Amazon’s Revenue Growth Puts It Ahead of Apple in Market Value

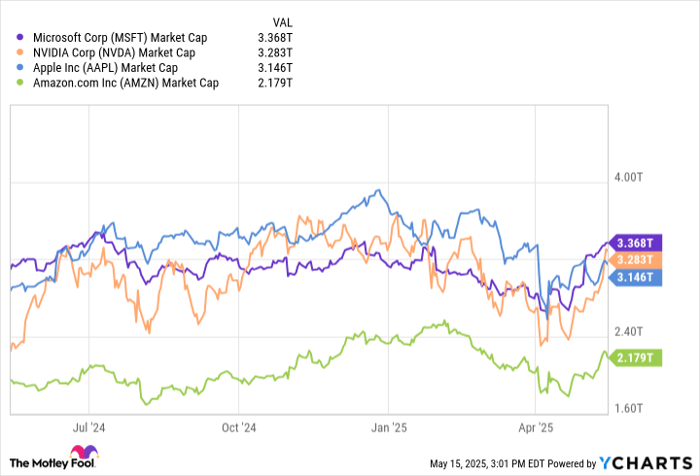

Apple (NASDAQ: AAPL) has been a prominent choice for long-term investors, yet the company faces challenges. The stock has shown minimal growth over the past year, with revenue showing only a slight increase compared to 2022. Due to these factors, Apple has lost its title as the largest company by market capitalization to Nvidia and Microsoft, both of which are demonstrating significantly faster growth than the iPhone maker.

Looking ahead, I predict that another major tech stock, Amazon (NASDAQ: AMZN), is likely to surpass Apple in market capitalization before the year ends. Amazon is poised for a significant leap due to margin expansion, advancements in artificial intelligence (AI), and potential legal challenges for Apple. Here’s why I believe Amazon stock will lead by the end of 2025.

Amazon’s Superior Revenue Growth

A key advantage for Amazon is its revenue growth. Over the last five years, Amazon’s revenue has increased by 102%, while Apple managed a 46% rise, mostly during the post-pandemic boom. Currently, Amazon generates $650 billion in annual revenue in comparison to Apple’s $400 billion.

How has Amazon achieved this rapid growth at such a large scale? The company thrives in two expansive markets: e-commerce and cloud computing. Online shopping continues to grow, which will drive further growth for Amazon in 2025. Additionally, AI has positively impacted Amazon Web Services (AWS), boosting revenue growth by 17% year over year last quarter, giving this segment very high profit margins.

While Facebook does not have the same favorable trends, Amazon will continue to benefit through the rest of the year.

Profit Margin Expansion and Legal Challenges

Examining profit margins, Amazon looks set to expand more easily than Apple in the coming months and beyond. The stock market typically values a company’s future potential, and Amazon’s operating leverage is promising. Conversely, Apple may face pressure to decrease profit margins from rising tariff costs on imports from China. Currently, Apple boasts a 32% operating margin over the past year, while Amazon’s stands at 11%.

Apple also faces potential legal issues related to its default search engine payments and App Store fees. If a legal remedy changes the $20 billion annual payment it receives from Google for default search settings on Safari, it could significantly impact Apple’s $127 billion in annual operating income.

Furthermore, a recent court ruling mandates that Apple must allow developers to offer alternate payment methods, undermining a significant revenue source by bypassing Apple’s 30% fee on in-app purchases.

Data by YCharts.

Amazon’s Favorable Valuation

While Apple stock has a slightly lower price-to-earnings (P/E) ratio of 33 compared to Amazon’s 34 based on trailing earnings, this does not account for Amazon’s growth potential and Apple’s risks. The outlook favors Amazon’s stock.

As we approach the end of the year, it should become evident that Amazon’s operating margin will continue to increase alongside its sustainable revenue growth. In contrast, Apple’s business faces challenges that could significantly reduce profitability.

Currently, Apple’s operating income of $127 billion outpaces Amazon’s $72 billion recorded over the past year. This disparity is what keeps Amazon’s market cap at $2.18 trillion against Apple’s $3.15 trillion. However, I expect this earnings gap to continue to narrow, prompting investors to increasingly favor Amazon and position it ahead of Apple by year-end in market capitalization.

Conclusion

Investors should closely monitor these developments, as shifts in market valuations could create new opportunities in the tech sector.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.