Is Apple Losing Its Luster for Berkshire Hathaway?

Apple (NASDAQ: AAPL) has been a standout investment for Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), led by Warren Buffett. However, it seems that 2025 might mark a turning point for this long-held position.

Why is Berkshire considering a sale? Buffett and his team have always praised Apple CEO Tim Cook and the direction he’s taken the company. Let’s explore the reasons behind this potential change.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

From Undervalued to Overvalued: Apple’s Journey

Berkshire Hathaway first invested in Apple during the first quarter of 2016. At that time, the company was seen as a classic Buffett investment. Apple was a massive consumer brand with shares trading at just 10.6 times trailing earnings, presenting a compelling case for value investing.

However, Apple’s profile has changed significantly since then. Since Q1 2016, the company has seen a remarkable growth of 66% in revenue and an astonishing 157% rise in earnings per share (EPS). Historically, stocks tend to reflect their EPS growth unless there is what analysts call multiple expansion.

Multiple expansion occurs when investors are willing to pay higher prices for stocks. This strategy aligns with Buffett’s value investing philosophy, which typically involves buying undervalued stocks and selling them when they reach full value.

Since 2016, Apple’s stock has soared approximately 850%, outpacing its revenue and EPS growth. Now, its shares trade at an impressive 41 times trailing earnings—an expensive valuation, leading many to believe Apple is either fully valued or overvalued. Consequently, it wouldn’t be surprising if Buffett chooses to reduce his stake further.

Current Appraisal: Is Apple Still Worth It?

As of Q3 2023, Berkshire owned around 916 million shares of Apple but has been gradually selling its stake, currently holding only about 300 million shares. Buffett has indicated that these sales were partly to capitalize on tax benefits in anticipation of a potential corporate tax hike, which appears unlikely under President-elect Donald Trump.

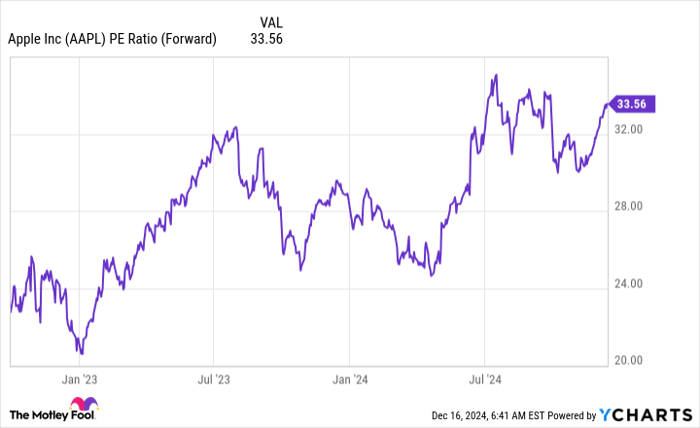

Despite this context, ongoing sales shouldn’t catch investors off guard; the core investment thesis for Buffett has essentially played out. In comparison to other tech giants, Apple isn’t particularly attractive at this moment, especially with its forward earnings at 34 times, and forecasts for 2025 looking weak.

AAPL PE Ratio (Forward) data by YCharts

Wall Street analysts project only 6% revenue growth this year, which is underwhelming given the stock’s high price. Investors will gain more insight into Apple’s future after it reports its fiscal 2025 first-quarter results by December 31, particularly regarding the iPhone 16’s market performance.

Additionally, many other tech companies are currently available at lower valuations and are experiencing faster growth, making them look like better investment options than Apple. Therefore, whether Buffett continues to sell Apple shares in 2025 or not, it may be wise for investors to explore alternatives.

Are You Considering Investing $1,000 in Apple?

Before making a decision to purchase Apple stock, keep in mind the following:

The Motley Fool Stock Advisor analysts have identified what they believe are the 10 best stocks to invest in now, and Apple isn’t among them. The selected stocks could yield impressive returns in the coming years.

For example, when Nvidia was recommended on April 15, 2005, if you invested $1,000, you’d now have $790,028.!*

Stock Advisor offers investors a clear path to success with guidance on portfolio building, regular analyst updates, and two new stock picks each month. Since 2002, Stock Advisor has outperformed the S&P 500 by more than four times.*

See the 10 stocks »

*Stock Advisor returns as of December 16, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.