Berkshire Hathaway’s Bold Moves: A Closer Look at Buffett’s Recent Decisions

Warren Buffett’s conglomerate Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) revealed surprising third-quarter results last Friday. The company continued to significantly sell off its largest equity holdings, Apple (NASDAQ: AAPL) and Bank of America (NYSE: BAC).

Berkshire sold about 25% of its Apple stock, totaling 600 million shares year-to-date, which is roughly two-thirds of its original stake. Additionally, it divested several billion dollars’ worth of Bank of America, once the conglomerate’s second-largest investment.

For the first time since mid-2018, Berkshire also opted not to repurchase any of its own shares. This move has resulted in a significant increase in Berkshire’s cash reserves, which ballooned from $276.9 billion at the end of June to an impressive $325.2 billion.

The Influence of Inflation and Interest Rates

These recent sales could signal potential troubles ahead. A historical perspective reveals that in 1969, Buffett dissolved his partnership because he couldn’t find many undervalued stocks, focusing instead on managing Berkshire Hathaway, which was then a textile company. This was a savvy move, as the 1970s turned out to be dire for the stock market, with flat returns despite increasing earnings.

Back then, the market’s Price-to-Earnings (P/E) ratio plummeted from roughly 20 to just 7. Inflation was a primary driver of this downturn, exacerbated by heavy government spending in the 1960s. The Federal Funds rate increased from about 4% at the end of 1970 to as high as 20% in the early 1980s, a drastic response to curb inflation by Fed Chairman Paul Volcker.

This historical context raises a significant question: Could Buffett be forecasting another wave of inflation and rising long-term interest rates?

Rising Rates and Apple’s Challenges

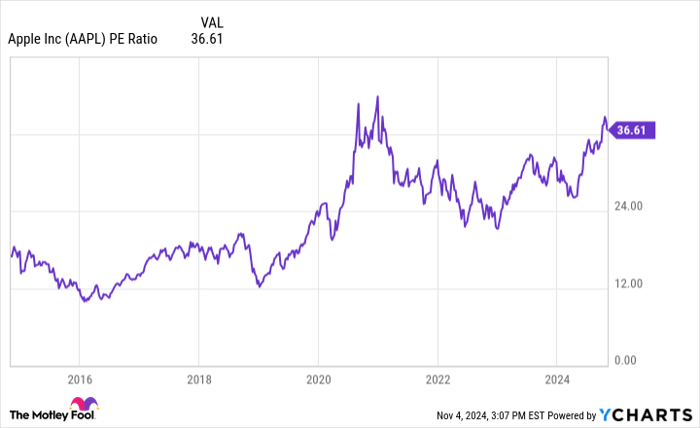

Buffett traditionally seeks stocks that show resilience against inflation and possess strong pricing power. Apple fits this mold to some degree, given its loyal customer base. However, as a mature company, Apple reported only 6.1% revenue growth last quarter, and its high valuation of over 36 times earnings raises concerns. In contrast, it traded around 12 times earnings when Buffett first invested in 2016.

AAPL PE Ratio data by YCharts

Although Apple’s core business remains strong, a sudden rise in interest rates could significantly impact its stock. The current high valuation may leave little room for investment safety if the market shifts downward.

Bank of America’s Sensitivity to Economic Changes

Buffett’s decision to sell Bank of America raises questions among investors. Despite a P/E ratio of 15, which is fairly average for banks, higher long-term interest rates could lead to potential complications. If these rates trigger a recession, Bank of America could face adverse effects on its underwriting results.

During the pandemic, Bank of America purchased long-term Treasuries and mortgage-backed securities at a time when interest rates were low. As rates surged afterward, these assets lost value, resulting in $85.7 billion in unrealized losses during the third quarter. While the bank classifies these as “held-to-maturity,” thus avoiding immediate accounting losses, these unrealized losses represent a considerable portion of its $200 billion tangible common equity.

Buffett’s concerns may stem from the prospect of further interest rate increases, which could exacerbate this ripple effect on Bank of America’s balance sheet.

Image source: The Motley Fool.

Buffett’s Strategic Buys Indicate Caution

Buffett and his colleagues have not only been offloading stocks; this year they notably acquired shares of Chubb (NYSE: CB), a prominent property and casualty insurance firm. Chubb’s high-end homeowner’s insurance products indicate solid pricing power in the market.

Insurance companies, unlike many others, navigate through insurance cycles rather than economic ones. A well-positioned insurer can raise prices in line with inflation, and Chubb’s bond portfolio has a shorter duration of about five years, allowing for swift reinvestment into higher-yielding securities compared to those at Bank of America.

Stay Informed, but Don’t Overreact

Apple and Bank of America remain substantial holdings for Berkshire, while Chubb is a newcomer. Buffett’s strategy may simply be a risk reduction from assets he considers fully valued.

Investor anxiety may be heightened by potential government policies that could inflate deficits, potentially impacting inflation levels. As the new administration takes office and the Federal Reserve works to manage post-pandemic inflation, seasoned investors should be mindful of these risks. Buffett’s recent actions could suggest he shares these worries.

Seize Investment Opportunities

For those who feel they’ve missed investing in successful stocks, now might be the moment to consider opportunities. Expert analysts occasionally highlight “Double Down” stock recommendations for companies poised for growth.

- Amazon: A $1,000 investment in 2010 could be worth $22,469!*

- Apple: A $1,000 investment in 2008 could be worth $42,271!*

- Netflix: A $1,000 investment in 2004 could be worth $411,970!*

Currently, there are alerts for three impressive companies, and opportunities may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

Bank of America is an advertising partner of Motley Fool Money. Billy Duberstein and/or his clients have positions in Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.