In our recent analysis of various ETFs, we examined the trading prices of individual holdings against their average analyst target prices. Our focus on the iShares Paris-Aligned Climate MSCI USA ETF (Symbol: PABU) reveals an implied analyst target price of $74.02 per unit.

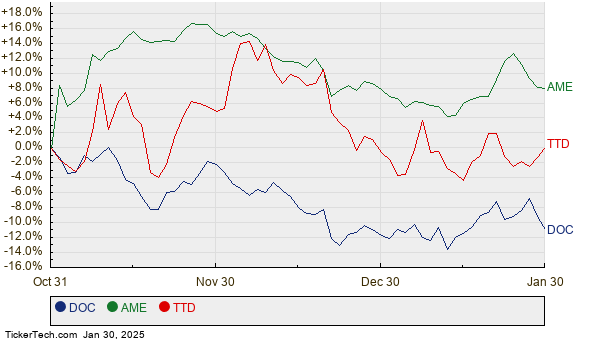

PABU currently trades around $65.70 per unit, indicating a potential upside of 12.66% based on analysts’ average forecasts for its underlying holdings. Significant upside can be found in three of its holdings: Healthpeak Properties Inc (Symbol: DOC), AMETEK Inc (Symbol: AME), and The Trade Desk Inc (Symbol: TTD). Healthpeak shares recently traded at $20.21, while the average analyst target sits 23.54% higher at $24.97. Similarly, AMETEK, priced at $182.52, has a target of $206.08, suggesting a 12.91% upside. For The Trade Desk, which currently trades at $122.59, the average forecast of $138.33 implies an upside of 12.84%. Below, find a twelve-month price history chart depicting the stock performance of DOC, AME, and TTD:

Here’s a summary table of the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Paris-Aligned Climate MSCI USA ETF | PABU | $65.70 | $74.02 | 12.66% |

| Healthpeak Properties Inc | DOC | $20.21 | $24.97 | 23.54% |

| AMETEK Inc | AME | $182.52 | $206.08 | 12.91% |

| The Trade Desk Inc | TTD | $122.59 | $138.33 | 12.84% |

Are analysts correct in their targets, or are they overly optimistic about future stock performance? Valid concerns arise regarding whether these projections align with recent developments in companies and their industries. A high target relative to a stock’s current trading price can suggest optimism but may also hint at possible downgrades if targets no longer reflect current realities. Investors should weigh these questions carefully in their research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Office Supplies Dividend Stocks

• PIAI shares outstanding history

• Funds Holding HZNP

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.