Changes in Berkshire Hathaway’s Investment in Apple Raise Questions

Apple (NASDAQ: AAPL) has been one of Warren Buffett and Berkshire Hathaway‘s (NYSE: BRK.A) (NYSE: BRK.B) most profitable and well-known investments. Recently, however, they have been gradually selling off their shares.

Berkshire’s investment in Apple reached its highest point in the third quarter of 2023, holding over 900 million shares valued at more than $150 billion. This represented 50% of its entire investment portfolio. By Q3 2024, Berkshire owned 300 million shares, with a value of just under $70 billion.

Wondering where to invest $1,000 nowadays? Our analysts believe they’ve found the 10 best stocks to buy right now. Learn More »

This decline is notable compared to the 400 million shares Berkshire held in the second quarter and the 789 million in the first quarter. The pattern indicates that Warren Buffett likely sold another $25 billion worth of stock in the fourth quarter.

Apple’s Place in Berkshire’s Portfolio is Shifting

Investors might wonder how this information regarding Buffett’s trades is available. Any company with over $100 million in investments must report its end-of-quarter holdings to the SEC. This information becomes public 45 days after each quarter in a document known as a 13F.

While these reports don’t provide a completely accurate picture of current holdings, they can signal the company’s investment direction, particularly for long-term investors like Buffett. The next 13F filings are scheduled for Feb. 14, offering insights into Buffett’s recent activities.

Despite the recent sell-off, Apple still accounts for about 23% of Buffett’s investment portfolio, making it his largest holding. Following closely is American Express (NYSE: AXP) at 16%. If Buffett does sell another 100 million shares of Apple, worth around $25 billion, it could shift Apple to his second-largest holding, depending on any changes to his other investments.

Challenges Amid Apple’s Sluggish Growth

Buffett’s decision to sell raises questions since he has long supported Apple’s business. However, Apple today is different from when Buffett first invested in Q1 2016. Back then, Apple was an inexpensive stock and a leader in consumer electronics, enjoying robust growth and innovation in its smartphone segment.

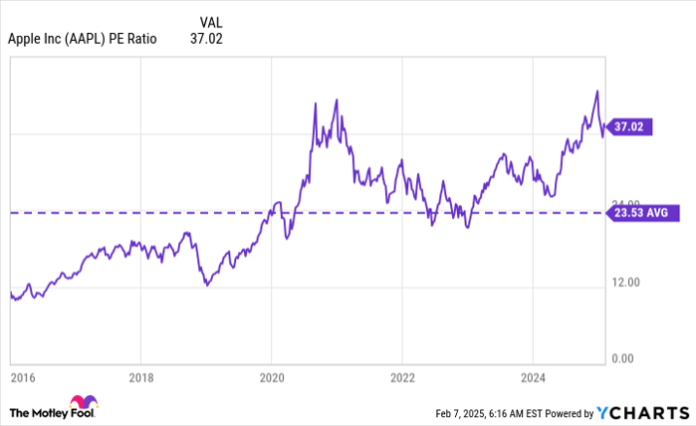

During Q1 2016, Apple’s average price-to-earnings (P/E) ratio was 10.6. This has escalated to 37 times earnings today.

AAPL PE Ratio data by YCharts.

This surge in valuation means that investors are now paying significantly more for Apple shares compared to 2016, while its earnings per share (EPS) have not increased as much over the years.

AAPL EPS Diluted (TTM) data by YCharts.

The core issue is that Apple’s EPS has plateaued since 2022, with no notable growth in revenue or earnings.

AAPL EPS Diluted (TTM) data by YCharts.

Compounding this issue is inflation over the past few years. The U.S. Bureau of Labor Statistics indicates that $1 today holds the same value as roughly $1.12 in January 2022. In real terms, Apple’s earnings and revenue have actually diminished, indicating a concerning trend for the company.

Nonetheless, since 2022, Apple’s stock has appreciated more than 30%. If you analyze this information without knowing it was Apple, one might argue the stock seems overvalued. Yet, the brand’s reputation often alters perceptions.

While Apple’s brand carries some weight, investors should examine the stagnant growth. Buffett and his team at Berkshire are likely acting preemptively by selling shares. It’s not easy to divest such a significant position without impacting the market.

Apple may no longer fit Buffett’s criteria for a value investment nor qualify as a growth stock. This leaves it in a precarious situation: overvalued. If my estimate of 100 million shares sold in Q4 proves accurate (to be confirmed on Feb. 14), it’s possible the number is even higher. Buffett appears to be making the right call, and other Apple shareholders should heed this caution.

Is Apple a Good Place for Your $1,000 Right Now?

Before purchasing Apple stock, you might want to consider this:

The Motley Fool Stock Advisor analyst team has recently highlighted what they deem the 10 best stocks to invest in now… and Apple is not among them. The chosen stocks have the potential for significant returns in the upcoming years.

For reference, when Nvidia made the list on April 15, 2005, if you had invested $1,000, it would have turned into $818,587!*

Stock Advisor provides an accessible guide for investors, offering portfolio-building advice, regular updates from analysts, and new stock recommendations twice a month. Since 2002, Stock Advisor has more than quadrupled the returns of the S&P 500.

Discover more »

*Stock Advisor returns as of February 7, 2025

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.