“`html

Nvidia Shines Amidst Rising AI Competition

In the fast-evolving technology landscape, artificial intelligence is poised to become the next major driver for business growth, reminiscent of the internet revolution that began three decades ago. This shift is reshaping corporate America, and companies are keen to harness its potential.

For nearly 30 years, Wall Street has anticipated a transformative technology akin to the internet, and now, artificial intelligence (AI) seems to fit the bill.

Image source: Getty Images.

AI stands out due to its versatile applications. With its ability to learn and improve over time, AI technologies can perform various tasks more efficiently, sometimes without any human input at all.

The potential of AI is immense. According to analysts at PwC in their report Sizing the Prize, AI could boost the global GDP by $15.7 trillion by 2030. This increase will come from enhanced productivity and higher consumer spending.

This $15.7 trillion opportunity allows many companies to thrive. Yet, in the past two years, no company has capitalized on the AI surge like Nvidia (NASDAQ: NVDA), whose market cap skyrocketed from $360 billion at the end of 2022 to $3.56 trillion by November 11, 2023.

Nvidia’s Unmatched Growth Strategy

Investors quickly recognize why Nvidia has emerged as the most valuable publicly traded company. Its graphics processing units (GPUs) are favored by businesses with AI-powered data centers. Notably, the company’s H100 GPU, also known as the “Hopper,” and its new Blackwell architecture are critical components that enable rapid AI decision-making.

Research from TechInsights shows that Nvidia dominated the market with about 98% of the 2.67 million GPUs shipped to data centers in 2022. In 2023, this number rose to 3.85 million GPUs, with Nvidia demonstrating a strong grip on its market share, as orders for the Hopper and Blackwell continue to stack up.

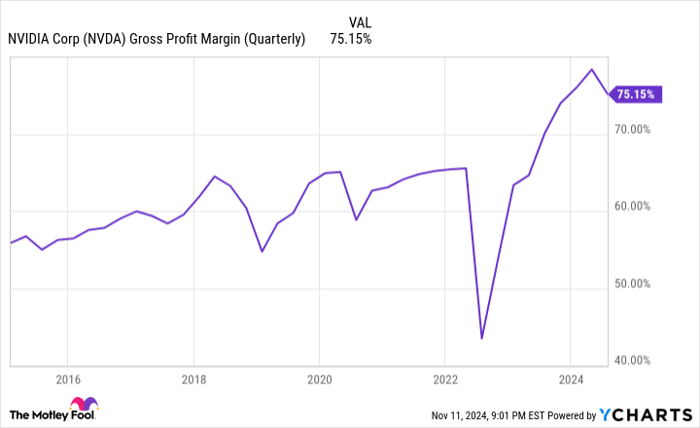

When demand exceeds supply, prices usually rise. Nvidia has successfully set prices between $30,000 and $40,000 for the Hopper, significantly higher than rival AI-GPUs. This premium pricing reflects the superior performance of Nvidia’s hardware, boosting its gross margins.

Another factor in Nvidia’s impressive growth is its CUDA platform. This software toolkit enables developers to maximize the functionality of their GPUs, including the ability to develop large language models (LLMs), which fosters customer loyalty within Nvidia’s ecosystem.

In fiscal 2023, Nvidia achieved $27 billion in sales, with projections suggesting it could reach $180 billion by fiscal 2026 – translating into a remarkable three-year compound annual sales growth rate of approximately 88%.

Despite this stellar performance, Nvidia faces a significant challenge that many investors may overlook.

Image source: Getty Images.

The Internal Challenge: Competitors Within

With businesses rushing to capture a share of the AI market, Nvidia is set to encounter increasing competition. Notably, despite having a later start, Advanced Micro Devices (NASDAQ: AMD) is ramping up production of its MI300X AI-GPU and unveiling chips like the MI325X, expected by year-end. AMD’s pricing strategy may appeal to companies seeking cost-effective solutions for AI integration.

However, the most pressing concern for Nvidia is not external competition. Instead, it comes from within its own customer base.

Large companies leveraging Nvidia’s GPUs include Microsoft (NASDAQ: MSFT), Meta Platforms (NASDAQ: META), Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG), Tesla, OpenAI, and Super Micro Computer, which utilizes Nvidia’s GPUs in its customizable servers.

For the quarter ending July 28, 2024, four of Nvidia’s major customers accounted for 46% of its net sales, while another customer contributed around 10%. This indicates that nearly half of Nvidia’s revenue hinges on these five clients, likely including Microsoft, Meta, Amazon, Alphabet, and Super Micro.

AI-GPU scarcity has sent Nvidia’s gross margin soaring. NVDA Gross Profit Margin (Quarterly) data by YCharts.

The central issue for Nvidia revolves around the fact that its top clients are creating their own AI-GPUs for use in their data centers:

- Microsoft is developing the Azure Maia AI chip for training large language models and supporting generative AI solutions within its Azure platform.

- Meta is working on the “Meta Training and Inference Accelerator” chip to enhance its AI data center performance.

- Amazon is focusing on creating GPU chips like Trainium2 and Inferentia for its Amazon Web Services (AWS) platform.

- Alphabet is also investing in its own AI chip technologies.

“`

Internal Competition Threatens Nvidia’s AI Supremacy

Impact of Custom Chips on the Semiconductor Market

Tensor Processing Units (TPUs) are custom-designed chips tailored for artificial intelligence (AI) tasks, particularly in training large language models (LLMs) and performing inference. These internal chips may have certain advantages over Nvidia’s Hopper and Blackwell models, but overall, Nvidia’s hardware still holds the edge in computing power. Despite this, Nvidia faces a potential decline in data center usage as competitors improve their own technology.

The Financial Powerhouses of AI Development

Companies like Microsoft, Meta, Amazon, and Alphabet are well-equipped financially. They can easily afford Nvidia’s high prices for AI-specific Graphics Processing Units (GPUs), but the willingness to pay such premiums is waning. As these firms develop their own AI-GPUs, the increasing backlog of orders for Nvidia’s products, combined with the lower costs of in-house solutions, suggests that Nvidia may gradually lose ground in data centers.

Threats to Nvidia’s Market Position

The remarkable pricing power Nvidia has enjoyed stems largely from AI-GPU shortages. However, as key customers begin to create their own chips, this scarcity will diminish, likely leading to reduced profit margins for Nvidia. The most significant challenge to Nvidia’s dominance comes not from external competitors but from within its own client base.

Explore Potential Investment Opportunities

Feel like you’ve missed your chance to jump on top-performing stocks? Here’s some timely news for you.

Occasionally, our team of analysts identifies a “Double Down” stock—a company poised for significant growth. If you think the window for investment is closing, now might be the perfect moment to act. Consider these historical returns:

- Amazon: A $1,000 investment in 2010 would be worth $24,113 now!*

- Apple: A $1,000 investment in 2008 could have grown to $42,634!*

- Netflix: A $1,000 investment in 2004 would amount to $447,865!*

Currently, we’re recommending “Double Down” alerts for three remarkable companies, and these chances might not come again soon.

Check out these 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, sits on The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a board member. Randi Zuckerberg, a former Facebook spokeswoman and sister of Meta’s CEO, holds a position on the board. Sean Williams has stakes in Alphabet, Amazon, and Meta Platforms. The Motley Fool features investments in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool also suggests specific options related to Microsoft. Further disclosures can be found in The Motley Fool’s policy.

The views expressed here belong to the author and do not necessarily reflect those of Nasdaq, Inc.