The Beauty Industry Faces Tumultuous Times: A Look at Estée Lauder’s Challenges

Once a beacon of growth, Estée Lauder is now navigating a market downturn that has significantly impacted its stock value. Below, we explore the reasons for the decline and what this means for investors moving forward.

The Struggles of the Chinese Market

Estée Lauder entered the Chinese market expecting rich rewards from its vast population and beauty culture. In 2021, the Asia Pacific segment saw a revenue surge to nearly $5.5 billion, with the brand portfolio that includes names like Clinique, Aveda, and Bobbi Brown. Unfortunately, that optimism has since waned.

The same year marked a downturn when China’s real estate sector collapsed, wiping approximately $18 trillion in consumer wealth, as reported by banking analysts. Since then, consumer spending in China has stagnated, notably affecting Estée Lauder’s performance.

In its fiscal 2025 first quarter, which ended on September 30, Asia Pacific revenue fell 11% year over year, totaling $944 million. This decline comes after ongoing decreases of 6% in fiscal 2024 and 4% in 2023. The company’s leadership has voiced concerns about a weak consumer sentiment in China, compounded by a shrinking population projected to decline further in the coming decades.

Impact on Performance and Profit Margins

Over the past year, Estée Lauder’s stock has dropped more than 40%, outpacing the general rise of the S&P 500. With trailing-12-month revenue at $15.4 billion, the figures have regressed to pre-pandemic levels. However, current stock prices remain significantly lower than during the height of the pandemic in 2019 and early 2020.

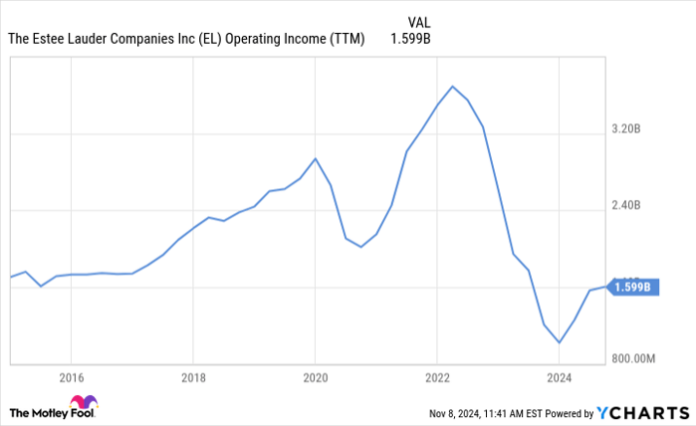

Rising operational costs have also hurt profit margins. The company’s operating margin has diminished to 10%, well below its usual range of 15% to 20%. This decline has brought operating income close to a 10-year low. Such figures are crucial, as investors typically prioritize profitability.

Data by YCharts.

Is Now the Time to Buy Estée Lauder Stock?

Predicting the future of Estée Lauder’s stock necessitates a careful evaluation of its earnings potential. On one hand, cost increases have squeezed margins, significantly impacting the Asia Pacific market. However, the company also operates in diverse regions like the Americas, Europe, and the Middle East, which contribute over 70% of its sales and may provide some stability.

Currently, expectations for Estée Lauder are low. The stock boasts a market cap of $23 billion, about 14 times its trailing operating income of $1.6 billion. With many of the challenges already reflected in the stock price, this could present a buying opportunity for investors who trust in the enduring appeal of Estée Lauder’s brands.

Should $1,000 Be Invested in Estée Lauder Companies Now?

Before making any investment decisions regarding Estée Lauder, it’s essential to consider some key points.

According to the Motley Fool Stock Advisor analysts, Estée Lauder Companies did not make their list of the 10 best stocks to buy at this time. The selected stocks are predicted to deliver outstanding returns in the coming years.

For context, if someone had invested $1,000 in Nvidia when it was first recommended on April 15, 2005, that investment would be valued at approximately $904,692* today.

Stock Advisor offers an accessible strategy for investors, providing insights into portfolio building, regular updates, and two new stock suggestions each month. The service has historically outperformed the S&P 500 by more than four times since its launch in 2002*.

Explore the 10 stocks »

*Stock Advisor returns as of November 4, 2024

Brett Schafer has no position in any stocks mentioned. The Motley Fool also holds no positions in these stocks. Full disclosure available upon request.

The views and opinions expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.