Dividend Declaration and Historical Perspective

Voya Global Equity Dividend and Premium Opportunity Fund announced on February 15, 2024, that it will be paying a regular monthly dividend of $0.04 per share ($0.48 annualized). This is consistent with the previous dividend payment.

To be eligible for the dividend, shares must be purchased before the ex-dividend date of March 1, 2024. Shareholders of record as of March 4, 2024, will receive the payment on March 15, 2024.

At the current share price of $5.06 per share, the dividend yield stands at an impressive 9.49%. A historical context reveals that over the past five years, the average dividend yield has been 9.38%, with the lowest at 7.55% and the highest at 12.47%. This illustrates a pattern of consistent returns, even achieving a yield of 0.10 standard deviations above the historical average.

However, it’s worth noting that the company has not raised its dividend in the last three years, a point that investors may consider as they evaluate their holdings.

The Sentiment of Fund Holders

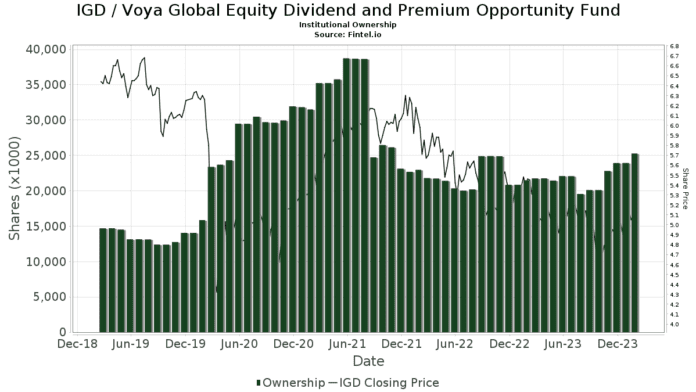

The sentiment of funds and institutions holding Voya Global Equity Dividend and Premium Opportunity Fund shares appears to be favorable. As of the last quarter, there are 114 reporting owners, marking an increase of 0.88%. The average portfolio weight of all dedicated funds to IGD has also risen by 1.06%, signifying a strengthened position. Institutions have demonstrated confidence in the fund, with a significant uptick of 6.20% in total shares owned over the last three months, reaching a total of 25,500K shares.

Karpus Management has notably increased its stake in IGD, now holding 2,978K shares, reflecting a substantial surge of 24.29% compared to its previous filing. On the other hand, Bank Of America, Capital Investment Advisors, Guggenheim Capital, and Invesco have all decreased their portfolio allocations in IGD by significant percentages over the last quarter. The diverse activities of these influential entities suggest contrasting opinions within the investor community regarding the future prospects of the fund.

Insights into Voya Global Equity Dividend and Premium Opportunity Fund

(This description is provided by the company.)

Voya Investment Management, a leading asset management firm, currently oversees more than $245 billion in assets for affiliated and external institutions, as well as individual investors. With a track record of over 40 years in asset management, the company is well-equipped to provide investment solutions, focusing on equities, fixed income, and multi-asset strategies and solutions. Accolades such as being named a “Best Places to Work” by Pensions and Investments magazine demonstrate the company’s commitment to delivering quality services to its clients.

Additional resources for comprehensive investment research and data are available through platforms such as Fintel, providing a wide array of valuable information and exclusive stock picks powered by advanced, backtested quantitative models.

Ultimately, the recent developments in the Voya Global Equity Dividend and Premium Opportunity Fund seem to reflect a nuanced blend of encouraging income returns, shifting sentiment among major stakeholders, and the enduring reputation of the company’s management expertise.

This article first appeared on Fintel and does not necessarily reflect the views and opinions of Nasdaq, Inc.