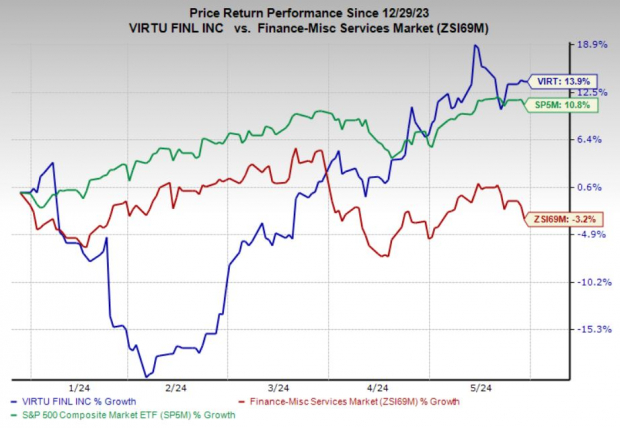

Shares of Virtu Financial, Inc. VIRT have gained 13.9% in the year-to-date period, outperforming the 10.8% growth of the S&P 500 Index and the 3.2% decline of the industry it belongs to. Factors such as strong operations, improving risk appetites and steady progress in profits areenhancing its results, which have been well-received by investors.

Virtu Financial, with a market capitalization of $3.6 billion, is a financial services company providing execution, market making, liquidity sourcing and other services. The company also boasts a prudent capital distribution history. These factors are collectively contributing to this Zacks Rank #1 (Strong Buy) company’s notable price appreciation.

Image Source: Zacks Investment Research

Can it Retain Momentum?

The ingredients are there, and now let’s get into the details and show you how its estimates for the coming days stand.

The Zacks Consensus Estimate for VIRT’s 2024 earnings is pegged at $2.34 per share, which witnessed one upward estimate revision and no downward movement in the past month. The estimate indicates a 27.2% year-over-year increase. Virtu Financial beat on earnings in two of the last four quarters and missed on other occasions.

The consensus mark for full-year 2024 adjusted net trading income stands at nearly $1.3 billion, suggesting an 8.1% rise from the prior-year reported number. Our estimate indicates an increase in trading income primarily from its Execution Services business (and to some extent from the Market Making business as well), which is likely to support the top-line growth.

The Spot Bitcoin ETFs’ launch is proving to be fruitful for VIRT and it is expected to continue expanding its addressable market opportunity. The ITG buyout, which diversified its revenues along with leveraging its core technology, is expected to continue supporting its Execution Services growth.

Its cash and cash equivalents of $399.6 million at the first-quarter end can easily address its short-term borrowings of $138.2 million. Its debt repayment efforts enabled it to keep the figure at a manageable $1.7 billion level as of Mar 31, 2024.

The company’s shareholder value boosting efforts are commendable. It repurchased 2 million shares worth $35.8 million in the first quarter of 2024 alone. It has increased the share repurchase authorization by $500 million for the next two years. It had a leftover capacity of $568.6 million under its buyback authorization.

These positive factors are likely to help the company maintain its share growth trajectory and continue outperforming the industry.

Risks

Despite the upside potential, there are a few factors that investors should keep an eye on.

Over the trailing 12-month period, its free cash flow declined 57.5%, following a 42.3% decrease in 2022 and a 35.3% fall in 2023. Also, with the market stabilizing fast, Virtu Financial’s Market Making business may encounter tepid growth. Nevertheless, we believe that a systematic and strategic plan of action will drive VIRT’s growth in the long term.

Key Picks

Investors interested in the broader Finance space may look at some other top-ranked players like Jackson Financial Inc. JXN, Euronet Worldwide, Inc. EEFT and CleanSpark, Inc. CLSK, each carrying a Zacks Rank #2 (Buy) now. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Jackson Financial’s current-year earnings indicates 32.2% year-over-year growth. JXN beat earnings estimates twice in the past four quarters and missed on the other occasions. The consensus mark for current year revenues suggests a 115.1% jump from a year ago.

The Zacks Consensus Estimate for Euronet Worldwide’s 2024 earnings indicates 15.8% year-over-year growth. During the past month, EEFT has witnessed three upward estimate revisions against none in the opposite direction. It beat earnings estimates in each of the past four quarters, with an average surprise of 9.3%.

The Zacks Consensus Estimate for CleanSpark’s current-year earnings suggests a 140.3% year-over-year improvement. During the past month, CLSK has witnessed one upward estimate revision against none in the opposite direction. The consensus mark for current year revenues suggests a 183.6% surge from a year ago.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

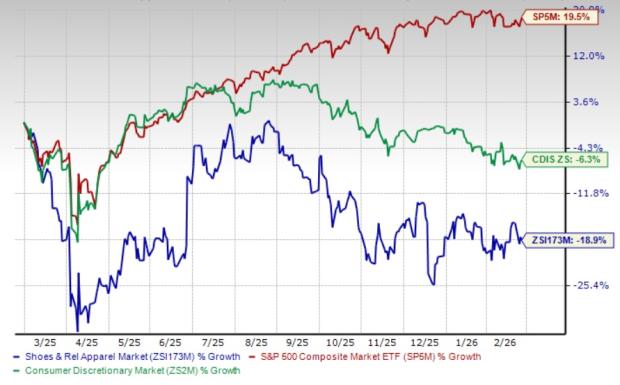

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Euronet Worldwide, Inc. (EEFT) : Free Stock Analysis Report

Virtu Financial, Inc. (VIRT) : Free Stock Analysis Report

Cleanspark, Inc. (CLSK) : Free Stock Analysis Report

Jackson Financial Inc. (JXN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.