Verizon and Nvidia Collaborate on New AI-Driven 5G Solutions

Innovative Infrastructure to Enhance AI Applications on Private Networks

On Tuesday, Verizon Communications Inc VZ revealed a new partnership with Nvidia Corp NVDA. Their collaboration aims to create solutions that allow a variety of AI applications to operate over Verizon’s dependable 5G private network, utilizing private Mobile Edge Compute (MEC) technology.

The innovative AI-enabled private 5G platform is designed for ease of use, allowing third-party developers to easily integrate and build upon the system, while also being prepared for future developments in AI tech and connectivity solutions.

This service can be delivered remotely through portable private network options or permanently installed at customer locations.

Also Read: Walmart Teams Up With China’s Meituan to Boost E-Commerce

The platform can support various compute-intensive applications such as Generative AI large language models, Vision Language Models, video streaming, broadcast management, computer vision, AR/VR/XR experiences, Autonomous Mobile Robots, Automated Guided Vehicles, and IoT devices.

Verizon plans to start demonstrating this solution in early 2025.

Srini Kalapala, Senior Vice President of Technology and Product Development at Verizon, emphasized the importance of combining Verizon’s leadership in private MEC with Nvidia’s AI technology. This partnership aims to enable real-time AI applications that require outstanding security, ultra-low latency, and high bandwidth.

Ronnie Vasishta, Senior Vice President of Telecom at Nvidia, expressed that incorporating Nvidia’s full-stack AI platform into Verizon’s solution represents a significant advancement. This move is expected to help businesses efficiently achieve their goals using AI.

In October, Keybanc analyst Brandon Nispel downgraded Verizon’s stock from Overweight to Sector Weight after a disappointing quarterly report.

Nispel raised concerns about Verizon’s possible acquisition of Frontier Communications Parent, Inc FYBR, suggesting it could limit the company’s ability to buy back shares in the near future, which typically results in yields above 6%. He also pointed out slowing growth in postpaid phone net additions and rising device subsidies that may lead to increased costs.

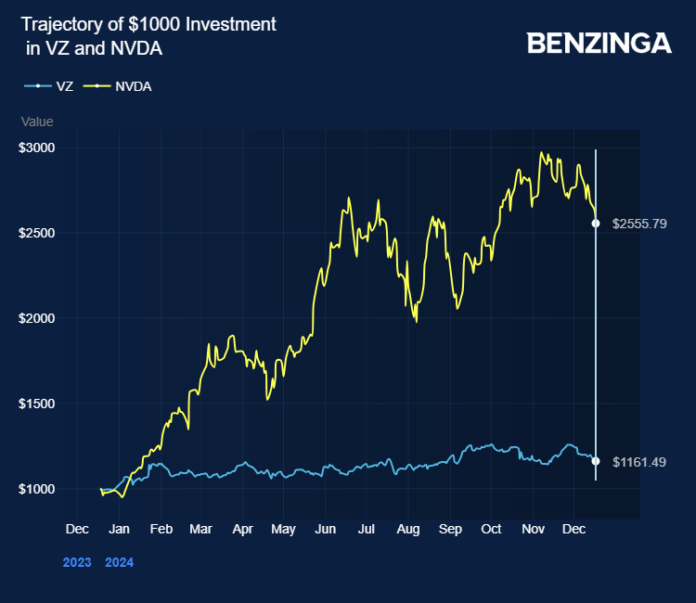

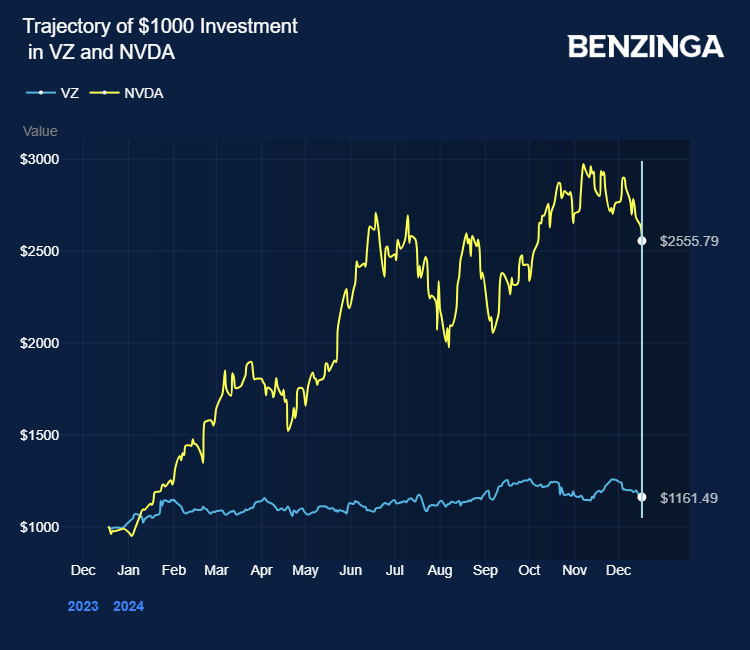

Price action: As of the latest update on Tuesday, VZ stock was down 0.02% to $40.87.

Also Read:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs