After scrutinizing the performance of different asset classes in 2023, this week is dedicated to appraising the implications for valuations as the year kicks off, and the potential ramifications for stock performance.

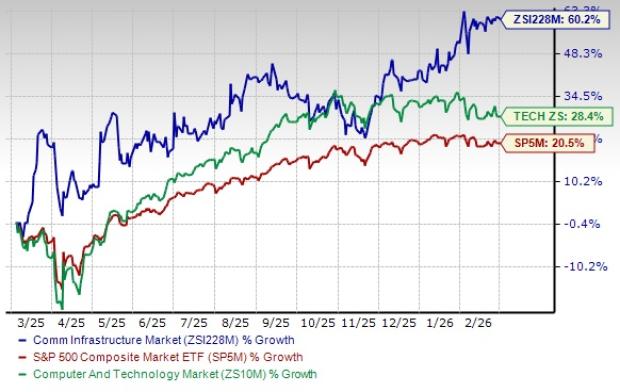

Large-Cap Sectors: A Balancing Act

For large caps, most sectors hover around their average PE valuation over the past decade, signifying relatively fair valuation. There are notable exceptions – Information Technology is rich, reflecting investor optimism about AI, and Energy is cheap due to hurt inflicted by plummeting oil and gas prices.

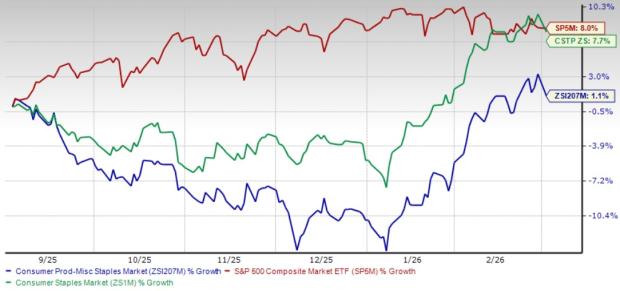

Small- & Mid-Cap State of Affairs

When it comes to small-caps and mid-caps, valuations remain inexpensive in comparison to their 10-year averages. This suggests that these stocks might be undervalued.

On the flip side, growth stocks appear to be overvalued, making investors cautious.

The Story of the Magnificent 7

The Magnificent 7 (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) experienced a remarkable 77% collective gain last year, propelled by substantial earnings growth, primarily due to AI optimism. Yet, not all growth stocks witnessed similar earnings surges. Although their valuations are a tad rich, analysts remain optimistic, foreseeing an average 11% gain this year with expected margin expansion.

Small-Cap Potential

Despite the positive outlook for the Magnificent 7, analysts predict even greater gains for small caps. With the Russell 2000 still maintaining cheap valuations and a healthy outlook for economic growth, a rally is on the cards, outperforming the large-cap S&P 500.

The Shadow of Interest Rates

However, the small caps’ prospects are not immune to risks. An increase in interest rates could potentially pose a threat, given their larger share of floating rate debt and heavy exposure to interest-rate sensitive sectors like Biotech, Banks, and Real Estate.

The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2024. Nasdaq, Inc. All Rights Reserved.