Analyst Insights: Potential Growth for the First Trust Large Cap Core AlphaDEX Fund ETF

We at ETF Channel analyzed the underlying assets of various ETFs, including the First Trust Large Cap Core AlphaDEX Fund ETF (Symbol: FEX). Our findings reveal that the average expected price for this ETF is $119.82 per unit, based on the analyst target prices of its holdings.

FEX Performance and Future Outlook

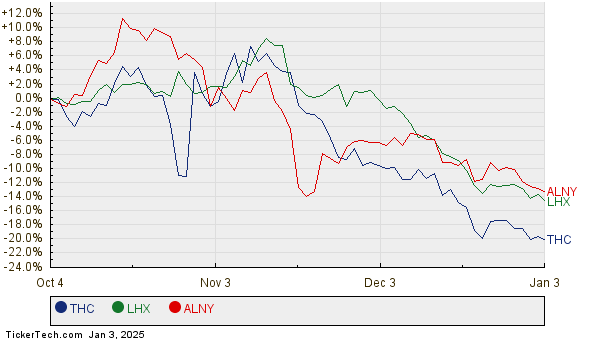

Currently, FEX is trading at approximately $104.38 per unit, which indicates a projected upside of 14.79% based on analyst expectations. Among its holdings, analysts see significant growth potential in three companies: Tenet Healthcare Corp. (Symbol: THC), L3Harris Technologies Inc. (Symbol: LHX), and Alnylam Pharmaceuticals Inc. (Symbol: ALNY). For instance, despite THC’s current price of $125.22 per share, the average analyst target is significantly higher at $180.84, representing an upside of 44.42%. Likewise, LHX shares, currently priced at $207.36, could reach an average target of $275.05, resulting in a 32.64% increase. Finally, ALNY’s current price of $233.62 suggests a potential rise of 27.90% towards the target price of $298.80.

Below is a chart illustrating the past twelve months of performance for THC, LHX, and ALNY:

Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Large Cap Core AlphaDEX Fund ETF | FEX | $104.38 | $119.82 | 14.79% |

| Tenet Healthcare Corp. | THC | $125.22 | $180.84 | 44.42% |

| L3Harris Technologies Inc | LHX | $207.36 | $275.05 | 32.64% |

| Alnylam Pharmaceuticals Inc | ALNY | $233.62 | $298.80 | 27.90% |

Analysts’ Perspectives: Are Targets Realistic?

The question remains: Are these analyst targets rational or overly optimistic? Investors should consider whether the analysts’ expectations are based on sound analysis of the companies and industry conditions. High target prices may suggest optimism about future performance, but they can also imply a risk of downgrades if the projections don’t align with the evolving market landscape. Thorough research is essential for investors to gauge the feasibility of these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Cheap Utilities Stocks

• TYRA shares outstanding history

• Institutional Holders of KDNY

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.