Perusing the latest in Zacks Rank additions, PennyMac Financial Services catches the eye – PennyMac Financial ServicesPFSI stands out with its top Zacks Rank, discounted valuation, remarkable growth, and an enticing technical momentum setup.

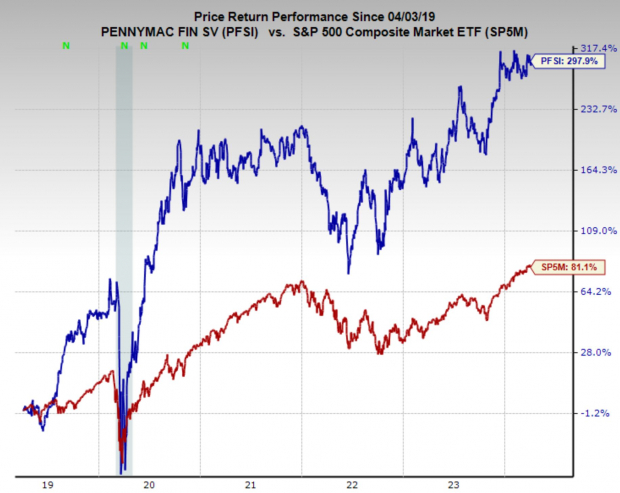

Over the past five years, PennyMac Financial Services has displayed a staggering 31.8% annual compound growth – soaring ahead of both the general market and its industry.

Image Source: Zacks Investment Research

Company Background

PennyMac Financial Services, a prominent US-based mortgage lending and servicing firm, operates through two key segments: Loan Production and Loan Servicing. The former involves originating, purchasing, and selling mortgage loans, catering to a wide customer base. On the other hand, the Loan Servicing segment focuses on managing mortgage loans, including payment collection, escrow account handling, and customer support.

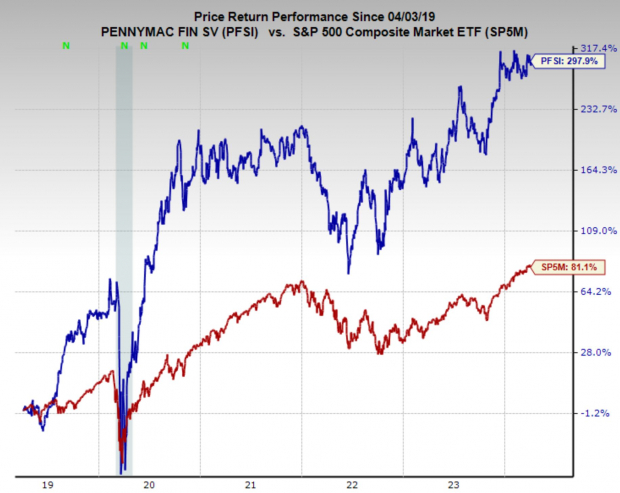

Navigating the challenges posed by a swiftly rising interest rate environment over the past couple of years, PennyMac has shown resilience. Despite a temporary dip in sales and earnings, the stock has weathered the storm. Looking ahead, projections indicate a significant surge in sales and earnings in the upcoming quarters and years.

Image Source: Zacks Investment Research

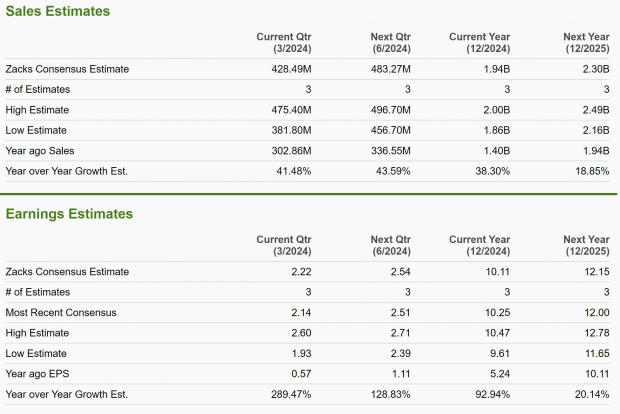

Recent Earnings Trends

The chart illustrates a sharp downturn in earnings revisions over the past year, attributed to high interest rates hindering mortgage sales. However, a visible shift is underway, with earnings revisions beginning to show improvement. Recent data reveals a 1.2% and 0.3% uptick in FY24 and FY25 earnings estimates, respectively, earning PFSI a Zacks Rank #1 (Strong Buy) designation.

Image Source: Zacks Investment Research

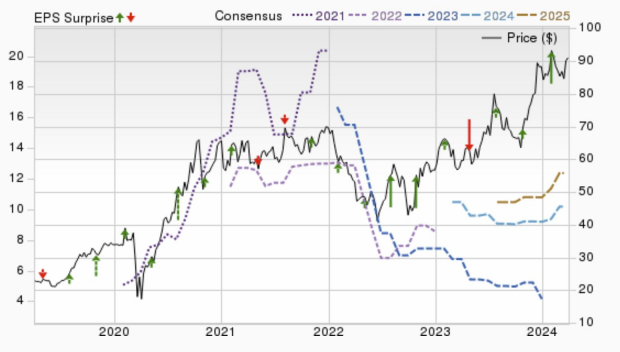

Technical Outlook

Post a significant rally in Q4 of 2023, PennyMac Financial Services is currently consolidating in a bull flag formation. A breakout above the $93.25 threshold would signify a technical breakout, potentially propelling the stock into another substantial uptrend.

Image Source: TradingView

Valuation Metrics

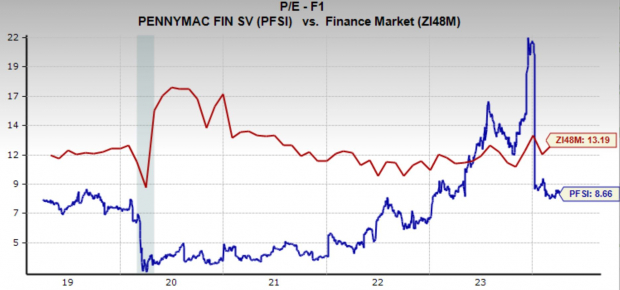

Adding to its appeal, PennyMac Financial Services boasts a highly attractive valuation. At just 8.7x forward earnings for the next year, it significantly undershoots the industry average.

However, what makes it even more enticing is its juxtaposition with growth prospects. With an anticipated 14.6% annual EPS growth over the next 3-5 years, PFSI boasts a PEG ratio of 0.6, characterizing it as an undervalued asset.

Image Source: Zacks Investment Research

Concluding Thoughts

Amidst concerns of rising interest rates and commercial real estate impacts on small and mid-cap financial institutions, the sector has witnessed tumultuous times. However, with dire expectations already factored in, this pessimistic sentiment unveils opportunities.

With a robust economy and future rate reduction forecasts, mortgage demand is primed for an upswing, placing PennyMac Financial Services at the forefront within the industry.

For investors seeking exposure to the Financials sector, PennyMac emerges as a compelling prospect.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.