Analyst Outlook: Vanguard Russell 1000 Growth ETF Shows Potential for Upside

In a recent analysis, ETF Channel assessed the underlying assets of various ETFs, comparing their trading prices to the average 12-month analyst target prices. For the Vanguard Russell 1000 Growth ETF (Symbol: VONG), the forecasted target price based on these holdings stands at $110.44 per unit.

Current Trading Performance of VONG

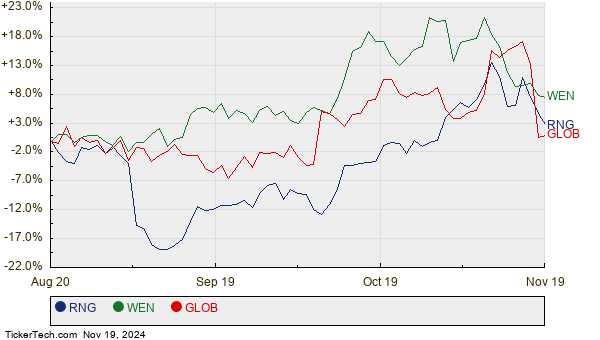

Currently priced around $100.12 per unit, VONG has a projected upside of 10.30%, according to analyst expectations for its holdings. Among VONG’s notable underlying stocks are RingCentral Inc (Symbol: RNG), Wendy’s Co (Symbol: WEN), and Globant SA (Symbol: GLOB), each showing promising potential for growth. RNG is currently trading at $35.03 per share, while analysts project a target of $40.41, indicating a possible increase of 15.36%. WEN sees a potential rise of 13.87%, with its recent price at $18.05 and a target of $20.55. Analysts also expect GLOB to reach $226.83 per share, reflecting an 11.14% upside from its recent trading price of $204.09. Below is a twelve-month price history chart for RNG, WEN, and GLOB:

Summary of Analyst Target Prices

Below is a table summarizing the current analyst target prices for the mentioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Russell 1000 Growth ETF | VONG | $100.12 | $110.44 | 10.30% |

| RingCentral Inc | RNG | $35.03 | $40.41 | 15.36% |

| Wendy’s Co | WEN | $18.05 | $20.55 | 13.87% |

| Globant SA | GLOB | $204.09 | $226.83 | 11.14% |

Evaluating Analyst Predictions

Analysts’ target prices raise questions about their validity. Are these estimates realistic, or is there excessive optimism regarding the future trading prices of these stocks? Historical context suggests that high target prices can reflect optimism but might also lead to downgrades if set against changing market conditions. Investors are encouraged to conduct further research to form their own conclusions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• MSG shares outstanding history

• Funds Holding RSG

• INSU Historical Stock Prices

The views and opinions expressed herein are the opinions of the author and do not necessarily reflect those of Nasdaq, Inc.