Warren Buffett Trims Apple Stake, Eyes Growth in Domino’s Pizza

In the third quarter, Warren Buffett sold another large portion of Apple (NASDAQ: AAPL) stock, valued at over $20 billion, equating to 100 million shares. Although Berkshire Hathaway, led by Buffett, still retains $70 billion worth of Apple stock, this holding has become significantly smaller compared to earlier in the year.

What prompts Buffett’s selling? While there’s speculation, the more pressing question is what he’s buying now. Recently, Berkshire Hathaway acquired a 3.5% stake in Domino’s Pizza (NYSE: DPZ). Let’s explore why this chain caught Buffett’s interest.

Reasons Behind Berkshire Hathaway’s Apple Selloff

Berkshire Hathaway has seen over $100 billion in capital gains from its Apple investment. Notably, Buffett has increased the company’s cash reserves beyond $300 billion this year by liquidating some of these gains.

The primary reason for reducing the Apple position appears to be valuation concerns. This decision doesn’t stem from any belief that an imminent market crash is on the horizon; instead, it reflects the current high valuation of Apple stock.

Apple is presently trading at a price-to-earnings ratio (P/E) of 37. While that figure might suit a high-growth stock, Apple’s growth has stagnated significantly. In fact, its revenue increased just 3% over the last three years, highlighting a much slower pace than inflation.

Buffett likely sees a risk that Apple may not outperform expectations due to its lackluster growth in relation to a high earnings ratio. While Apple continues to operate successfully, the current stock price does not promise solid capital gains.

Could Domino’s Pizza Become the Next Franchising Powerhouse?

In contrast, Berkshire Hathaway’s recent position in Domino’s Pizza marks an intriguing addition to their portfolio. Although smaller than the stake in Apple, Buffett’s choice to invest now raises questions about the potential of this fast-food chain.

Buffett has long favored the capital-efficient model of restaurant franchising, appreciating the success of companies like McDonald’s. Domino’s operates under a similar franchise structure.

Like McDonald’s did years ago, Domino’s is pushing for significant global expansion. The company plans to open between 800 to 850 new locations this year, building on a base of 21,000 stores. If this pace continues, Domino’s could reach as many as 40,000 stores in two decades, aligning with management’s projections of 7% sales growth and 8% operating income growth from 2026 to 2028.

Berkshire Hathaway is likely attracted to Domino’s for its long-term growth trajectory. As Buffett often emphasizes, growth and value are closely linked; companies with sustainable earnings growth justifying higher current valuations are often sound investments. In stark contrast, Apple presents a high P/E value with minimal growth.

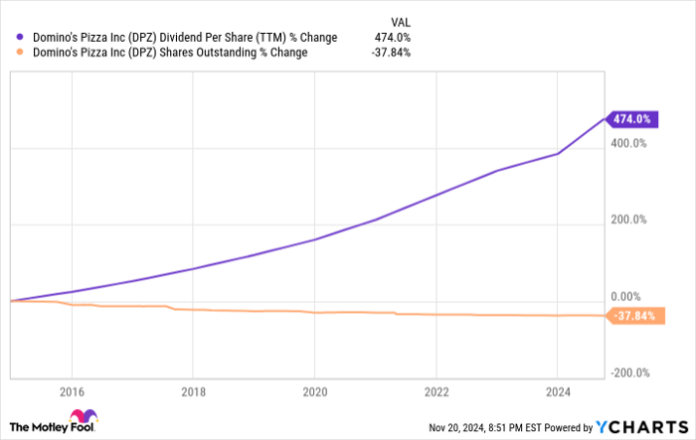

DPZ Dividend Per Share (TTM) data by YCharts

Is Domino’s Stock a Wise Investment?

Despite having a more favorable growth outlook than Apple, Domino’s Pizza currently trades at a P/E ratio of 26, which is below the S&P 500 (SNPINDEX: ^GSPC) average of 30. This discrepancy suggests that Domino’s stock might be a good buy at present levels.

Moreover, Domino’s boasts an impressive capital returns program. Over the last decade, the company has increased its dividend per share by 474% while reducing the number of shares outstanding by 38% through a consistent share repurchase initiative. There are solid reasons to anticipate that these trends will continue.

Combining these factors, Domino’s Pizza emerges as a compelling option for long-term investors. It is clear why Buffett and his investment team are showing interest in this stock.

A New Opportunity Awaits

If you’ve ever felt like you missed out on investing in successful stocks, now could be your chance.

On rare occasions, our analysts designate a “Double Down” stock recommendation for companies poised for growth. If you’re concerned about having missed the boat, the time to invest is now, before opportunities slip away. The metrics are striking:

- Nvidia: An investment of $1,000 when we first recommended it in 2009 would be worth $368,053!

- Apple: A $1,000 investment from 2008 would now be valued at $43,533!

- Netflix: If you invested $1,000 back in 2004, it would have grown to $484,170!

Currently, we’re announcing “Double Down” alerts for three remarkable companies, and opportunities like this may not arise again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Brett Schafer has no positions in any stocks mentioned. The Motley Fool recommends Apple, Berkshire Hathaway, and Domino’s Pizza. The Motley Fool has a disclosure policy.

The views and opinions expressed herein reflect those of the author and do not necessarily represent those of Nasdaq, Inc.