Warren Buffett: A Cautious Approach Amid Market Highs

Investors often look to Warren Buffett for insights into potential stock market trends. As the head of Berkshire Hathaway, he has consistently demonstrated his market acumen, achieving a nearly 20% compounded annual gain over 58 years. In comparison, the S&P 500 has seen an approximate 10% compounded annual increase during the same period.

Buffett possesses a keen intuition on when to buy or sell stocks, often going against prevailing trends. He’s famously stated that he and his team “attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

Now, with the S&P 500 reaching record highs and projected to climb 22% this year, examining Buffett’s recent actions could provide valuable insights. Recently, he sold shares of his largest holding, Apple (NASDAQ: AAPL), and invested $2.9 billion in another preferred company. Does this signal a potential warning for Wall Street? Let’s explore further.

Image source: The Motley Fool.

Market Valuations on the Rise

Firstly, it’s worth noting that the recent gains in the S&P 500 have led to increased valuations, indicating that stocks may be becoming overpriced. This could raise concerns for Buffett, who is a value investor focused on purchasing stocks below their true worth. His strategy is to buy stocks at a bargain price and hold them long-term, expecting that their value will eventually be recognized by the market.

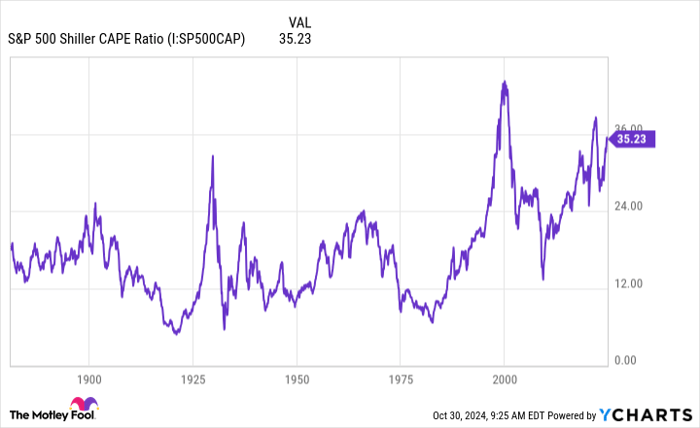

Currently, the S&P 500 Shiller CAPE ratio—an adjusted measure of earnings over the past decade compared to price—is at one of its highest levels ever. This marks the third instance since the late 1950s that the ratio has exceeded 35 since the S&P 500 was introduced as a 500-stock index.

S&P 500 Shiller CAPE Ratio data by YCharts

Buffett’s Recent Actions

In light of these high valuations, Buffett has not been aggressively purchasing stocks. For instance, during the second quarter, he only added two new positions—Ulta Beauty and Heico—while significantly reducing his Apple holdings by selling 49% after previously dropping it by 13% in the first quarter.

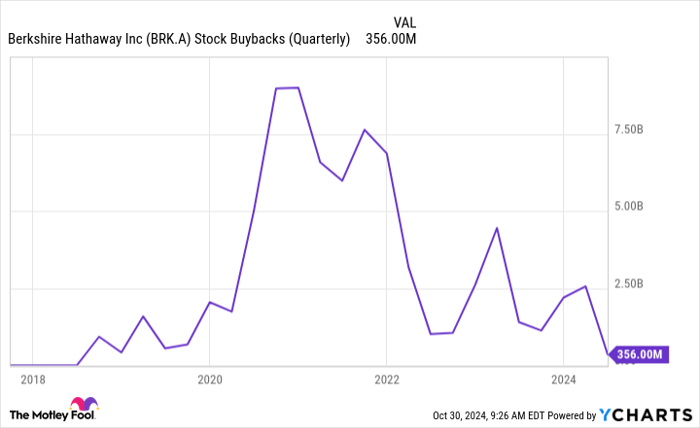

Additionally, Buffett’s investment of $2.9 billion in repurchasing shares of Berkshire Hathaway reflects a more cautious trend, as buybacks have slowed since a notable surge in 2020 and 2021.

BRK.A Stock Buybacks (Quarterly) data by YCharts

Interpreting Buffett’s Signals

So, what do Buffett’s recent stock sales and reduced buybacks indicate? Could he be bracing for a market downturn? While it’s plausible that Buffett anticipates a decline, his previous comments suggest he views current markets as exhibiting “casino-like behavior.”

The sales of stocks like Apple could also be a strategic move to secure profits ahead of potential capital gains tax increases, rather than a lack of confidence in that company. After all, Apple remains Berkshire Hathaway’s largest holding.

When questioning the decline in stock repurchases, Buffett noted in his recent letter to shareholders that buybacks are “100% discretionary.” Furthermore, he emphasized that Berkshire is constructed for durability. Therefore, any slowdown in buybacks doesn’t necessarily indicate pessimism about the market or the company’s future.

Generally, Buffett’s steady investments in quality companies reflect his long-term strategy. Despite market fluctuations, his approach favors worthwhile investments over immediate trends.

Ultimately, Buffett’s recent moves aren’t a warning sign for Wall Street. Instead, they reveal a continued faith in quality companies and the overall market to appreciate in the long run.

Investing in Apple: A Smart Choice?

Before making any investment in Apple, consider this:

The Motley Fool Stock Advisor analysts have recently identified what they believe are the 10 best stocks to buy right now, and Apple isn’t among them. The top 10 stocks could yield significant returns in the near future.

For example, consider Nvidia, which was recommended on April 15, 2005. If you invested $1,000 then, it would be worth around $813,567 today!*

Stock Advisor offers an easy-to-follow roadmap for investors, featuring guidance on portfolio building, regular analyst updates, and two new stock picks monthly. Since 2002, Stock Advisor has more than quadrupled the return of the S&P 500.*

Discover the 10 stocks »

*Stock Advisor returns as of October 28, 2024

Adria Cimino holds no positions in any stocks mentioned. The Motley Fool has holdings in and recommends Apple, Berkshire Hathaway, and Ulta Beauty. The Motley Fool also recommends Heico and maintains a disclosure policy.

The views expressed here belong to the author and do not necessarily represent those of Nasdaq, Inc.