“`html

Trump’s Policies May Propel Stock Market Gains: A Cautious Outlook

Recent developments have sparked renewed optimism for stock growth in the next year.

Let’s dive into the two main factors that influence a stock’s price: earnings and investor sentiment. These elements contribute to the price-to-earnings ratio (PE), a key metric in valuing stocks.

Throughout the past year, readers of Digest have noted numerous valuation indicators showing that stock market increases have largely been driven by investor sentiment more than earnings.

If this bull market is to continue, today’s high valuations will eventually need backing from increased earnings, which would help alleviate the pressures from elevated sentiment-driven prices.

Without improvement in earnings, stock values could decline if investors begin to feel they are overpaying for limited returns, prompting sell-offs.

So, what’s behind the recent optimism for stocks?

It’s largely linked to former President Trump.

Specifically, his proposals for corporate tax cuts and deregulation play a crucial role.

Impact of Tax Cuts on Corporate Profits

While it’s not guaranteed, with Trump in the White House, a Republican Senate, and the potential for Republican control in the House, his plan to reduce corporate tax rates from 21% to 15% seems feasible.

This means corporate profits could surge without having to sell additional products.

As reported by The Wall Street Journal:

In 2018, following the implementation of Trump’s initial tax cuts, the S&P 500’s earnings-per-share (EPS) rose by 21%, a significant jump compared to the 11% growth the year before…

Some Wall Street analysts believe another round of tax cuts could result in an EPS increase of between 5% and 10%.

Deregulation may offer even greater benefits for earnings and growth.

Many business leaders argue that high taxes and strict regulations are problematic, with regulation often viewed as the bigger issue.

For instance, here’s what was said in Insights from Stanford Business School in 2017:

Jamie Dimon, the CEO of JPMorgan Chase, stated that excessive regulation and taxation have stunted U.S. GDP growth…

He argued that many small businesses never came to fruition due to government restrictions.

Elon Musk, CEO of Tesla, has likened excessive regulation to carrying heavy stones in a backpack.

Looking to Europe for examples, Ericsson’s CEO, Börje Ekholm, commented that regulation could render the region irrelevant.

In this context, AP News reported:

The president-elect aims to lessen the influence of federal regulations across various economic sectors, viewing regulatory reductions as vital for economic growth.

He promises to lower utility costs for U.S. households by easing fossil fuel production all while launching housing construction by diminishing regulatory requirements, and combating “frivolous environmental lawsuits.”

According to Thomson Reuters:

Deregulation is anticipated to be a significant trend affecting various sectors including energy and finance.

In essence, fewer regulations can lead to higher profits for U.S. corporations by cutting compliance costs or increasing revenue opportunities in a freer market.

Both scenarios could drive up earnings per share, potentially increasing market returns.

Shifts in Investor Sentiment

Following Trump’s election, investors have embraced a “risk-on” mentality, shifting funds from bonds to stocks.

Recently, Lucas Downey, a quant specialist at TradeSmith, shared insights on the stock market response:

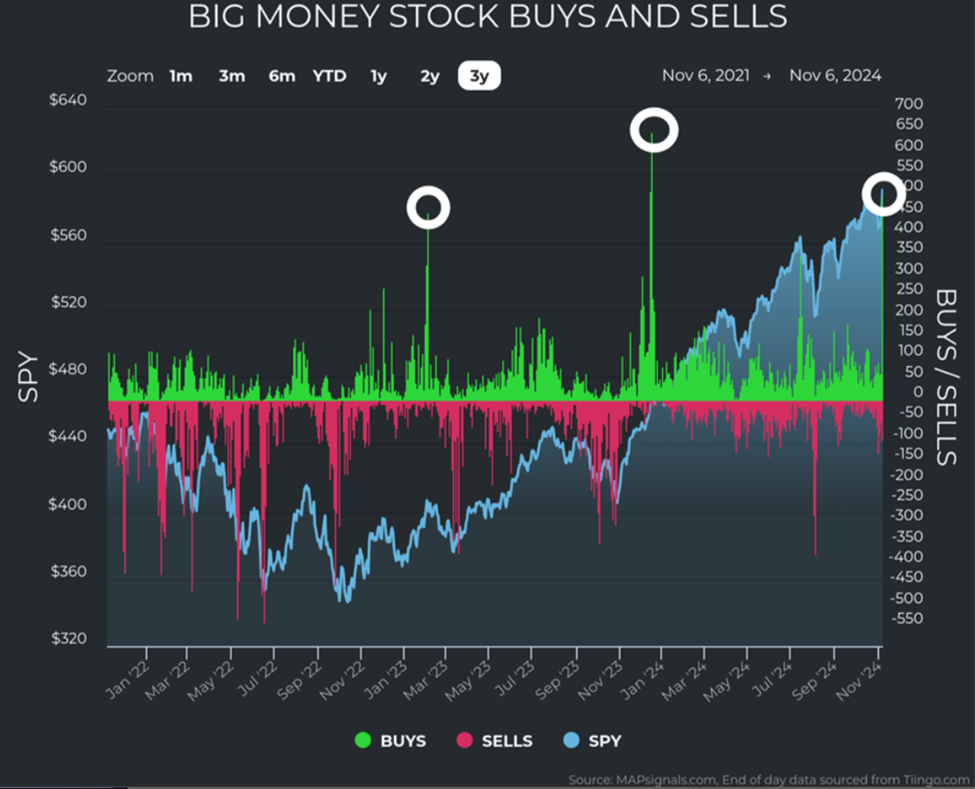

Yesterday’s substantial rally saw record inflows, with 486 stocks being purchased—the fifth highest buying day recorded since 2009.

Source: MAPsignals.com

Consider the asset managers who accommodate nervous clients in bonds, and the investors sitting on cash.

Post-election and with expectations of lower taxes, deregulation, increased government spending, and possible inflation, many of these managers might feel pressured to shift clients’ investments into stocks.

After all, it’s often said that investors dread underperforming the market even more than they fear underperforming their neighbors.

A market pullback may be necessary following this surge, but a surge driven by FOMO into stocks seems likely as we move into the holiday season.

Stay Alert Amid Market Opportunities

While the prospect of market growth is exciting, a defensive strategy remains crucial for protecting wealth. Experts have long emphasized the importance of defense over offense.

- Charles Ellis stated: “If you avoid large losses with a strong defense, the winnings will have every chance to become permanent.”

“`

Market Forecast: The Potential Impact of Trump’s Economic Policies

Understanding the Risks Ahead for Stock Investors

- Benjamin Graham: “The essence of investment management is the management of risks, not the management of returns.”

- Paul Tudor Jones: “Don’t focus on making money; focus on protecting what you have.”

A pressing question for investors is: what risks could arise from a potential economic surge under Trump?

The answer lies in interest rates and Treasury yields.

This past Wednesday, financial analyst Luke Lango shared a detailed 10-point guide about the market’s probable trajectory during Trump’s second term. Although he’s optimistic, he highlights the 10-year Treasury yield as a crucial factor that may hinder stock market growth.

According to Luke:

“The future of interest rates and Treasury yields is quite uncertain and will largely depend on inflation trends in the coming months.”

“If Trump’s pro-economic and protectionist policies lead to increased inflation, interest rates may not drop as significantly as anticipated. Instead of multiple cuts, we might only see two or three, while Treasury yields could rise.”

“An increase in inflation and sustained high interest rates may compress the valuation multiples of the S&P 500, therefore limiting potential stock price increases.”

“Compressing valuation multiples” refers to instances when stock prices decline because investors feel they are paying too much for insufficient earnings, prompting them to sell.

Luke emphasizes the importance of the 10-year Treasury yield:

“If Treasury yields remain at or below 4.5%, stock multiples can grow, leading to further stock price increases.”

“Conversely, if yields rise to 5% or more, multiple compression could restrict gains.”

This evolving economic scenario is potentially one of the most significant elements of Trump’s presidency, and its future remains unpredictable.

As I write on Friday, the 10-year Treasury yield has eased slightly. After reaching 4.47% earlier this week, it’s now sitting at 4.27%.

This trend is favorable for the market.

Current Sentiment: Investors Are Preparing for Growth

Turning to what a potential market “boom” could entail, Luke anticipates that stocks might gain 30% over the next two years, possibly even 40%.

However, for this growth to materialize, specific conditions must be met:

Trump’s policies related to spending, tax cuts, and deregulation should not trigger renewed inflation. Additionally, the Federal Reserve needs to implement four or more interest rate cuts in the upcoming months. Lastly, maintaining the 10-year Treasury yield below 4.50% (the lower, the better) is essential.

If these strategies align appropriately, stocks could yield significant returns for investors in the forthcoming quarters.

Investors should carefully consider their portfolios, employing stop-loss orders and maintaining appropriate position sizes. It’s also wise to develop a comprehensive investment strategy.

With these precautions in place, staying aligned with the current market momentum seems prudent. There appear to be valid reasons to believe that this bull market has gained renewed momentum.

Wishing you a pleasant evening,

Jeff Remsburg