I always include a few mentors when I write new books and in my latest book, I reference my friend and fellow Seeking Alpha writer, Chuck Carnevale.

I met Chuck around fourteen years ago when I began writing on Seeking Alpha and he was kind enough to teach me how to become a value investor. As Chuck explained,

…if you’re looking for short-term profits, value investing is not a strategy for you. To keep this clear in my own mind rather than calling it value investing, I like to think of it as business perspective investing.

In other words, I am not seeing myself speculating in a stock, instead, I see myself partnering as a shareholder in a wonderful business that I purchased at an attractive value. Therefore, I am thinking like a business owner not a day trader.”

Over the last decade, I’ve become a student of value investing, always seeking to own stocks that I could purchase at a wide discount, or margin of safety. As Seth Klarman explained,

Few are willing and able to devote sufficient time and effort to become value investors, and only a fraction of those have the proper mind-set to succeed.”

More words of wisdom from Chuck, also known as Mr. Valuation:

There are numerous ways on how value investing can pay off.

You can simply buy a great company that is growing at a sound valuation and then let the growth generate strong future returns.

Or, you can buy a slower-growing company at a significant bargain and make your money through P/E expansion as the undervalued stock moves back into alignment with fair value.

There are other ways that value investing produces good returns…”

Klarman adds,

The most beneficial time to be a value investor is when the market is falling.”

I just reread Klarman’s book, Margin of Safety, which I would encourage all of you to read. A few more sentences from Klarman:

The disciplined pursuit of bargains makes value investing very much a risk-averse approach. The greatest challenge for value investors is maintaining the required discipline.”

I’ll admit, when I was younger, I had no interest in discipline, and in fact, I was a speculator, always looking to get rich quickly. Here’s how another Wall Street writer, Frank J. Williams explained speculation:

The quick profits are just froth. They arouse a fever in the blood and don’t last. The worst thing that can happen to a new spectator is to make a lot of quick money on his first trade.”

That’s precisely why I limit my speculative holdings (to 10% of my portfolio) and ignore the so-called “sucker yields” and “value traps”. As Klarman pointed out,

Being a value investor usually means standing apart from the crowd, challenging conventional wisdom, and opposing the prevailing investment winds. It can be a very lonely undertaking.”

I’m honored to be the most-followed writer on the Seeking Alpha platform, and I hope that my “conservatism” pays off for all of my readers.

It’s rare (or very unlikely) that you will see me touting a high yield stock like Annaly (NLY) or AGNC Investment Corp. (AGNC), both of which have witnessed numerous dividend cuts and have drastically underperformed.

I had a hard time grasping the concept of value investing because I could not recognize the fact that markets misappraise stocks in the short run, however Chuck Carnevale explained,

…at any point in time, the market can and will overvalue or undervalue a given company’s stock without regard to fundamental values. As a result, these same investors lack the confidence to trust that fundamentals will inevitably rule over the long run.”

As Chuck pointed out, “most unsuccessful value investors fail because they lack the patience to commit to long-term holding periods of time.”

Uncovering Opportunities in REITs

Most of you know that I spend a lot of time researching REITs. As Seth Klarman wrote,

Investment research is the process of reducing large piles of information to manageable ones. Distilling the investment wheat from the chaff. There is, needless to say, a lot of chaff and very little wheat.”

Our REIT coverage spectrum consists of over 150 companies, ranging from large S&P 500 names like Realty Income (O) to small-cap companies like Orion Office (ONL).

The reason I spend so much time researching REITs is because I want to achieve investment success and to help others (like Chuck did for me) reach financial freedom. As Klarman pointed out,

…today’s research may be advance preparation for tomorrow opportunities.”

So, in this article, I want to provide you with two REITs that our team has researched extensively and are in our so-called “sweet spot”.

Essential Properties Realty Trust (EPRT)

EPRT is a relatively unknown net lease REIT that I’ve been buying.

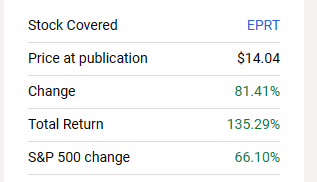

The company began trading in June 2018 and we picked up coverage almost immediately (August 2018). At the time (August 2018) EPRT was trading at $14.04 per share and since that time shares have returned over 135% (over 2x the S&P 500).

EPRT was my top pick in 2019,

EPRT and HIW: Investigating Quality and Value REIT Options

Thriving in the world of finance, one cannot help but realize the immense significance of sound investments. Countless individuals strive to identify that elusive stock or asset that will undoubtedly catapult them into financial prosperity—the colossal reward for a shrewd investment, akin to unearthing a hidden treasure.

EPR Properties (EPRT)

A behemoth amidst REITs, EPR Properties (EPRT), has garnered the reverence of investors for its unwavering success. For one ambitious investor, EPRT has proven to be not merely a vehicle for wealth accumulation, but a veritable golden goose. With returns surging over 80% in the past, the decision to procure more shares in 2020 yielded another remarkable 75% return.

The linchpin of this formidable success story can be attributed to the investor’s sagacious adherence to value investing. This unswerving commitment to fundamentals has furnished the investor with the acumen to discern a true bargain amidst the tumult of the market.

At present, EPRT is the proud owner of an impressive array of 1,793 properties, spread across 48 states. With a weighted average lease term of 13.9 years—the most extensive in the sector—and a mere 3% of rent due to expire through 2026—also the lowest in the sector—EPRT stands head and shoulders above its peers.

The eclectic portfolio is a testament to diversity, encompassing 363 tenants across 16 industries, with the company boasting a commendable 98.7% unit-level reporting, providing unparalleled insight into the financials of its tenants. Notably, 93% of cash ABR comes from service-oriented and experience-based tenants, underscoring the robustness and resilience of the portfolio.

Moreover, EPRT clings steadfastly to a disciplined capital structure, with well-laddered debt maturities, fixed 100% debt, and a 100% unencumbered asset base. As of Q3-23, the company boasted a record liquidity of $990 million, a feat since going public.

The company has impressively charted a path of consistent growth, reflected in its enviable CAGR of 6.2% in dividend growth and 10% in AFFO per share growth. With analysts predicting a 5% growth in 2024 and 6% in 2025, EPRT’s payout ratio, currently standing at 68% as of 2023, is nothing short of commendable.

Though not as attractively priced as in late October 2023, EPRT remains an enticing buy at $25.47. The P/AFFO currently sits at 15.4x, compared with the customary 19.5x, highlighting its potential for substantial returns.

The compelling historical data make for a compelling proposition—the stock historically traded around 19.5x prior to the COVID era—an encouraging sign, bolstered by projections of a triumphant return to that level by the end of 2025, promising annualized returns of 20%. The dividend yield of 4.5%, coupled with the lowest payout ratio in the net lease sector, further distinguishes EPRT.

Highwoods Properties (HIW)

Highwoods Properties (HIW), a stalwart in the realm of office REITs, commands attention for its unwavering resilience. This North Carolina-based REIT rightfully boasts a pristine record, standing as the sole office REIT to have weathered the tempest of the Great Recession without a dividend cut.

The company’s robust numbers tell a tale of their own—basking in the glow of a 28.5 million square foot office portfolio, with a staggering 95% of the assets basking in the sunbelt markets. These markets, flourishing with potential, encompass burgeoning cities like Dallas, Nashville, Raleigh, Charlotte, Atlanta, Orlando, and Tampa.

The portfolio exudes strength, with an impressive 88.7% occupancy rate, accompanied by a noteworthy 6.0-year weighted average lease term. Notably, there is a conspicuous absence of exposure to WeWork, leaving it shielded from potential volatility, which further fortifies HIW’s position.

Turning attention to the balance sheet, HIW maintains an admirable 41.8% in det + preferreds as a percentage of gross assets, with a striking 83.4% of NOI being unencumbered. This financial fortitude, underscored by investment grade ratings from Moody’s (Baa2) and S&P (BBB), elevates HIW’s standing among its peers.

Despite the modest dividend growth (1.3% per year since 2019 with no growth in 2023) and projected negative earnings growth in 2023 and 2024, HIW has earmarked a return to positive growth in 2026. Trading at $23.04 per share, with a P/AFFO multiple of 9.7x, the REIT is priced well below the customary P/AFFO of 18.2x, sporting a tantalizing dividend yield of 8.7%.

Brimming with the promise of potential, the stock, despite facing unfavorable growth estimates, stands resilient and appears poised to navigate the current cycle without resorting to a dividend cut. HIW’s in-process development and core land bank, valued at $518 million and $3.7 billion respectively, inject vitality into the stock, appealing to discerning value investors.

In Conclusion

In my foray into the world of finance in 2023, I meticulously devised our Quality and Value Tracker—an invaluable tool that guides the selection of constituents for our REIT ETF. The tracker has bestowed commendable scores upon EPRT for its quality and HIW for its attractive valuation, shedding light on the inherent potential of these REITs.

The core ethos of this index is to empower our team to explore the REIT universe in quest of the most lucrative prospects, highlighting that the unwavering pursuit of bargains epitomizes value investing as an inherently risk-averse approach—a philosophy echoed by the illustrious Seth Klarman.

As a quote attributed to Benjamin Graham—perhaps the most illustrious value investor of all time—aptly captures, the investor’s triumph is contingent not upon the concurrence of the masses but rather on the robustness of data and sound reasoning.

As articulated in the seminal work, The Intelligent Investor, the value investor’s raison d’être is to seize upon the fortuitous discord between price and intrinsic value.

Bottom Line

Please note: Brad Thomas is a Wall Street writer. Consequently, fallibility is an integral facet of his predictions and recommendations. In the same vein, grammatical errors might intermittently infiltrate his writing. This article is provided without charge, designed to aid research endeavors and foster second-level thinking.