Walt Disney Co., the entertainment behemoth known for its magical narratives and captivating characters, is pivoting its strategy in the fiercely competitive world of streaming services. Recently, the company announced a bold move to monetize on password sharing on its flagship Disney+ platform.

For a nominal fee, users can now extend their subscription privileges to a friend or family member outside their household. This innovative offering is priced at an extra $6.99 per month for the ad-supported tier and $9.99 monthly for the ad-free plan, enhancing the connectivity of Disney’s beloved content beyond the confines of a single household.

It’s important to note that this newfound feature exclusively applies to Disney+, differentiating it from sister streaming platforms like Hulu and ESPN+.

Disney’s Evolution Towards Profitable Streaming

This strategic decision comes amidst Disney’s concerted efforts to fortify the profitability of its digital streaming arm. In the company’s Fiscal Q3 report released in August this year, Disney’s streaming segment – encompassing Disney+, Hulu, and ESPN+ – heralded a significant milestone by turning a profit for the first time.

With combined streaming platforms raking in a profit of $47 million in Fiscal Q3, Disney markedly reversed the staggering loss of $512 million recorded a year earlier. This resurgence in profitability underscores the urgency to strengthen streaming revenue streams as Disney’s traditional TV domain, notably the ABC network, faces dwindling viewership and advertising revenues.

This development gained urgency following a costly strike by Hollywood luminaries last year, illuminating the imperative to enhance revenue streams. The surge in Disney+’s subscriber base – a 1% uptick to 118.3 million in Fiscal Q3 – signals a promising trajectory amid an industry-wide crackdown on password sharing practices.

Evaluating the Investment Landscape for DIS Stock

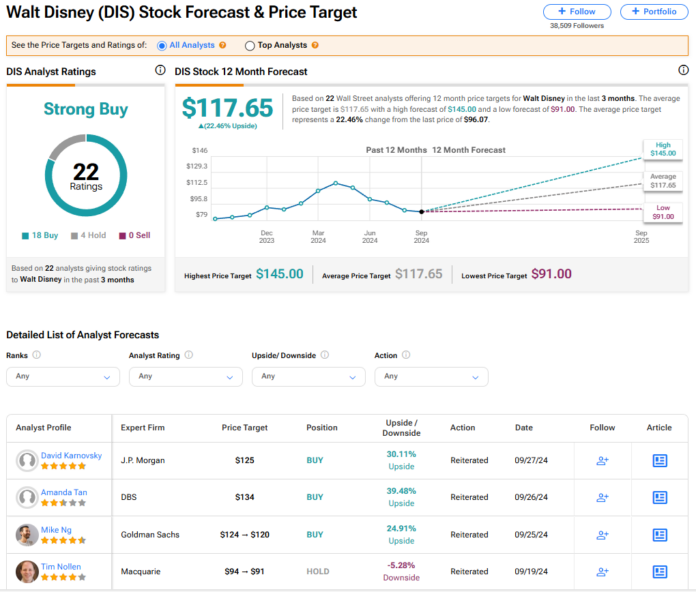

On the investment frontier, Walt Disney’s stock commands a resounding Strong Buy consensus among 22 Wall Street analysts. With 18 Buy and four Hold recommendations in the past three months, the stock currently bears no Sell ratings. Notably, the average price target of $117.65 reflects a potential upside of 22.46% from current levels.

Gain more insights on analyst ratings for DIS stock

The thoughts and analyses offered here belong to the author and may not necessarily align with the views of Nasdaq, Inc.