“`html

Artificial Intelligence: A Turning Point for Corporate America and Wall Street

About thirty years ago, the rise of the internet transformed corporate America by opening up new sales avenues and expanding market reach, particularly internationally.

Since then, exciting technologies have emerged, each promising significant financial success. However, many—such as 3D printing, blockchain, and the metaverse—have not lived up to expectations until now.

Start Your Mornings Smarter! Get Breakfast News delivered to your inbox every market day. Sign Up For Free »

After a lengthy wait, it appears Wall Street and investors might finally have a new growth engine: artificial intelligence (AI).

Image source: Getty Images.

The $15.7 Trillion AI Opportunity for Investors

AI stands out due to its seemingly limitless potential. As AI-driven software and systems become increasingly skilled, they can learn and adapt to new tasks independently, enhancing productivity across various industries worldwide.

Estimates of AI’s market size differ widely, as is common with emerging technologies. However, analysts at PwC project that AI could contribute an impressive 26% to global GDP—about $15.7 trillion—by 2030.

Leading the AI wave is the semiconductor giant Nvidia (NASDAQ: NVDA), which has gained more than $3 trillion in market value since early 2023, mainly due to the soaring demand for its AI-graphics processing units (GPUs).

Nvidia charges significantly more for its Hopper (H100) GPUs—up to four times more than what Advanced Micro Devices earns from its Insight MI300X chips. Furthermore, the upcoming Blackwell GPU architecture promises even greater energy efficiency and faster computing, solidifying Nvidia’s position as the leader in AI GPU market share.

Investment in AI is undeniably strong. For instance, Meta Platforms (NASDAQ: META) plans to spend about $10.5 billion to acquire 350,000 Hopper chips from Nvidia, essential for its AI data center strategies. Moreover, Meta is also creating its own AI chip, called the Meta Training and Inference Accelerator.

Similarly, Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG) ranks among Nvidia’s top clients. Its Google Cloud segment, the third-largest in cloud infrastructure, is set to benefit from generative AI solutions, supporting robust growth in this lucrative sector. Alphabet is also developing its own AI chip, known as Trillium.

Even tech giant Apple (NASDAQ: AAPL) has deepened its investment in AI. Unlike Meta and Alphabet, which rely heavily on Nvidia’s hardware, Apple utilizes Google’s tensor processing units to power its recently launched Apple Intelligence model, enabling users to create content and process data more efficiently.

However, the amount spent on another type of investment by these prominent names far surpasses their AI expenditures.

Image source: Getty Images.

AI Leaders’ $1.23 Trillion Investment in Stock Buybacks

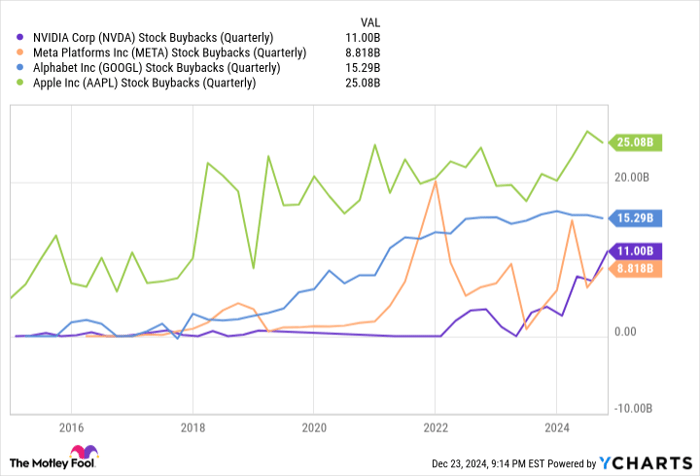

If you examine the financial reports of Nvidia, Meta, Alphabet, and Apple, it’s clear they invest tens of billions in research and development (R&D). However, these four companies also share a staggering investment of $1.23 trillion in share buybacks over the last decade, ending September 30, 2024.

This overwhelming chunk of capital has been directed towards buying back shares rather than just supporting R&D efforts.

According to data from S&P Global, companies in the S&P 500 have repurchased a total of $7.11 trillion in stock over the last decade. Notably, 20 companies accounted for 34% of this amount during the third quarter of 2024. Breakdown of buybacks for Nvidia, Meta, Alphabet, and Apple includes:

- Apple: $695.312 billion

- Alphabet: $286.684 billion

- Meta Platforms: $186.187 billion

- Nvidia: $63.828 billion

This totals to a notable $1.232 trillion focused on share buybacks.

NVDA Stock Buybacks (Quarterly) data by YCharts.

For those curious about why these leading AI companies devote so much to stock repurchases over R&D or acquisitions, three reasons stand out.

First, share buybacks can enhance earnings per share (EPS) for firms with stable or increasing net income—all four of these companies qualify for this advantage. Reducing the number of outstanding shares can elevate EPS, making the companies more appealing to investors.

Secondly, consistent buybacks indicate to investors that the company’s leadership views its stock as a solid investment. Although insider purchases can convey a similar message, buybacks offer further confirmation of a company’s commitment and financial confidence.

“`

Exploring Cash Flow and Investment Opportunities Among Tech Titans

Four major tech companies lead the way in operating cash flow, which allows them to invest and innovate in artificial intelligence (AI) advancements. Here’s a closer look at their financial strength over the last year:

- Nvidia: $48.7 billion

- Meta Platforms: $82.7 billion

- Alphabet: $105.1 billion

- Apple: $118.3 billion

These substantial cash reserves not only enable these companies to repurchase shares but also give them the flexibility to take calculated risks in emerging technologies.

Is Now the Right Time to Invest $1,000 in Nvidia?

Before considering an investment in Nvidia, take note of the following:

The Motley Fool Stock Advisor has recently spotlighted the 10 best stocks for potential buyers, with Nvidia not making the cut. The firms selected are believed to hold significant potential for high returns in the near future.

Reflecting back, when Nvidia was included on this list on April 15, 2005, an investment of $1,000 at that time would have grown to an impressive $859,342!*

The Stock Advisor service offers investors a comprehensive strategy for building wealth, featuring investment insights, regular analyst updates, and two new stock recommendations each month. Since 2002, the service has more than quadrupled the returns of the S&P 500 index.*

Explore the 10 recommended stocks »

*Stock Advisor returns as of December 23, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former Facebook executive and sister to Meta Platforms CEO Mark Zuckerberg, is also a board member. Additionally, Sean Williams holds positions in Alphabet and Meta Platforms. The Motley Fool has investments in Advanced Micro Devices, Alphabet, Apple, Meta Platforms, Nvidia, and S&P Global. They adhere to a strict disclosure policy.

The views expressed here are from the author and do not necessarily represent those of Nasdaq, Inc.