Should You Buy Meta Platforms? Analyzing Analyst Recommendations

Wall Street analysts play a significant role in helping investors determine whether to buy, sell, or hold stocks. Changes in their ratings can sway stock prices. But how reliable are these recommendations? Let’s explore what analysts say about Meta Platforms (META) and how to interpret their insights.

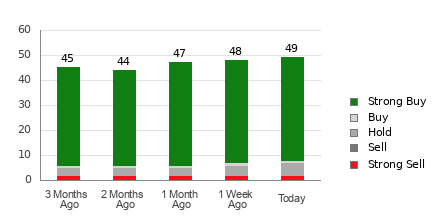

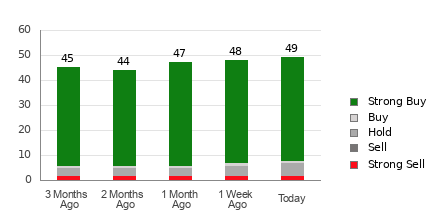

Currently, Meta Platforms holds an average brokerage recommendation (ABR) of 1.39, rated on a scale from 1 (Strong Buy) to 5 (Strong Sell). This rating comes from 49 brokerage firms and reflects a general opinion leaning towards a Strong Buy. In detail, 41 recommendations are Strong Buy and only one is a Buy, meaning that Strong Buy and Buy make up 83.7% and 2% of the total recommendations, respectively.

Understanding Current Trends for META

The current ABR shows that analysts are optimistic about Meta Platforms, but relying solely on this for investment decisions can be misleading. Research suggests that brokerage recommendations often do not successfully lead investors to stocks with the highest potential for price growth.

One reason for this is the potential bias among brokerage firms. Their analysts often display a strong positive bias in their ratings. Studies indicate that firms give five “Strong Buy” recommendations for every “Strong Sell” they make.

This indicates that their interests do not always align with those of retail investors, resulting in misguidance rather than clarity. Consequently, using these recommendations as a means for validating your own research could be more fruitful.

For instance, our proprietary rating tool, the Zacks Rank, offers a more reliable short-term performance indicator. It rates stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell) and can effectively complement your investment decisions when paired with the ABR.

Distinguishing Between ABR and Zacks Rank

Though both the ABR and Zacks Rank use a similar scale from 1 to 5, they measure different factors.

The ABR is based solely on broker recommendations and typically appears in decimal form, such as 1.28. Meanwhile, the Zacks Rank stems from earnings estimate revisions, presented in whole numbers.

Often, analysts tend to be overly optimistic due to their firms’ interests, leading to more favorable ratings than their data might dictate. Conversely, the Zacks Rank relies on earnings estimate revisions, which empirical research has shown correlate closely with stock price movements.

Additionally, while the Zacks Rank is regularly updated according to the latest earnings estimates, the ABR may not be as current, affecting its reliability for immediate decisions.

Should You Consider Investing in META?

The earnings estimates for Meta Platforms have recently risen by 5.1%, now at a consensus of $22.44 for the current year, indicating growing analyst optimism. Their agreement to raise earnings per share (EPS) estimates lends credence to the idea that Meta’s stock may perform well in the near future.

This notable shift in consensus, accompanied by three additional related factors, has earned Meta Platforms a Zacks Rank of #2 (Buy). For a complete list of Zacks Rank #1 (Strong Buy) stocks, you can explore here.

Thus, the Buy-equivalent ABR for Meta Platforms can provide valuable guidance for your investment choices.

Expert Picks for Significant Gains

Among thousands of stocks, five Zacks experts have each selected a favorite, predicting a potential surge of +100% or more in the coming months. Director of Research Sheraz Mian highlights one stock with exceptional upside potential.

This company focuses on millennial and Gen Z markets, boasting almost $1 billion in revenue last quarter alone. A recent downturn presents an excellent entry point for potential investors. Though not every suggestion is a guaranteed success, this stock might outperform previous high-flyers like Nano-X Imaging, which increased by +129.6% within nine months.

To gain insight into our top stock and four additional runners-up, download our free report.

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read more on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.