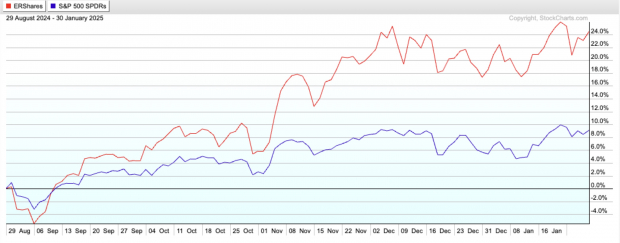

Currently, XOVR has approx. $300 million in assets and charges an expense ratio of 0.75%. Following its strategy change, the ETF has yielded about 24%, while the S&P 500 recorded a 9% gain.

Notable holdings besides SpaceX include NVIDIA ($NVDA), Alphabet ($GOOGL), and Meta Platforms ($META). The value of the SpaceX position has dipped slightly to 12.3% due to new inflows.

Image Source: stockcharts

Future Prospects for Private Asset ETFs

As the private asset market grows, major investment firms are eager to make these assets accessible to retail investors. However, incorporating illiquid assets into ETFs presents challenges, especially regarding valuation and liquidity.

The SEC imposes a 15% cap on open-ended funds holding illiquid assets, classifying investments that cannot be sold within seven days without significant loss as illiquid.

BlackRock, the largest asset manager globally, is heavily investing in private markets, committing nearly $28 billion to acquire multiple private equity ventures. Meanwhile, State Street is working with Apollo Global to establish a public-private credit ETF, which aims to address the difficulties surrounding the valuation of private assets.

Despite these hurdles, ETFs have fostered accessibility to markets that were once off-limits. The industry thrives on innovation, and many investors value the ETF structure for its benefits. It is expected that the market will find ways to effectively value these elusive assets, paving the way for more private asset ETFs in 2025.

Stay Updated on Key ETF Insights

Zacks’ free Fund Newsletter offers weekly updates on top news, analyses, and information about high-performing ETFs.

Want the latest recommendations from Zacks Investment Research? Download the report titled “7 Best Stocks for the Next 30 Days” for free.

Tesla, Inc. ($TSLA) : Free Stock Analysis Report

Alphabet Inc. ($GOOGL) : Free Stock Analysis Report

Get Your Free (BPTRX): Fund Analysis Report

Get Your Free (BFGFX): Fund Analysis Report

Meta Platforms, Inc. ($META) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views and opinions expressed herein are the opinions of the author and do not necessarily reflect those of Nasdaq, Inc.