How Consistent Monthly Investments Can Lead to Over $1 Million

Starting with little savings does not prevent you from growing your portfolio to over $1 million. Investing wisely while saving can help maximize the value of the money you set aside for stock investments.

A safer choice than picking individual stocks is to invest in an exchange-traded fund (ETF). ETFs offer an easy way to diversify your investments without the risk of one stock negatively impacting your returns too much. This makes them a suitable option for managing overall risk.

One ETF to consider is the Vanguard Mega Cap Growth ETF (NYSEMKT: MGK). Here’s how investing $275 each month in this fund could lead to substantial long-term gains.

A Look at the Vanguard Mega Cap Growth ETF’s Performance

The Vanguard Mega Cap Growth ETF targets large-cap growth stocks, including well-known companies like Apple, Microsoft, and Nvidia. The fund holds 71 stocks, making it less diverse than some alternatives. However, focusing on major players helps investors achieve significant returns with manageable risk. It charges a very low expense ratio of just 0.07%.

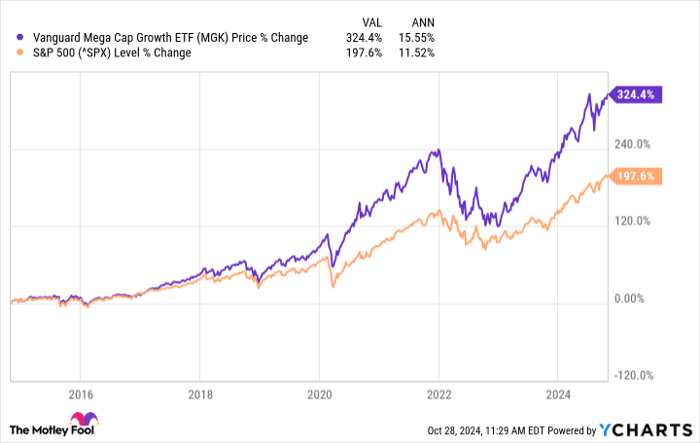

Over the last decade, this ETF has delivered total returns (including dividends) of about 324%. This performance surpasses what you’d earn by simply tracking the S&P 500.

According to data, the ETF has generated an annualized return of 15.6%. Growth and technology stocks have thrived in recent years. While past performance is not always an indicator of future results, a more conservative estimate of around 10% per year remains attractive for long-term investors.

Potential for a Million-Dollar Portfolio

Consistently investing in a powerful fund like the Vanguard Mega Cap Growth ETF could significantly boost your portfolio’s growth compared to slower, safer dividend stocks.

Assuming an annual growth rate of 10% with a monthly contribution of $275, your portfolio could grow substantially over the years. The following table illustrates what your investment balance might look like over time:

| Year |

Portfolio Balance |

|---|---|

| 10 | $56,332.37 |

| 15 | $113,979.35 |

| 20 | $208,826.43 |

| 25 | $364,879.19 |

| 30 | $621,634.18 |

| 35 | $1,044,075.46 |

Calculations by author.

By consistently investing $275 per month, there’s potential to build a portfolio worth over $1 million. Even if you contribute for just 10 years, you could amass over $56,000, far exceeding your original investment of $33,000.

While results may vary, allocating funds to a growth-focused ETF like the Vanguard Mega Cap Growth ETF typically yields better outcomes than simply saving in a bank account.

Vanguard ETFs Simplify Investment Choices

Investing in a Vanguard ETF can greatly streamline your investment strategy. With minimal fees and effective diversification, you can mitigate the risks associated with investing in one stock at a time. While selecting individual stocks remains an option, a well-chosen Vanguard ETF can provide a solid foundation for your portfolio.

Seize the Chance for Major Investment Success

If you’ve ever felt you missed the opportunity to invest in successful stocks, this could be your chance.

Occasionally, our team of experts recommends “Double Down” stocks—companies they believe are on the verge of significant gains. Now might be the perfect time to invest before prices rise further. Here’s how previous recommendations have performed:

- Amazon: A $1,000 investment in 2010 would be worth $21,154!*

- Apple: Investing $1,000 in 2008 would yield $43,777!*

- Netflix: A $1,000 investment in 2004 would be worth $406,992!*

We are currently issuing “Double Down” recommendations for three promising companies, and such opportunities might not come around frequently.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.