Walmart Stock Soars: A 72% Jump in 2024 and What Analysts Predict Next

Walmart’s shares (NYSE: WMT) surged by an impressive 72% in 2024, marking the company’s most significant annual gain since 1998. This remarkable performance far exceeded the S&P 500 index, which saw a commendable rise of 23%. The last time Walmart shareholders experienced such a boost was 25 years ago, leading many investors to wonder what drove this change.

Where should you invest $1,000 today? Our analysts have outlined the 10 best stocks for investment right now. Discover the 10 stocks »

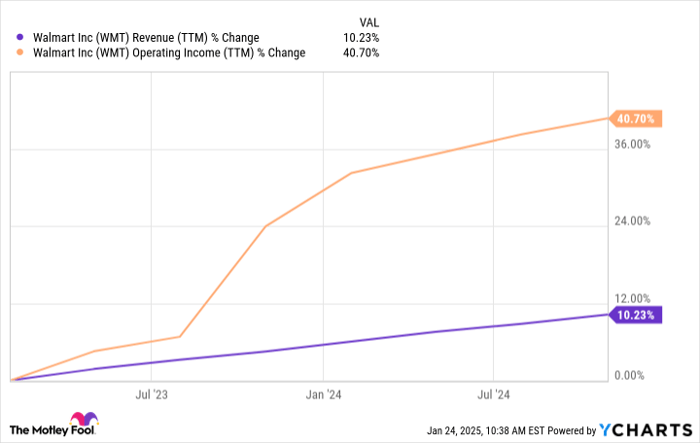

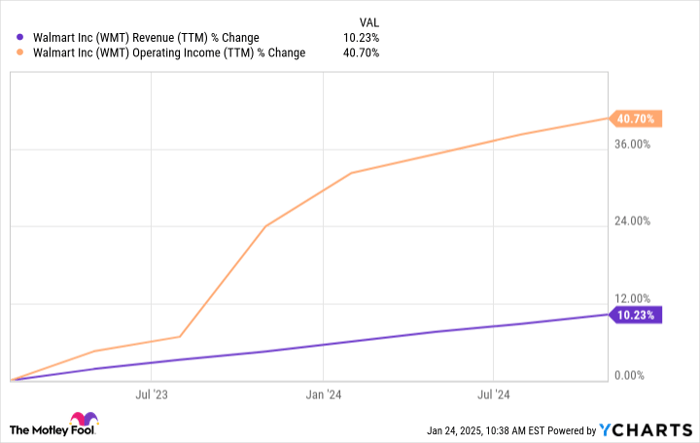

The striking correlation between Walmart’s stock price and its rising operating income cannot be overlooked. Since the beginning of 2023, operating income has improved significantly, as illustrated in the chart below.

WMT revenue (TTM) data by YCharts; TTM = trailing 12 months.

What’s Driving Profit Growth at Walmart?

In a recent earnings call discussing Q3 2024 results, CEO Doug McMillon commented on the company’s remarkable growth:

Globally, we drove strong growth in e-commerce, up 27%. Advertising grew 28%, and membership income was up 22%. This helped us grow profits faster than sales.

McMillon pointed out that e-commerce, advertising, and membership fees have collectively fueled profit growth. Understanding these factors is crucial for assessing Walmart’s soaring stock prices and determining if this positive trend will continue.

How Membership, E-Commerce, and Advertising Are Transforming Walmart

Walmart launched its membership program, Walmart+, in 2020, which has experienced exceptional growth. As reported by PYMNTS, the program had over 60 million subscribers by September 2022, with continued double-digit growth expected since then. It’s possible the subscriber count is nearing 100 million now.

The e-commerce sales reflect transactions where customers buy online and pick up their orders in-store. Walmart+ members are incentivized to utilize these services, contributing to the company’s e-commerce growth. This digital expansion allowed Walmart to welcome third-party sellers on its platform, akin to its competitor, Amazon, and significantly boost advertising revenue.

In summary, Walmart’s digital growth strategy is proving effective. Fees from memberships, cuts from third-party sales, and advertising revenues are driving operating income higher. Consequently, the stock has achieved its most substantial gain since 1998.

Is Walmart’s Growth Sustainable?

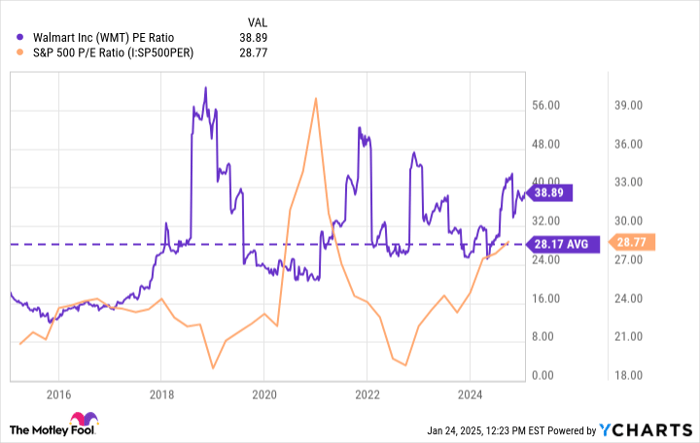

After such a stellar performance, one might wonder if Walmart’s stock is now overvalued. However, this perspective may overlook critical details. Historically, Walmart’s shares have averaged a price-to-earnings ratio (P/E) of 28, aligning with the current P/E valuation of the S&P 500, according to YCharts.

WMT PE ratio data by YCharts.

While Walmart’s valuation exceeds its historical average, the rapid profit growth justifies this increase. The key question now is whether this trend of faster profit growth will continue beyond 2025.

I believe Walmart can sustain this momentum, at least for the next year. Factors driving growth such as e-commerce and advertising continue to thrive, as evidenced by increases of over 20% in revenue across these segments during the third quarter.

Typically, such growth doesn’t suddenly cease; it tends to decelerate gradually. Therefore, double-digit growth in these areas is reasonable to expect moving forward. Furthermore, the company remains early in its digital transformation, suggesting that growth could either stabilize or pick up pace.

While another 72% gain in 2025 seems unlikely, the strength of Walmart’s digital sector should positively influence its profits. This positions the stock well to potentially outperform the S&P 500 again in the coming year.

Don’t Miss Your Chance on Promising Investment Opportunities

Have you ever felt you missed out on top-performing stocks? Now is your chance to catch up.

Our experts occasionally issue a “Double Down” stock recommendation for companies they believe are poised for significant growth. If you fear you missed your opportunity, consider investing now before it’s too late. The results speak volumes:

- Nvidia: If you invested $1,000 when we first recommended it in 2009, you’d have $369,816!*

- Apple: An investment of $1,000 from 2008 would have grown to $42,191!*

- Netflix: If you jumped in at our recommendation in 2004, your $1,000 would now be worth $527,206!*

Currently, we are providing “Double Down” alerts for three remarkable companies, and this might be a unique opportunity.

Learn more »

*Stock Advisor returns as of January 21, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.