The Future of Nvidia: More Growth Ahead?

It’s common for investors to feel they’ve missed out after a stock spikes. For instance, shares of Nvidia (NASDAQ: NVDA) have more than tripled in the past year, which might lead to that feeling.

While previous performance doesn’t guarantee future success, it also doesn’t prevent potential returns. Nvidia is involved in more than just selling advanced artificial intelligence (AI) chips that have contributed to its soaring revenue. Ongoing investments in Nvidia stock could still pave the way for future financial gains.

A Diversified Growth Story

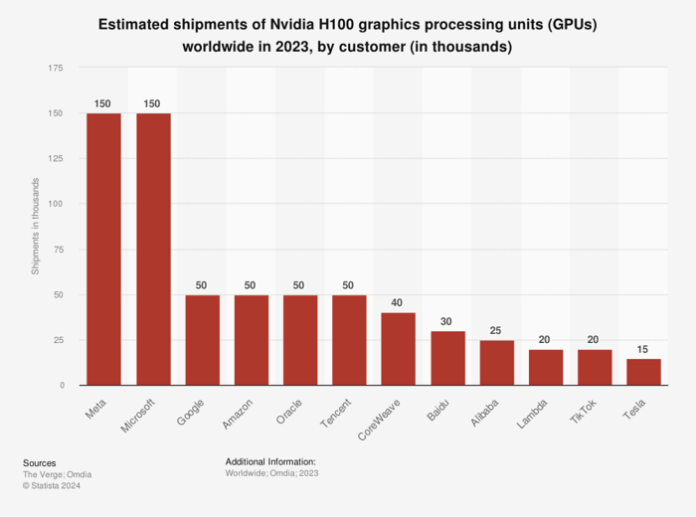

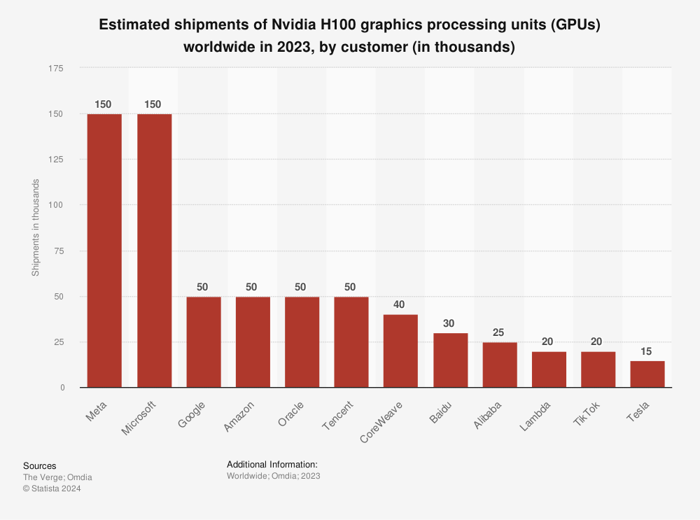

A significant part of Nvidia’s recent revenue stems from the high demand for GPUs (graphics processing units) as companies build AI data centers. In fiscal 2024, which ended on January 28, 2024, Nvidia’s sales soared 126% to surpass $60 billion, largely thanks to major growth tech firms.

Image source: Statista.

Despite this impressive growth, there is a noteworthy concentration of customers. The U.S. leads the world in new data centers, boasting nearly 5,400 as of March 2024, while Germany, the United Kingdom, and China follow with around 500 each. In contrast, India, the world’s most populous country, has only 152.

Nvidia’s CEO Jensen Huang aims to partner with India’s top industrial and technology firms to place the country at the forefront of this new industrial revolution, using “data to create models generating and producing intelligence at scale for various industries.”

Eyes on the Indian Market

At a recent event in late October, Huang spoke with Mukesh Ambani of Reliance Industries, which spans sectors such as energy, retail, telecommunications, and digital services. Huang envisions transforming India, a nation of nearly 1.5 billion people, into a hub for AI technology.

Huang highlighted that Nvidia employs over 10,000 engineers in India and is considering semiconductor chip production in the country. A partnership with Reliance is already in motion to develop AI infrastructure there.

Focusing on India makes sense for Nvidia, as the nation has vast amounts of data and a large user base. However, many investors seem to be fixated on Nvidia’s existing GPU clients, potentially missing out on India’s vast market potential.

Still Time to Invest

Investors lucky enough to have held Nvidia stock have enjoyed significant portfolio returns. Yet, for those who haven’t invested or want to increase their shares, there’s still an opportunity to buy Nvidia stock.

Analyst Harsh Kumar from Piper Sandler recently expressed confidence in Nvidia’s growth potential. He issued a ‘buy’ rating, citing Nvidia’s “dominant positioning in AI accelerators” and the launch of the Blackwell architecture. He believes Nvidia is well-positioned to capture most of the increasing total addressable market while minimally impacting its chip competitors.

It’s important not to dwell on Nvidia’s past performance over the last year. Adding to positions or initiating a new investment could still enhance an investor’s journey toward building a million-dollar portfolio.

Another Opportunity Awaits

Feeling like you missed the chance to invest in successful stocks? This could be your moment.

Occasionally, our expert analysts suggest “Double Down” stock recommendations for companies poised for growth. If you’re concerned about missing your opportunity, now may be the best time to act. The numbers back this up:

- Amazon: A $1,000 investment in 2010 would now be worth $24,113!*

- Apple: If you invested $1,000 in 2008, it would now be $42,634!*

- Netflix: A $1,000 investment in 2004 could yield $447,865!*

Currently, we are announcing “Double Down” alerts for three noteworthy companies, and opportunities like this may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

Howard Smith has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and may not reflect the views of Nasdaq, Inc.