Amazon’s Remarkable Growth: Harnessing AI for Future Success

Few stocks have risen 230,000% since their initial public offerings without offering dividends, especially in under 30 years. Typically, such massive gains come from global giants transitioning into value stocks while distributing dividends. However, Amazon (NASDAQ: AMZN) is different. Despite its astounding growth, it remains on a pathway to continue expanding. The rise of artificial intelligence (AI) in the past two years has positioned Amazon strongly in this market, enhancing its potential even further.

Considering your next investment? Our analysts have identified the 10 best stocks to buy now. See the 10 stocks »

This tech titan still has ample room for growth ahead.

The Buzz Around Generative AI

If you’ve been paying attention, generative AI is revolutionizing various industries, particularly how businesses operate. Companies offering generative AI services are already generating billions, with expectations that this could reach the trillions.

These services range from hardware, such as Nvidia chips, to the software provided by companies like ChatGPT and Amazon itself.

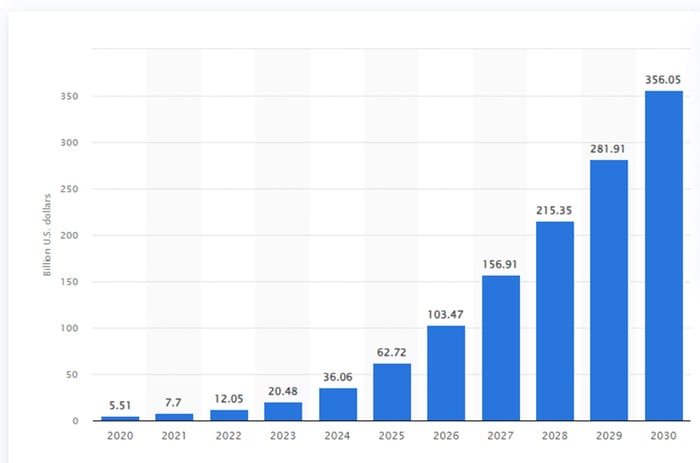

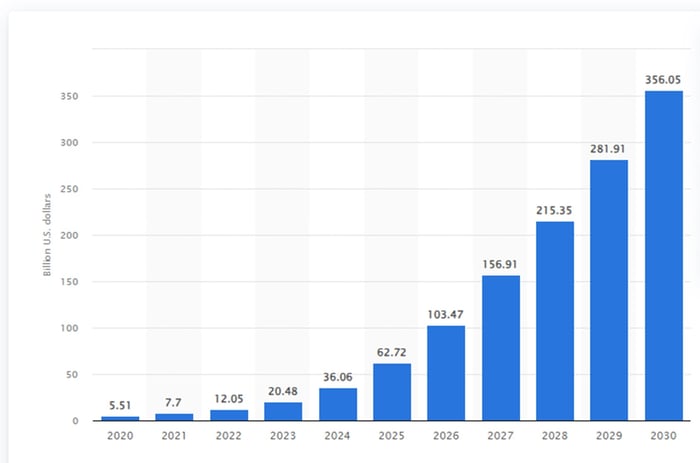

Is generative AI just a flashing trend, or is it a revolutionary force? It’s clearly impacting numerous fields by helping save time and reduce costs. Statista reports that the market is projected to multiply tenfold by 2030, with a compound annual growth rate of 46.5%. This promise explains why there’s fervent interest in the sector.

Image source: Statista.

Amazon’s Integration of AI

Amazon is actively tapping into the generative AI landscape, with its AI business contributing billions to its revenue. CEO Andy Jassy believes this is just the start, emphasizing that the migration to cloud computing remains in early stages. Amazon’s strong AI platform stands to benefit significantly from this transition.

Staying true to its approach, Amazon’s AI service structure includes three tiers designed to cater to varying budgets and needs. With Amazon Web Services (AWS) being the leading cloud provider globally, the company is well-positioned to leverage its extensive client base to drive AI growth.

The bottom tier serves large clients with custom large language models (LLMs). The middle tier combines Amazon’s LLMs with client data for semi-custom generative AI models. Lastly, the top tier delivers ready-to-use solutions for smaller businesses.

According to McKinsey, the creation of Amazon Bedrock, positioned in the middle tier, is a pivotal development in the generative AI domain. Bedrock blends client databases with Amazon and other LLMs to streamline the generative AI experience.

Amazon also offers inventive strategies for third-party sellers, such as crafting videos from a single image and creating complete marketing campaigns based on prompts. In addition to its service offerings, Amazon is manufacturing its own graphics processing units (GPUs) to compete with partner Nvidia, promoting customization for cost-effective solutions.

Amazon’s Stock Performance

Amazon’s stock underwent a 50% decline in 2022; however, it rebounded 166% since reaching its low point, coinciding with the introduction of its generative AI services.

All sectors of Amazon’s business are currently growing, with e-commerce and advertising showing steady improvements, alongside AWS’s substantial contributions. Even though AWS accounted for just 17% of total sales during the third quarter, it contributed an impressive 62% of the operating income. The rise of generative AI serves as a significant growth engine, boosting profitability. With solid prospects ahead, 2025 may usher in great achievements for Amazon and its investors.

Seize This Opportunity Before It’s Gone

Have you ever felt you might have missed your chance to invest in top-performing stocks? Here’s your moment.

On rare occasions, our expert analysts issue a “Double Down” stock recommendation for companies considered primed for growth. If you’re concerned about missing out, now is the optimal time to invest before opportunities vanish. Here are some standout examples:

- Nvidia: If you invested $1,000 in 2009, you’d have $356,514!*

- Apple: A $1,000 investment in 2008 would be worth $47,762!*

- Netflix: An investment of $1,000 in 2004 would grow to $485,594!*

Currently, we are issuing “Double Down” alerts for three remarkable companies. Don’t wait; seize your chance now.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.