Nvidia Dominates AI Chip Market as Amazon Eyes 2025 Supremacy

The spotlight is increasingly on Nvidia in 2024. This semiconductor company has positioned itself as the premier provider of computer chips used in artificial intelligence (AI) data centers, driven by a significant rise in demand. As a result, Nvidia has witnessed remarkable growth in revenue and profits, which has led to heightened enthusiasm among investors. Currently, Nvidia boasts a market cap of $3.46 trillion, making it the largest company globally by market value.

Looking ahead, 2025 could mark a resurgence for other major tech firms as they regain leverage as semiconductor supply chains adapt to the rising demand for AI products. Among the key beneficiaries, I predict that Amazon (NASDAQ: AMZN), the world’s largest cloud computing service provider, will lead the charge. Amazon serves as the backbone for many rapidly growing AI applications.

Considering an investment of $1,000? Our analyst team has identified the 10 best stocks to buy right now. See the 10 stocks »

Amazon’s robust e-commerce platform, combined with its cloud computing capabilities, is set to position the company as the world leader by market cap by the end of 2025. Here’s how.

Slow but Steady Margin Improvements

Unlike other major tech companies with already high profit margins, Amazon has been understated in profitability due to its heavy investment in future growth. Last year marked a shift, indicating that Amazon may lessen its spending pace, a trend likely to continue in 2025.

In the last year ending September, Amazon achieved an operating margin of 9.8%, an all-time high. This success is partly attributed to the Amazon Web Services (AWS) cloud segment, boasting an impressive operating margin of 35%. Although AWS is vital, it accounts for less than 20% of Amazon’s total sales.

Much of Amazon’s margin expansion is coming from its dominant North American e-commerce business, which reported a 5.9% operating margin. Considering the additional revenue from high-margin services such as third-party e-commerce fees, subscriptions, and advertising, there’s significant potential for margins to rise even higher in 2025.

Though it won’t happen overnight, Amazon could realistically deliver a profit margin of 15% or even 20% in 2025, depending on its expense management concerning research projects, such as Alexa.

<

A Surge in AI Spending

Amazon has a clear opportunity to boost its profit margins in 2025, and signs suggest that revenue growth, especially in AWS, will accelerate.

AWS’s net sales growth jumped from 12% in Q3 of the previous year to 19% in the most recent quarter. With increasing budgets for AI investments, AWS stands to gain as demand for AI computing power surges. Notably, the notable investor Softbank has pledged $100 billion to AI in the U.S. While not all this will be allocated to AWS, the positive trend is undeniable.

If AWS achieves a projected 30% revenue growth over the coming year, sales could reach $134 billion, bolstering Amazon’s overall revenue growth.

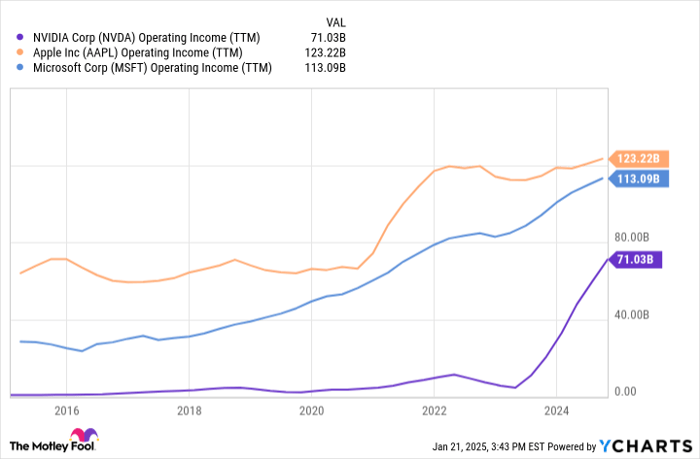

NVDA Operating Income (TTM) data by YCharts.

Why Amazon May Top the Market in 2025

My confidence in Amazon’s potential as the largest company in 2025 centers on the acceleration of revenue growth at AWS and improving overall profit margins.

Currently, Amazon’s trailing 12-month revenue stands at $620 billion, with an 11% year-over-year growth last quarter. Should growth accelerate to 15% over the next year, Amazon’s annual sales would climb to $713 billion. This figure reflects the vast potential markets Amazon is pursuing in e-commerce, retail, and cloud computing.

As previously noted, there’s a clear path for Amazon to enhance its operating margin towards 20% in 2025. While hitting exactly 20% may be uncertain, the trend shows promise. If Amazon were to halt spending on research projects, its profit margins could easily exceed 20%.

A 20% margin on $713 billion translates to an impressive $142.6 billion in operating income, surpassing the figures produced by Nvidia, Apple, and Microsoft over the past 12 months. Although this is not guaranteed, the company that generates the highest profits often leads in market cap. Given Amazon’s bright prospects, I believe it may claim the top spot by the end of 2025, making it a wise investment choice now.

A Unique Investment Opportunity Awaits

Have you ever felt that you missed out on buying top-performing stocks? Here’s a rare opportunity.

Occasionally, our analysts issue a “Double Down” stock recommendation for exceptional companies poised for growth. If you’re worried about having missed your chance to invest, now could be the ideal time before it’s too late. The past performance is compelling:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $369,816!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,191!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $527,206!*

Currently, our recommendations include “Double Down” alerts for three outstanding companies—opportunities that may not come again soon.

Learn more »

*Stock Advisor returns as of January 21, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Brett Schafer holds positions in Amazon. The Motley Fool has positions in and recommends Amazon, Apple, Microsoft, and Nvidia. The Motley Fool endorses the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool follows a disclosure policy.

The views and opinions within this piece reflect the perspective of the author and do not necessarily represent those of Nasdaq, Inc.