Why MercadoLibre Could Be a Smart Investment Move Today

Shares of Latin American e-commerce and fintech giant MercadoLibre (NASDAQ: MELI) have skyrocketed over 6,560% since its initial public offering (IPO) in 2007. An investment of $15,000 at the IPO price would now yield around $1 million, showcasing remarkable growth in less than two decades.

Despite this impressive track record, I remain keen on boosting my investment in MercadoLibre, as I believe its potential for future growth remains strong. The company recently released solid earnings, yet the stock price dipped by 10%, possibly providing a discount for buyers looking to expand their holdings.

Here are four reasons why MercadoLibre presents a unique investment opportunity right now.

1. Riding the Wave of E-commerce Growth in Latin America

MercadoLibre has seen its revenue grow 33 times over the past decade. This trend is expected to continue, thanks in part to megatrends favoring the company over the next ten years and beyond.

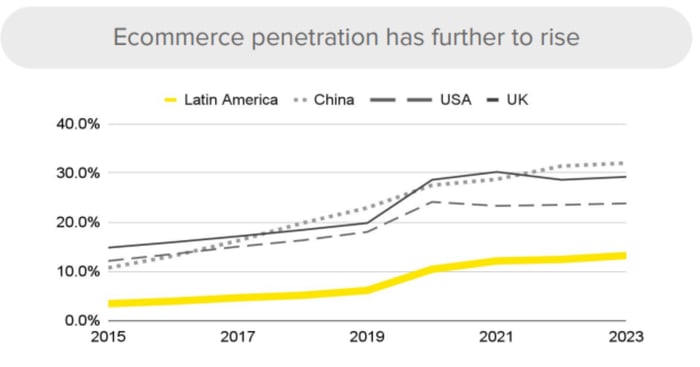

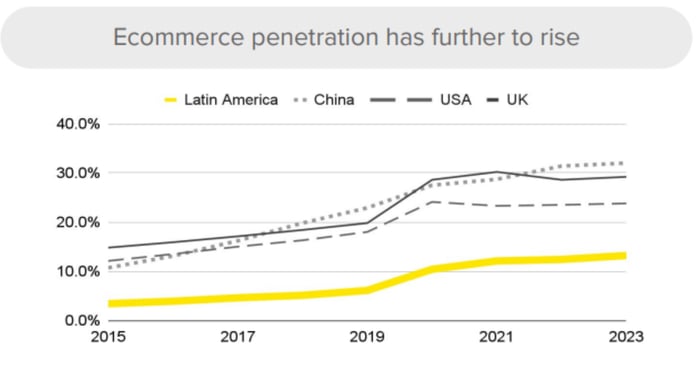

The most notable advantage is that Latin America’s e-commerce market is about a decade behind regions like the U.S., U.K., and China in terms of penetration rates.

Image Source: MercadoLibre Investor Presentation.

Due to this low penetration, the $150 billion Latin American e-commerce market is projected to expand by 50% over the next four to five years. MercadoLibre expects to secure more than half of this growth thanks to its leading position and first-mover advantage.

Over the last few years, U.S. e-commerce sales have increased by around 14%. New investments in logistics, such as five new fulfillment centers in Brazil and one in Mexico, might have briefly affected profitability, but these will bolster long-term gains.

Image source: Getty Images.

2. Expanding Beyond Core Markets

While the growth of e-commerce in Latin America is enticing, it’s noteworthy that 96% of MercadoLibre’s revenue is generated from just three countries: Brazil, Argentina, and Mexico.

Countries like Chile, Colombia, Peru, and Ecuador represent a significant opportunity, as their combined GDP is similar to that of Mexico. However, these markets account for less than 5% of MercadoLibre’s sales, revealing room for growth.

Leandro Cuccioli, Senior Vice President of Strategy, has highlighted this potential, stating in a recent podcast that e-commerce penetration in some of these regions remains in the single digits, likening them to ‘hidden gems.’ However, he acknowledged that expanding resources to these areas will take time.

3. Strong Returns on Investment

The company’s future growth prospects are bright, but more exciting is its ability to generate significant profits from its investments. Since 2020, MercadoLibre has transformed from a basic growth stock into a robust compounder, driven by its increasing return on invested capital (ROIC).

MELI Return on Invested Capital data by YCharts

MercadoLibre’s 18% ROIC places it in the top 20% among S&P 500 companies. Historically, a rising ROIC generally leads to stock outperformance. As the company capitalizes on its high-margin advertising business and scales its logistical network, one can expect this strong ROIC to remain.

4. An Attractive Valuation Opportunity

Despite its remarkable share price growth and promising future, MercadoLibre is now trading at a nearly once-in-a-decade valuation. The company’s price-to-sales (P/S) ratio stands at 5.3, which is less than half of its historical average.

MELI PS Ratio data by YCharts

Additionally, MercadoLibre’s 1.5% earnings yield is at its highest consistent level since 2017. This valuation looks increasingly attractive, especially as the company reported a 21% growth in monthly active buyers in Q3, its highest since 2020. Fintech users also grew by 35%, with overall revenue increasing at the same rate.

Given these growth figures, ongoing favorable megatrends, and strong ROIC, MercadoLibre currently seems like a rare investment opportunity.

Considering an Investment in MercadoLibre?

Before making a purchase, it’s important to note:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks to buy right now, and MercadoLibre was not included in this selection. The stocks that made the cut are expected to yield substantial returns in the coming years.

For historical context, if Nvidia had been on the list back on April 15, 2005, an investment of $1,000 would now be worth a staggering $869,885.

Stock Advisor offers investors a solid framework for success, including tips on portfolio building and regular analyst updates, alongside two new stock picks each month. Since 2002, this service has more than quadrupled the return of the S&P 500.

Discover the 10 stocks »

*Stock Advisor returns as of November 18, 2024

Josh Kohn-Lindquist has positions in MercadoLibre. The Motley Fool has positions in and recommends MercadoLibre. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.