Before diving into the latest Wall Street heavyweights’ insights on Royal Caribbean (RCL), it’s essential to ponder whether analyst recommendations truly shape the market and inform investment decisions. A stock, like a ship navigating choppy waters, relies on these assessments to steer its course, but are they the guiding light investors seek?

Let’s first explore what these financial titans are asserting about Royal Caribbean (RCL) and the significance of brokerage recommendations in driving investment decisions.

Analyst Recommendations for Royal Caribbean (RCL)

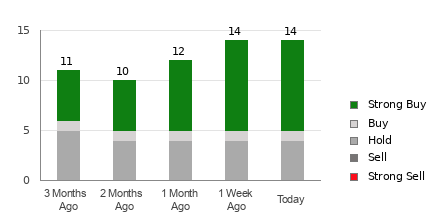

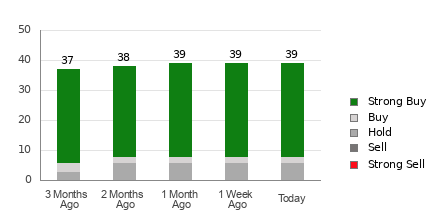

Royal Caribbean presently holds an average brokerage recommendation (ABR) of 1.44 on a scale of 1 to 5, indicating a sentiment between Strong Buy and Buy, based on recommendations from 16 brokerage firms. Out of the 16 recommendations, 75% are Strong Buy and 6.3% are Buy, contributing to the current ABR. These figures illustrate a bullish outlook from Wall Street.

The Reliability of Brokerage Recommendations

Despite the seemingly optimistic ABR for Royal Caribbean, relying solely on this metric to make investment decisions may not be prudent. Numerous studies have demonstrated that brokerage recommendations have limited efficacy in identifying stocks with the greatest potential for price appreciation. This lacksluster performance is attributed to an inherent bias among analysts, who tend to issue disproportionately positive ratings driven by their firms’ vested interests, misguiding investors more often than providing accurate guidance.

Understanding the Zacks Rank

While the ABR provides insights based on brokerage recommendations, it is critical to differentiate it from the Zacks Rank, a proprietary tool that categorizes stocks from Strong Buy (Zacks Rank #1) to Strong Sell (Zacks Rank #5). The Zacks Rank underscores the significance of earnings estimate revisions and their impact on stock price movements, offering a more objective assessment compared to broker recommendations.

Exploring Earnings Estimate Revisions

Analysts’ increasing optimism regarding Royal Caribbean’s earnings prospects, evident in the upward revisions of EPS estimates, has resulted in a Zacks Rank #2 (Buy) for the company. This indicates a strong consensus among analysts regarding the stock’s potential for near-term growth, signaling a favorable outlook for prospective investors.

Investment Implications

While the ABR may offer a cursory guide, considering insights from the Zacks Rank, underpinned by earnings estimate revisions, could serve as a more robust framework for making informed investment decisions.

Read the full article on Zacks.com for an in-depth analysis.