Alibaba’s Stock Shows Strong Upside Potential, Analysts Suggest

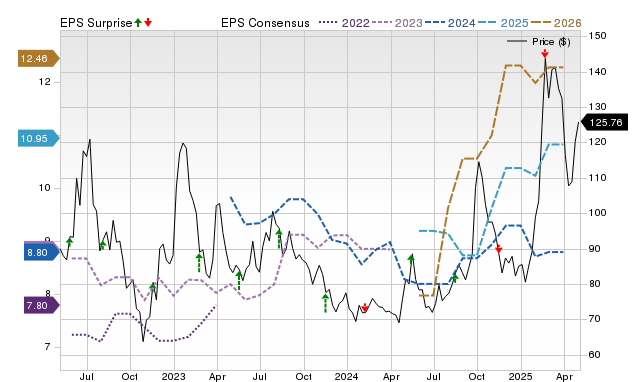

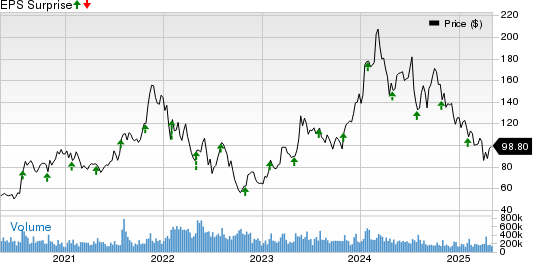

Alibaba (BABA) closed the last trading session at $125.76, reflecting a gain of 7.9% over the past four weeks. Analysts predict that there could be further upside, with a mean price target of $158.20 indicating a potential increase of 25.8% from the current price.

This mean estimate is based on 20 short-term targets, with a standard deviation of $20.48. While the lowest forecast stands at $112, which represents a 10.9% decline, the most optimistic analyst anticipates a surge to $190, reflecting a 51.1% increase. Notably, the standard deviation helps assess the variability among estimates; a smaller standard deviation suggests stronger agreement among analysts.

Analyst Consensus and Reliability

While the consensus price target is valued by investors, the objectivity of analysts in making these predictions has been questioned historically. Relying solely on such targets might mislead investors, as they often do not reflect accurate future stock prices.

Factors influencing analysts may include the desire to boost interest in companies linked to their firms. Consequently, inflated price targets can result from business biases, and thus should be approached with caution.

A tighter clustering of price targets, indicated by lower standard deviation, can show analysts’ consensus on a stock’s directional movement. Although this does not guarantee that the stock will meet the average price target, it provides a basis for further investigation into fundamental drivers.

The Case for BABA’s Upside

Increasing analyst optimism regarding Alibaba’s earnings potential also supports the argument for an upside. Research highlights the correlation between earnings estimate revisions and near-term stock price movements.

Over the past month, the Zacks Consensus Estimate for the current year has risen by 1.2%, with more estimates increasing than decreasing.

BABA currently holds a Zacks Rank #2 (Buy), placing it in the top 20% of over 4,000 ranked stocks based on earnings estimates. This ranking underscores the stock’s potential for near-term gains.

Final Insights on Price Targets

Although the consensus price target may not directly indicate how much BABA could increase, it does suggest a favorable direction for price movements, warranting investor attention.

The views expressed in this article reflect the author’s opinions and do not necessarily align with those of other publications. Investors are encouraged to conduct their own research.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.