Schwab U.S. Large-Cap Growth ETF: A Consistent Performer for Long-Term Investors

The Schwab U.S. Large-Cap Growth ETF (SCHG) may seem straightforward, but its approach to investing in large-cap U.S. growth stocks has proven successful. With a market cap of $36.5 billion, SCHG has established itself as a strong contender in the ETF space.

Understanding the SCHG ETF Strategy

SCHG follows a simple investment strategy. According to Charles Schwab (SCHW), it is a “straightforward, low-cost fund offering potential tax efficiency,” providing easy access to large-cap U.S. equities that exhibit growth characteristics.

Strong Long-Term Performance

This simplicity has been effective. SCHG has outperformed the broader market for several years. As of October 31, the Vanguard S&P 500 (VOO) reported an annualized return of 9.0% over the past three years. Meanwhile, SCHG surpassed this with a 9.3% annualized return during that same period.

When looking at a five-year horizon, SCHG’s success becomes even more evident. While VOO delivered an impressive annualized return of 15.2%, SCHG achieved a remarkable 19.7%. Over the last decade, SCHG maintained its lead with an annualized return of 16.1%, compared to VOO’s 13.0%.

Though past performance is not a guarantee of future success, consistently beating the S&P 500 over three, five, and ten years is a noteworthy achievement. It’s a strong indicator for investors to consider remaining with such long-term winners.

Decade of Wealth Creation

This strong performance translates into substantial wealth for investors. For instance, someone who invested $100,000 in SCHG a decade ago would see their investment grow to $431,580 today.

Portfolio Highlights

SCHG provides diverse exposure to top large-cap U.S. growth stocks, holding a total of 228 stocks. Its top ten holdings comprise 54.5% of the portfolio.

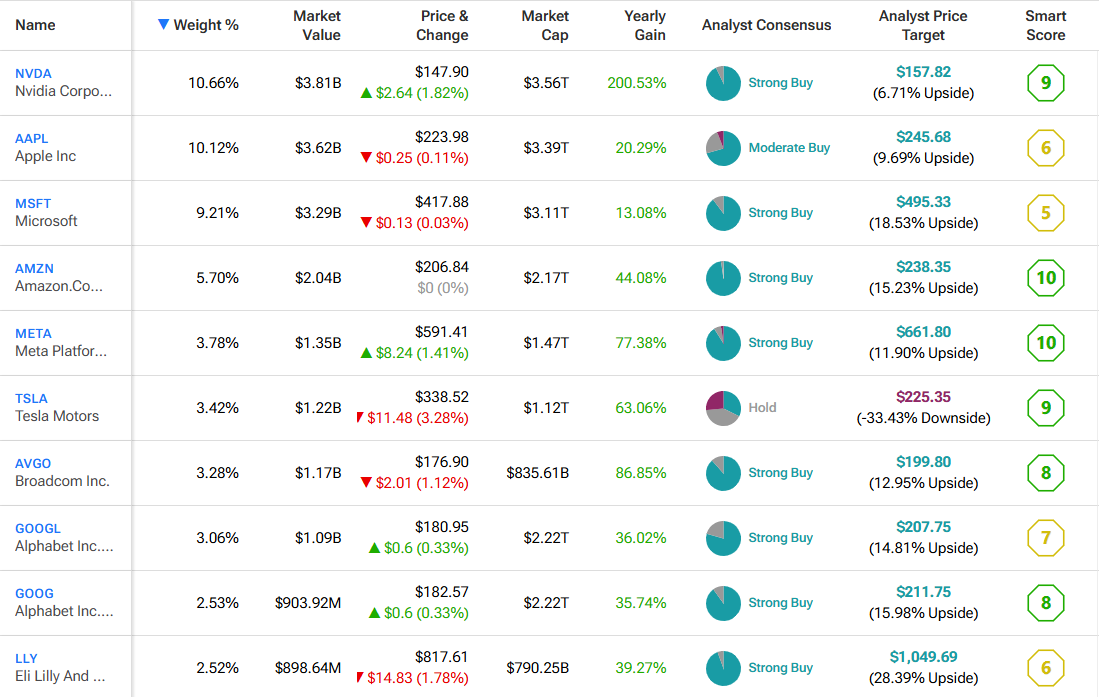

According to TipRanks, SCHG’s top ten holdings include major players like Nvidia (NVDA), which accounts for 10.7% of the portfolio and has seen a 200% increase over the past year. Other notable names include Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Meta Platforms (META), Tesla (TSLA), Broadcom (AVGO), and Alphabet (GOOGL) (GOOG), positioning investors in a range of sectors leading current market trends.

Additionally, many of these stocks have received high ratings from TipRanks’ Smart Score system. Stocks with a score of eight to ten are seen as outperformers; notable holdings like Amazon and Meta have perfect scores, with SCHG itself receiving a Smart Score of 8 out of 10.

Cost-Efficient Investment

Investors will find that SCHG comes at a very low cost, charging an expense ratio of just 0.04%. For a $10,000 investment, this amounts to only $4 in fees per year. Over time, these savings can significantly boost returns. For example, if SCHG maintains this fee structure and delivers a 5% annual return, the fees for the same investor will only be $51 over the next decade.

Understanding Stock Splits

Interestingly, SCHG recently underwent a 4-for-1 split. While stock splits are common among stocks, they are less frequent for ETFs. A split does not alter the total value held by a shareholder; owning four shares at $25 each is equivalent to holding one share at $100.

Notably, many high-profile stocks, such as Nvidia (NVDA) and Chipotle (CMG), have announced splits to make their shares more accessible to retail investors. Prior to its October 10 split, SCHG traded around $105, making the necessity for a split less apparent. However, it can aid in broadening the shareholder base and enhancing liquidity.

Key Risks to Consider

A critical risk for SCHG includes high valuations among its large holdings. The ETF has a price-to-earnings ratio of 37.0, which is much higher than the overall market. However, SCHG features some of the most innovative companies, known for consistently increasing their earnings power, helping to mitigate valuation concerns over the long term.

Investors should also remember that they don’t need to invest everything in SCHG at once. They can initiate a position and gradually add to it over time, making it a versatile component of a balanced investment portfolio.

Analysts’ Ratings on SCHG

On Wall Street, SCHG has earned a Strong Buy consensus rating from analysts. In the past three months, there have been 194 Buy ratings, 34 Holds, and just one Sell rating. The average target price for SCHG stands at $30.17, suggesting an upside potential of 8.32%.

Your Top Investment Option

In conclusion, SCHG appears to be a solid long-term investment and an excellent building block in investors’ portfolios. This fund encompasses a diverse array of the nation’s leading large-cap growth stocks while charging minimal fees. Its history of outperforming the S&P 500 over significant periods makes it a worthy consideration for any investment strategy.

Disclosure

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.