Understanding Brokerage Recommendations

Investors often consult Wall Street analysts’ recommendations before deciding on their stock investments. These sell-side analysts wield significant influence, and their rating changes can sway a stock’s price. But how reliable are these recommendations, and should you base your investment decisions solely on them?

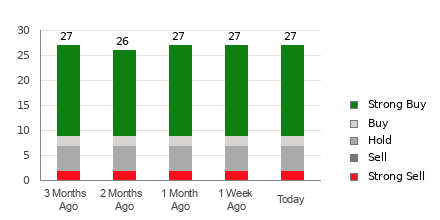

Brokerage Recommendation for Micron (MU)

Micron currently holds an average brokerage recommendation (ABR) of 1.33, falling between Strong Buy and Buy on a scale from 1 to 5. This calculation is derived from actual recommendations made by 26 brokerage firms, with a dominating majority of 80.8% endorsing a Strong Buy. The bullish sentiment is apparent, but does it warrant unquestioning traction from retail investors?

Reliability of Brokerage Recommendations

Research has consistently shown the limited success of brokerage recommendations in accurately predicting a stock’s price movement. Analysts, driven by the vested interests of their employers, often exhibit a strong positive bias, with five “Strong Buy” ratings for every “Strong Sell” endorsement. Consequently, their recommendations may not always align with the actual trajectory of a stock.

Validating Recommendations

In contrast to conventional brokerage recommendations, the Zacks Rank, a tool with a proven track record, leverages earnings estimate revisions to assess a stock’s potential. This model, categorized from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), serves as a reliable indicator of near-term price performance.

The Distinction: ABR vs. Zacks Rank

While the ABR relies solely on broker recommendations, the Zacks Rank is grounded in a quantitative model centered around earnings estimate revisions. The bias in broker ratings contrasts with the empirical correlation between earnings estimate trends and short-term stock price movements, endorsing the credibility of the Zacks Rank.

Assessing Micron’s Potential

Despite the positive ABR for Micron, the recent surge in the Zacks Consensus Estimate by 49% for the current year to -$0.44 has resulted in a Zacks Rank #2 (Buy) for the stock. This growing optimism among analysts underscores the potential for Micron’s stock to soar in the near term.

Unlocking Investment Opportunities

Ultimately, while brokerage recommendations may offer a fleeting sense of direction, validating these insights with robust tools like the Zacks Rank could significantly enhance the precision of investment decisions. As the investment landscape continually evolves, relying on a singular source for guidance may not always yield favorable outcomes.