Analysts Predict Upswing for Global X Conscious Companies ETF (KRMA)

An analysis of the Global X Conscious Companies ETF (Symbol: KRMA) reveals optimism among analysts, projecting a target price that suggests potential gains for investors.

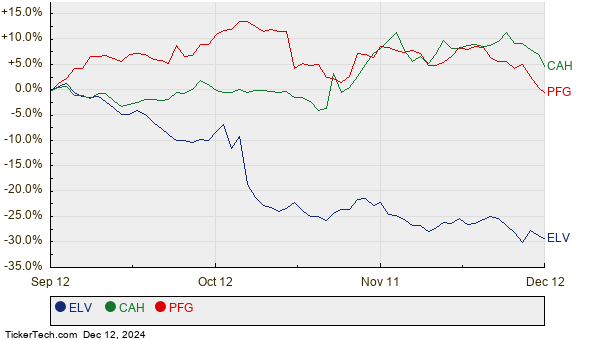

Based on a review of KRMA’s underlying assets, the implied analyst target price stands at $44.76 per unit. Currently, the ETF is trading around $40.73 per unit, indicating a projected upside of 9.89%. Notably, several of KRMA’s holdings are expected to hit higher target prices, with positive forecasts for Elevance Health Inc (Symbol: ELV), Cardinal Health, Inc. (Symbol: CAH), and Principal Financial Group Inc (Symbol: PFG). ELV, trading at $385.56, has a target price of $520.05, suggesting a significant upside of 34.88%. In comparison, CAH’s recent price of $117.42 aligns with a target of $129.75, marking a potential gain of 10.50%. Similarly, analysts anticipate PFG to achieve an average target of $87.92, which is 10.12% above its recent trading price of $79.84. Below is a chart depicting the recent performance of these stocks:

Here is a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Global X Conscious Companies ETF | KRMA | $40.73 | $44.76 | 9.89% |

| Elevance Health Inc | ELV | $385.56 | $520.05 | 34.88% |

| Cardinal Health, Inc. | CAH | $117.42 | $129.75 | 10.50% |

| Principal Financial Group Inc | PFG | $79.84 | $87.92 | 10.12% |

Investors may wonder whether these targets are achievable or overly optimistic. Historical performance and recent developments in the companies and their industries will play a crucial role in determining future stock prices. A target price that significantly exceeds the current trading price may indicate strong potential, but it could also lead to adjustments if the forecasts no longer align with reality.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Victor Mashaal Stock Picks

• Funds Holding AXAS

• SURG Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.