Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) may not be seen as the frontrunner in the artificial intelligence (AI) race. While some label the company as an overall “leader,” there are reservations about this description. However, investors should reconsider, as Alphabet possesses a unique asset that could propel its generative AI model, Gemini, to new heights.

That asset? Its rapidly growing cloud computing division, Google Cloud.

The Rapid Ascent of Google Cloud

Cloud computing is crucial to the AI competition, often overlooked by the general public. Major cloud providers are acquiring large quantities of Nvidia GPUs to deliver computing power to their clients. Since most companies can’t afford to invest in their own supercomputers for AI training, they rely on providers like Google Cloud to lease this powerful computing capacity.

Yet, within the AI realm, there are hardware options beyond Nvidia GPUs. Custom AI accelerators, such as Google’s tensor processing units (TPUs), can significantly outperform Nvidia GPUs for specific tasks. However, setting up workloads for TPUs can be time-consuming, which is why GPUs remain a popular choice for many as they are more versatile.

The competition is fierce, with Amazon (NASDAQ: AMZN) and Microsoft (NASDAQ: MSFT) each offering their own services, Amazon Web Services (AWS) and Azure. As of now, AWS commands 31% of the market, while Azure holds 20%, according to Synergy Research Group.

Google Cloud currently stands at 12% market share, but its exceptional growth rate could change that status soon. In the recent Q3 period (or Q1 FY 2025 for Microsoft), here’s how the cloud platforms fared:

| Company | Q3 Revenue Growth |

|---|---|

| Alphabet (Google Cloud) | 35% |

| Microsoft (Azure) | 33% |

| Amazon (Amazon Web Services) | 19% |

Data sources: Alphabet, Microsoft, and Amazon.

Google Cloud has displayed the highest growth rate among its competitors during Q3. This ongoing trend offers Alphabet a solid growth prospect that appeals to today’s tech investors, who favor strong quarterly performance. Despite its growth, Alphabet’s stock currently presents an attractive buying opportunity.

Valuation of Alphabet’s Stock

Alphabet overall observed a 15% year-over-year rise in Q3 revenue. While this is solid growth, the standout figure is the 37% increase in earnings per share (EPS), climbing from $1.55 last year to $2.12 this year. This growth is partly due to a 4 percentage point boost in operating margin, which moved from 28% last year to 32%.

Of the $7.2 billion gained in operating profits, approximately $1.7 billion came from Google Cloud’s enhancing margins. At 17% in Q3, there’s significant potential for further improvement, especially when compared to AWS’s leading operating margin of 38%.

Typically, when a company achieves 15% revenue growth alongside a 37% rise in EPS, investors expect a premium stock price. However, this is not the case for Alphabet.

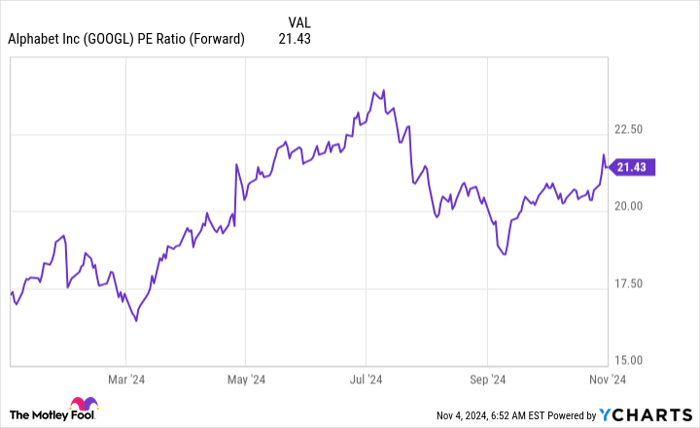

GOOGL PE Ratio (Forward) data by YCharts

Currently, Alphabet trades at 21.4 times forward earnings, falling below the S&P 500‘s valuation of 23.8 times forward earnings. This discount indicates that Alphabet’s stock is undervalued, positioning it as a strong buy amidst the intensifying AI race.

Is Now the Time to Invest in Alphabet?

Before buying stock in Alphabet, it’s important to weigh some considerations:

The Motley Fool Stock Advisor analyst team recently uncovered what they believe are the 10 best stocks for investors to consider now… and Alphabet did not make the list. These selections could lead to exceptional returns in the upcoming years.

Reflect on when Nvidia was first recommended on April 15, 2005… if you invested $1,000 then, your investment would now be worth $892,313!*

Stock Advisor offers a straightforward guide for investors, featuring tips on portfolio building, consistent analyst updates, and two new stock recommendations each month. Since its inception, the Stock Advisor service has substantially outperformed the S&P 500.*

Explore the 10 recommended stocks »

*Stock Advisor returns as of November 4, 2024

John Mackey, the former CEO of Whole Foods Market, which is an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, also serves on the board. Keithen Drury holds positions in Alphabet and Amazon. The Motley Fool has investments in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has also disclosed positions in long January 2026 $395 calls and short January 2026 $405 calls on Microsoft. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein reflect those of the author and do not necessarily represent those of Nasdaq, Inc.