Analysts See Significant Upside for Xtrackers MSCI USA Climate Action Equity ETF

Analysis of the Xtrackers MSCI USA Climate Action Equity ETF (Symbol: USCA) suggests potential growth based on underlying holdings.

At ETF Channel, we evaluated the current trading prices of the ETF’s holdings against their average 12-month analyst target prices. The findings show that the implied target price for USCA is $41.81 per unit. Given that USCA is currently trading around $37.53 per unit, this indicates an expected upside of 11.40% based on analyst predictions.

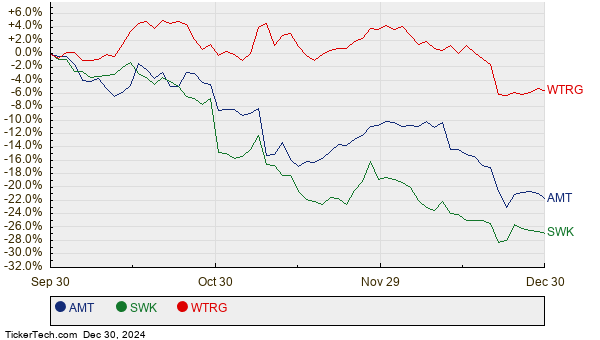

Several underlying holdings contribute to this anticipated growth. American Tower Corp (Symbol: AMT) stands out, currently priced at $181.87 per share, with an average target price of $237.22 per share, reflecting a 30.43% potential upside. Similarly, Stanley Black & Decker Inc (Symbol: SWK) trades at $80.58, with a target of $103.27—indicating 28.16% upside. Essential Utilities Inc (Symbol: WTRG) is priced at $36.46, but analysts expect it to reach $46.11 per share, a 26.47% increase. Below is a chart showing the stock performance of AMT, SWK, and WTRG over the last twelve months:

A summary of the highlighted analyst target prices is shown in the table below:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Xtrackers MSCI USA Climate Action Equity ETF | USCA | $37.53 | $41.81 | 11.40% |

| American Tower Corp | AMT | $181.87 | $237.22 | 30.43% |

| Stanley Black & Decker Inc | SWK | $80.58 | $103.27 | 28.16% |

| Essential Utilities Inc | WTRG | $36.46 | $46.11 | 26.47% |

These figures raise an important question: Are analysts’ target prices realistic, or perhaps overly optimistic? Investors should consider whether analysts’ expectations genuinely reflect future company performance or if they are reacting to past developments. A high target price can signal optimism but may also foreshadow potential downgrades. Careful research is essential for making informed investing decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• ETFs Holding ERI

• Funds Holding ACFC

• Top Ten Hedge Funds Holding TEKX

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.