When it comes to making investment decisions, the guidance of Wall Street analysts weighs heavily on the minds of investors. However, can these broker recommendations be relied upon as a dependable indication of a stock’s potential?

Before delving into the credibility of brokerage advice and its strategic usage, let’s first understand the sentiment of the Wall Street heavyweights towards Boeing (BA).

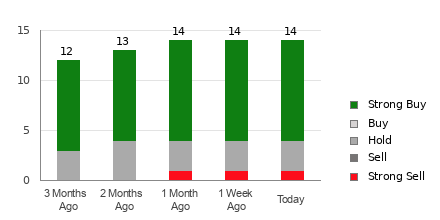

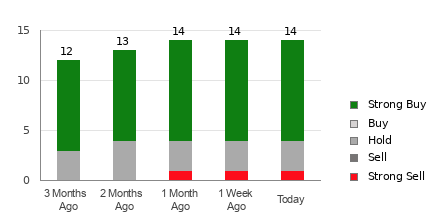

Boeing currently holds an average brokerage recommendation (ABR) of 1.35, falling between the range of 1 to 5 (Strong Buy to Strong Sell). This calculation is derived from the actual recommendations provided by 20 brokerage firms, indicating a confluence around the “Buy” sentiment.

Of the 20 recommendations contributing to the current ABR, a substantial 80% advocate a “Strong Buy” and 5% recommend a “Buy,” portraying an overwhelmingly positive sentiment from the analyst community.

Wall Street’s Take on Boeing (BA)

Check price target & stock forecast for Boeing here>>>

While the ABR signals an affirmative stance on Boeing, it is crucial for investors to recognize that relying solely on brokerage recommendations may not always lead to prudent investment decisions. Research has indicated limited success in using brokerage advice as a reliable predictor of a stock’s price movement.

Why is this the case? The vested interest of brokerage firms in the stocks they cover tends to result in an optimistic bias among their analysts. As per our findings, for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” recommendations, casting doubt on the objectivity of their assessments.

Therefore, it is advisable to use this information as a reference point to validate independent analysis or a proven tool for predicting stock price movements.

With a meticulously audited track record, our proprietary stock rating tool, the Zacks Rank, offers invaluable insights into a stock’s short-term performance. Overlaying the ABR with the Zacks Rank can significantly augment informed investment decisions.

Deciphering ABR and Zacks Rank

It’s essential to distinguish between the ABR and the Zacks Rank. While both are depicted on a scale of 1 to 5, they represent distinct evaluation metrics.

The ABR is calculated solely based on brokerage recommendations, often presented in decimals like 1.35, reflecting the prevailing sentiment from analysts. On the other hand, the Zacks Rank operates as a quantitative model that harnesses the power of earnings estimate revisions, portrayed in whole numbers ranging from 1 to 5.

Notably, brokerage analysts have historically exhibited a tendency towards excessively optimistic recommendations, influenced by their employers’ vested interests. In contrast, the Zacks Rank derives its foundation from earnings estimate revisions, which have demonstrated a strong correlation with short-term stock price movements, as substantiated by empirical research.

Moreover, the Zacks Rank ensures a proportional distribution across all stocks for which brokerage analysts provide earnings estimates, maintaining equilibrium among the five assigned ranks at all times.

Another critical disparity lies in the timeliness of ABR and the Zacks Rank. While the ABR may not always reflect the most current sentiments, the Zacks Rank swiftly incorporates analysts’ earnings estimate revisions, offering timely insights into future stock prices.

Is Boeing (BA) a Lucrative Investment?

Assessing the earnings estimate revisions for Boeing, the Zacks Consensus Estimate for the current year has witnessed a notable 5.7% increase in the past month, settling at -$5.97.

The extensive consensus among analysts in revising EPS estimates upward signals growing optimism regarding the company’s earnings potential, a prominent catalyst for potential stock upsurge.

This substantial change in the consensus estimate and other related factors have culminated in a Zacks Rank #2 (Buy) for Boeing, positioning it favorably for prospective investors.

Hence, the buy-equivalent ABR for Boeing could serve as an informative guide for investors navigating the stock market terrain.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

The Boeing Company (BA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.