Analysts See Strong Upside for VanEck BDC Income ETF

ETF Channel’s analysis of ETF holdings reveals that the VanEck BDC Income ETF (Symbol: BIZD) has an implied analyst target price of $16.68 per unit. This figure is derived from evaluating the trading price of each underlying holding in relation to average analyst forecasts over the next 12 months.

Currently trading at approximately $15.11 per unit, BIZD presents a potential upside of 10.37% based on these analyst targets. Notably, three of its underlying holdings—Fidus Investment Corp (Symbol: FDUS), Oaktree Specialty Lending Corp (Symbol: OCSL), and Blue Owl Capital Corp (Symbol: OBDC)—show significant room for growth relative to their respective analyst target prices.

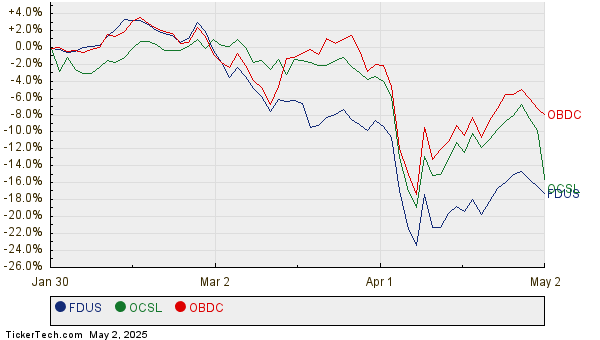

Fidus Investment Corp, for instance, is trading at $18.65 per share, yet analysts target a price of $21.67 per share, indicating a potential upside of 16.17%. Oaktree Specialty Lending Corp’s recent share price of $13.27 translates to an expected upside of 16.05%, with a target of $15.40. Meanwhile, Blue Owl Capital Corp, currently at $13.86, has an analyst target price of $15.99, reflecting a potential increase of 15.40%. The following chart illustrates the 12-month price history for FDUS, OCSL, and OBDC:

These three companies together account for 15.04% of the VanEck BDC Income ETF. Below is a summary of the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| VanEck BDC Income ETF | BIZD | $15.11 | $16.68 | 10.37% |

| Fidus Investment Corp | FDUS | $18.65 | $21.67 | 16.17% |

| Oaktree Specialty Lending Corp | OCSL | $13.27 | $15.40 | 16.05% |

| Blue Owl Capital Corp | OBDC | $13.86 | $15.99 | 15.40% |

Investors may ponder whether these analyst targets are warranted or overly optimistic. Are the forecasts justified based on recent developments in the companies and their respective industries? A high target relative to an asset’s current trading price may signal optimism but could also precede potential downgrades if the expectations prove unrealistic. Thus, further investigation is recommended for potential investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

STRO Insider Buying

Funds Holding IGS

ABCB Next earnings Date

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.