Analyst Targets Indicate Potential Growth for Vanguard Russell 1000 ETF

Our analysis from ETF Channel looks at the performance of the Vanguard Russell 1000 ETF (Symbol: VONE) in relation to analysts’ predictions, revealing promising upside potential.

Current trading for VONE stands at $264.88 per unit, while analysts project an average 12-month target price of $303.94 per unit. This represents a potential upside of 14.75% based on the analysts’ expectations. Some of VONE’s key underlying holdings that show significant upside potential include Loar Holdings Inc (Symbol: LOAR), nCino Inc (Symbol: NCNO), and FNB Corp (Symbol: FNB).

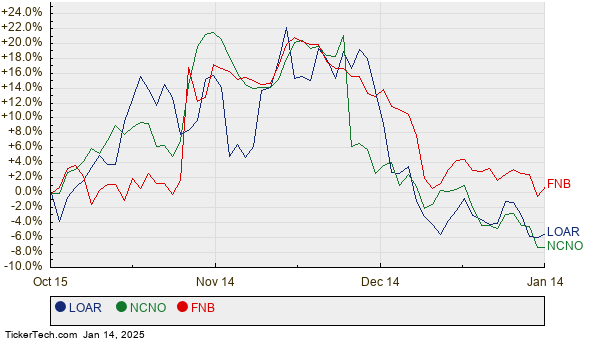

Loar Holdings Inc trades at a recent price of $72.99, yet analysts believe it could climb to $96.00 per share—an increase of 31.52%. Similarly, nCino Inc, currently at $32.54, has an average target price of $42.25, indicating a potential gain of 29.84%. FNB Corp also shows promise, with a recent price of $14.46 and an expected target of $18.75, which reflects a potential upside of 29.67%. A comparative chart illustrates the performance of these stocks over the past year:

Below is a summary table detailing the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Russell 1000 ETF | VONE | $264.88 | $303.94 | 14.75% |

| Loar Holdings Inc | LOAR | $72.99 | $96.00 | 31.52% |

| nCino Inc | NCNO | $32.54 | $42.25 | 29.84% |

| FNB Corp | FNB | $14.46 | $18.75 | 29.67% |

Are analysts providing realistic targets, or are they overly optimistic? While high price targets can reflect confidence in future growth, they may also lead to price downgrades if they do not consider recent developments. Investors should research these targets further before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Yield Charts

• CNA Options Chain

• Institutional Holders of SILC

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.