Analyzing the Invesco S&P SmallCap 600 Revenue ETF: Potential Upside Ahead

Through an evaluation of the underlying holdings in the ETFs we monitor at ETF Channel, we have measured the current trading prices against the average 12-month target prices set by analysts. This analysis led to a calculated implied target price of $54.69 per unit for the Invesco S&P SmallCap 600 Revenue ETF (Symbol: RWJ).

Current Price and Analyst Outlook for RWJ

Presently, RWJ is trading around $45.91 per unit, suggesting analysts anticipate a 19.13% increase based on their forecasts for the ETF’s underlying assets. Among RWJ’s holdings, three are notable for their projected gains: Fox Factory Holding Corp (Symbol: FOXF), Balchem Corp. (Symbol: BCPC), and Tripadvisor Inc (Symbol: TRIP). Specifically, FOXF is currently priced at $30.17/share, while analysts have set an average target of $38.71/share, reflecting an expected upside of 28.32%. Likewise, BCPC is trading at $159.08 and has a target of $198.00, indicating a potential rise of 24.47%. Tripadvisor Inc, with a recent price of $15.02, has an anticipated target of $18.59, suggesting a 23.75% increase.

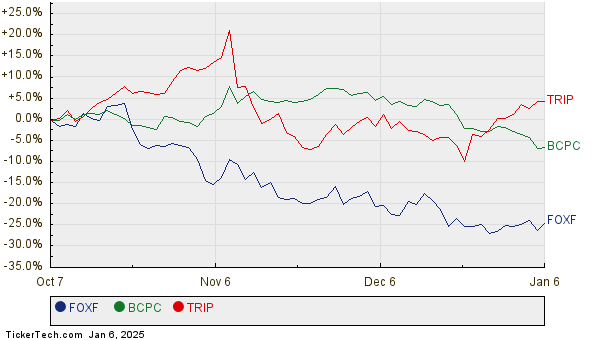

Comparative Performance of Recommended Stocks

Below, you’ll find a chart showcasing the 12-month price performance of FOXF, BCPC, and TRIP:

Analyst Target Price Summary

The following table summarizes the current analyst target prices for each discussed holding:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P SmallCap 600 Revenue ETF | RWJ | $45.91 | $54.69 | 19.13% |

| Fox Factory Holding Corp | FOXF | $30.17 | $38.71 | 28.32% |

| Balchem Corp. | BCPC | $159.08 | $198.00 | 24.47% |

| Tripadvisor Inc | TRIP | $15.02 | $18.59 | 23.75% |

Considering Analyst Predictions

Are analysts accurate in their predictions or perhaps too optimistic about these stocks’ future performance? Investors must consider whether the analysts have valid grounds for their targets or if they may be outdated due to recent developments in the companies and their respective industries. High price targets often reflect positive expectations but may also lead to downgrades if those expectations are not met. Investors would benefit from conducting further research into these questions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• SPR Videos

• Funds Holding USTB

• FICV market cap history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.