Anticipation Builds as Earnings Season Approaches for Major Tech Firms

U.S. equity investors are gearing up for earnings season, a crucial period occurring four times a year when many of the most closely watched companies disclose their financial results. These reports provide insights into sales, profits, expenses, and, significantly, future projections. Earnings season is essential for investors as these results can influence stock performances for the upcoming quarter. Additionally, even if investors aren’t holding a stock before earnings are announced, post-earnings reactions often present new opportunities.

Stay informed on all quarterly releases: Visit Zacks Earnings Calendar.

Here are three key earnings previews for technology companies that will address crucial performance indicators:

Tesla: EPS Report Scheduled for 10/23

Zacks Rank #2 (Buy) stock Tesla (TSLA) enters earnings amid a challenging backdrop, having dropped over 12% last week due to concerns following the company’s much-anticipated “Robotaxi” event. Investors appear to have responded negatively to the timelines presented, which extend to 2027. Nonetheless, Wall Street often operates on recent performance and expectations.

Tesla EPS: Key Aspects to Monitor

Cybertruck Sales Forecast

The Cybertruck, Tesla’s eye-catching SUV, shows promising sales by being the third best-selling electric vehicle in the third quarter. If Tesla’s leadership provides optimistic sales projections for the Cybertruck, it may boost investor confidence.

Opportunities from a Chinese Economic Recovery

The Chinese government has recently unveiled significant stimulus measures after a period of economic stagnation. As part of this economic landscape, Tesla must consider its growing Chinese electric vehicle sales from the last quarter, an encouraging shift in a crucial market.

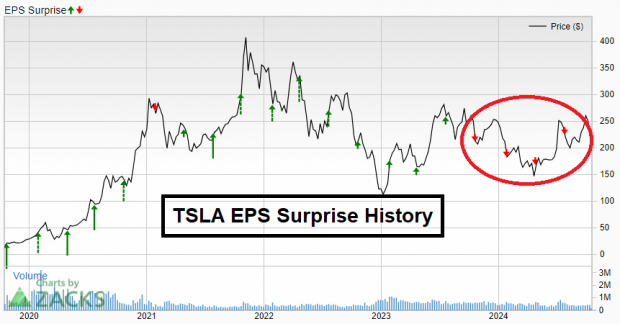

TSLA EPS: Focus on Market Expectations

Tesla has not met Wall Street expectations for four straight quarters. Should it exceed the Zacks Consensus Estimates this time around, it would signal to the market that the company might be improving.

Image Source: Zacks Investment Research

Super Micro Computer: EPS Scheduled for 10/29

Zacks Rank #2 (Buy) stock Super Micro Computer (SMCI) specializes in high-performance servers and storage systems aimed at AI data centers. As the AI sector grows, SMCI has seen substantial earnings growth, attracting investor interest.

Scrutiny from Hindenburg Research

After a surge in SMCI shares from January to March fueled by AI enthusiasm, the stock recently fell back. Hindenburg Research, known for its short-selling tactics, accused SMCI of questionable accounting practices late in August. Following this, SMCI postponed its annual report filing (10K), resulting in a significant plunge in shares. Historically, Hindenburg’s reports have often followed later downturns for companies but not always indicate their demise.

Investors should note the need for caution with Hindenburg’s claims for two reasons: first, the firm establishes short positions before releasing its findings, which could bias their presentation. Secondly, while such reports can lead to immediate declines, they haven’t always spelled long-term issues – as seen with the Adani Group, which faced significant challenges in 2022 but later rebounded.

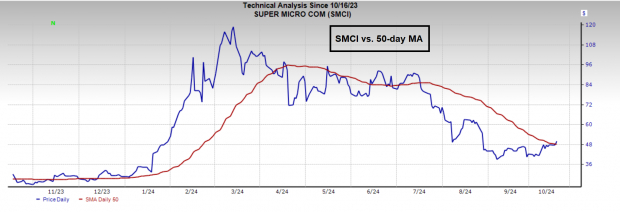

SMCI: Potential for Short Squeeze

If SMCI’s upcoming earnings report reveals no significant issues, it might trigger a rally. Recently, the short interest in SMCI has surged by almost 1,000% since September, and the stock has surpassed its 50-day moving average for the first time since July.

Image Source: Zacks Investment Research

Coinbase: EPS Report Expected on 10/30

Coinbase Global (COIN) is the largest cryptocurrency exchange in the United States. Since 2023 began, Coinbase shares have increased due to rising crypto prices, expanding global adoption of digital currencies, and the growing popularity of its USDC stablecoin.

The Rise of Crypto ETFs

According to Bloomberg’s Eric Balchunas, “Bitcoin ETFs have crossed $20 billion in total net flows for the first time, following a significant week of $1.5 billion. For context, it took gold ETFs about 5 years to reach the same threshold.” Coinbase stands to benefit as the custodial exchange for popular ETFs like the iShares Bitcoin ETF (IBIT) and the newly launched iShares Ethereum Trust (ETHA). Investors will be keen to assess the impact of these ETFs on Coinbase’s performance.

Discover All of Zacks’ Buys and Sells for Only $1

We’re serious.

Years ago, we surprised our members by offering 30-day access to all our recommendations for just $1. There’s no obligation to spend more.

Thousands have seized this opportunity, while others have hesitated, thinking there must be a catch. This initiative aims to familiarize you with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which collectively secured 228 positions with double- and triple-digit gains in 2023 alone.

Want to get the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double for free. Click to get this report:

Tesla, Inc. (TSLA): Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI): Free Stock Analysis Report

Coinbase Global, Inc. (COIN): Free Stock Analysis Report

To read the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.