Analysts Predict Significant Upside for JPMorgan Market Expansion Enhanced Equity ETF

In our latest analysis at ETF Channel, we examined the trading prices of holdings within various ETFs. We specifically focused on the JPMorgan Market Expansion Enhanced Equity ETF (Symbol: JMEE) and calculated the weighted average implied analyst target price for the ETF, which stands at $71.51 per unit.

Current Market Position and Upside Potential

Currently, JMEE is trading at approximately $61.81 per unit. This suggests that there is a potential upside of 15.69%, according to analysts’ average targets for its underlying holdings. Notably, three of JMEE’s holdings show particularly high upside to their analyst target prices:

Highlights of Promising Holdings

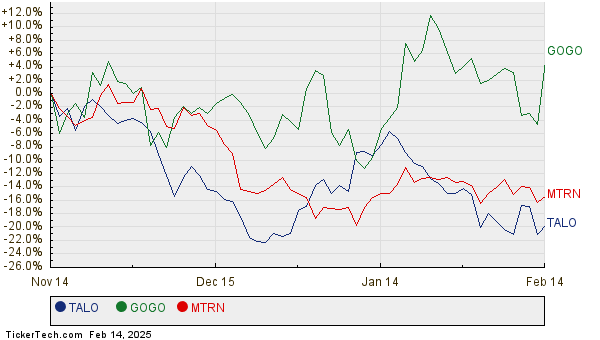

Talos Energy Inc (Symbol: TALO) has a recent trading price of $9.39 per share, while analysts have a target of $15.85, indicating an upside potential of 68.80%. Similarly, Gogo Inc (Symbol: GOGO) is priced at $8.52 with a target price of $12.75, representing a possible increase of 49.65%. Finally, Materion Corp (Symbol: MTRN) is currently at $99.14 and is expected to rise to $140.67, a target that reflects an increase of 41.89%. Below is a comparison chart showing the past twelve months of stock performance for TALO, GOGO, and MTRN:

Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| JPMorgan Market Expansion Enhanced Equity ETF | JMEE | $61.81 | $71.51 | 15.69% |

| Talos Energy Inc | TALO | $9.39 | $15.85 | 68.80% |

| Gogo Inc | GOGO | $8.52 | $12.75 | 49.65% |

| Materion Corp | MTRN | $99.14 | $140.67 | 41.89% |

Evaluating Analyst Predictions

As we consider these target prices, one must ask: are analysts justified in their optimistic outlook, or are they overly hopeful about the future? Analyst targets can act as markers of expected growth, but they may also face downgrades if they no longer align with current market trends or company performance. Investors are encouraged to conduct thorough research to understand these dynamics better.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Dividend Growth Stocks

INPX Split History

IYM Options Chain

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.