U.S. auto giant General Motors GM has seen its earnings estimates for 2025 and 2026 move north over the past seven days. Last Tuesday, the company released impressive fourth-quarter 2024 results. The top and bottom lines beat expectations and rose from the corresponding quarter of 2023.

See the Zacks Earnings Calendar to stay ahead of market-making news.

General Motors’ full-year 2024 revenues grew 9% to roughly $187 billion. Revenues have grown at a CAGR of 10% since 2021. GM retained its title of the top-selling automaker in the United States, with full-year market share rising 30 basis points to 16.5%. It also set new records in adjusted EBIT ($14.9 billion) and free cash flow ($14 billion) in 2024.Annual earnings spiked 38% to a record $10.60 per share. Encouragingly, the company expects 2025 EPS in the range of $11-$12 per share.

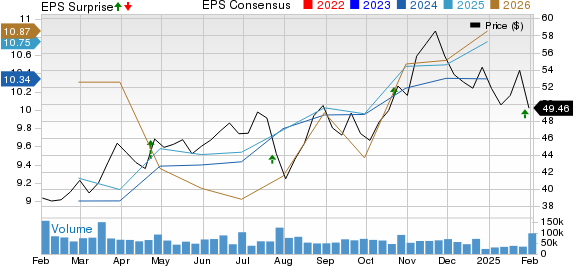

General Motors Company Price, Consensus and EPS Surprise

General Motors Company price-consensus-eps-surprise-chart | General Motors Company Quote

Amid stellar 2024 results and upbeat EPS view for 2025, analysts are seemingly turning optimistic on the stock and upwardly revising earnings estimates.

Image Source: Zacks Investment Research

Having said that, General Motors expects a slight decline in ICE wholesale volume in North America, though EV growth will partially offset the impact. Another challenge is the 25% tariffs that President Trump has imposed on imports from Mexico and Canada. This could impact GM’s results as the company imported roughly 750,000 vehicles from Canada/Mexico in 2024. The higher tariffs would not only affect fully assembled vehicles but also the cost of parts sourced from Mexico, further escalating production costs for GM’s U.S.-based plants. This policy change has indeed added a layer of uncertainty, but GM’s long-term prospects still appear bright overall.

GM’s Electrification Strides Are Impressive

GM was the second best-selling EV maker in the second half of 2024 in the United States, just behind Tesla TSLA, which continues to dominate with a 50% market share. General Motors’ U.S. EV sales totaled 114,000 in 2024, representing a 50% increase from 2023.The company’s diverse lineup, including the Chevy Equinox EV, Cadillac Lyriq and GMC Hummer EV, positioned it as the second-largest EV seller in the country. Per S&P Global Mobility, Lyriq is the best-selling midsized luxury SUV in the United States. GM expects models like Escalade IQ, OPTIQ and VISTIQ to expand its market share in the EV space.

Importantly, in the final quarter of 2024, GM’s EV portfolio became “variable profit positive” thanks to production scale efficiencies, lower material cost and expansion of the portfolio with the Cadillac Escalade IQ and Sierra EV launches. General Motors produced 189,000 EVs last year and aims to build 300,000 in 2025. It expects its EV operating losses to reduce by about $2 billion this year.

Also, General Motors’ deals with Vianode, Lithium Americas, LG Chemical, POSCO Chemical and Livent have boosted its EV supply chain, aligning with its long-term electrification goals.

GM’s Restructuring of China Operations Paying Off

The company’s business in China struggled for most of 2024 amid intense competition and pricing wars. In response to its declining fortunes in China, GM is now focusing on overhauling its operations in the country by rightsizing, launching new products and reducing dealer inventory and costs. Its restructuring efforts have begun to yield results. The company reported positive equity income in China in the last quarter of 2024, excluding $5 billion in restructuring costs. Deliveries in the fourth quarter jumped over 40% sequentially, marking the highest quarter-on-quarter increase since the second quarter of 2022. General Motors targets to turn around its China business to profitability this year.

GM’s Liquidity & Buyback Program Lift Confidence

GM’s balance sheet further underscores its strength. With $35.5 billion in total automotive liquidity as of Dec. 31, 2024 — including $21.7 billion in cash — the company is well-equipped to weather macroeconomic challenges.

Investor-friendly initiatives add another layer of appeal. The company returned $7.6 billion in dividends and buybacks last year. It completed its accelerated share repurchase program of $10 billion, retiring 25 million shares. GM met its goal of reducing its outstanding share count below 1 billion, closing the year at 995 million shares. As of 2024 end, GM had $300 million in capacity remaining under its share buyback program.

General Motors is Undervalued

At its current levels, GM stock looks highly attractive from a valuation standpoint. With a forward price-to-earnings (P/E) ratio of 4.36, GM trades at a significant discount to industry levels as well as its closest rival, Ford F.

GM’s P/E F12M Vs. Industry & Ford

Image Source: Zacks Investment Research

This bargain valuation, combined with strong earnings growth, makes GM an appealing pick for value investors. GM has a Value Score of A.

GM is a Buy Now

Despite policy changes under the Trump administration, we think GM is well-positioned to navigate any uncertainty. Its robust US presence, strategic focus on cost reduction, EV innovation, attractive valuation and positive earnings estimate revisions make us bullish on the stock. The Wall Street average target price of $58.04 for GM stock suggests an upside of over 17% from current levels.

With a mix of value, growth potential and resilience, GM stock is a compelling addition to any portfolio. The stock carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.