Berkshire Hathaway’s Strategic Bet on AI Through Amazon

When you think of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) and Warren Buffett, artificial intelligence (AI) investing may not come to mind. Yet, a look at their stock holdings reveals a connection to the AI trend, illustrating the company’s adaptive investment strategy.

This connection stems from the companies in which Berkshire invests, many of which are adopting AI technologies, rather than a direct intention to invest specifically in AI firms. Nevertheless, investors should take notice when one of history’s most successful investment firms decides to stake its position in a particular company.

Highlighting Amazon in Berkshire’s Portfolio

Among the notable investments, Amazon (NASDAQ: AMZN) stands out. Although Berkshire Hathaway owns 10 million shares of Amazon, valued at roughly $2 billion, this only represents about 0.7% of the entire portfolio. While this amount is significant, it does not drastically influence Berkshire’s overall investment returns.

It remains unclear if Warren Buffett personally made this investment. While he serves as the CEO, his investment managers, Ted Weschler and Todd Combs, have the autonomy to explore options outside of Buffett’s traditional value-oriented approach, which includes stakes in companies like Amazon.

If Berkshire had anticipated the success that would follow with Amazon, it likely would have acquired more shares sooner.

Berkshire first announced its investment in Amazon in the first quarter of 2019, when the stock was trading at an average price of about $83 per share. Presently, shares are trading around $200, showcasing a remarkable return of 141%.

The Role of AWS in Amazon’s Future

Amazon’s journey with AI doesn’t only reflect its diverse operations but is significantly anchored in its cloud computing division, Amazon Web Services (AWS). AWS stands as the leading provider in this market and has recently experienced substantial growth fueled by the rising demand for AI solutions.

Cloud computing is essential for AI development, as it allows businesses to access computing power and storage without investing heavily in infrastructure. Amazon has also partnered with Anthropic, a leader in generative AI, to equip AWS clients with innovative tools for integrating AI into their systems.

This strategic boost has positively impacted AWS, which reported a 19% year-over-year increase in revenue, reaching $27.5 billion for Q3. Operating income soared by 50% to $10.4 billion, resulting in a robust operating margin of 38%.

Despite only constituting 17% of total sales, AWS is responsible for 60% of Amazon’s operating profits, underscoring its vital role in the company’s financial performance. Continued growth in this segment bodes well for Amazon’s stock in the future.

High Expectations and the Stock Price

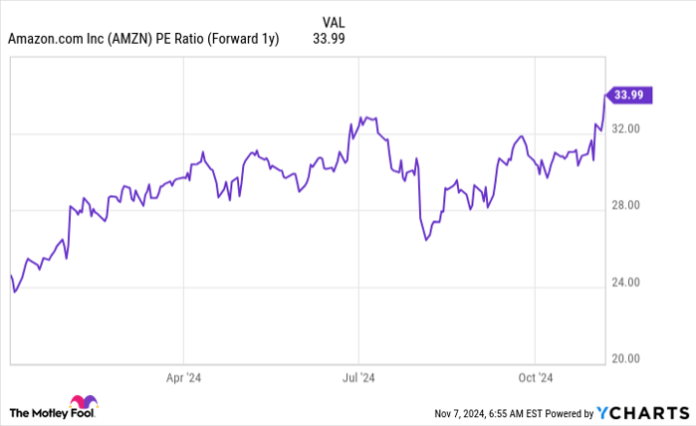

With the ongoing success in cloud computing powered by AI, Amazon’s valuation has climbed, trading at 34 times its projected earnings for 2025. This figure presents a high bar for entry, yet given the favorable industry trends and increasing profitability across Amazon’s various segments, analysts remain optimistic about the stock’s potential.

Investors who are cautious about possibly missing out on Amazon’s growth should consider the company’s ability to maintain its momentum within AWS, as this will likely drive stock value higher in the years ahead.

A New Opportunity for Savvy Investors

Investors often worry about missing opportunities with successful stocks. Presently, there is a chance to capitalize on companies poised for significant growth.

Our team of analysts regularly identifies standout stocks they consider ripe for investment, dubbed “Double Down” stocks. For those who feel they’ve missed previous opportunities, now could be the ideal time to act. Historical returns have been impressive:

- Amazon: Investing $1,000 at our 2010 recommendation would have grown to $23,295!*

- Apple: A $1,000 investment at our 2008 recommendation would now be worth $42,465!*

- Netflix: If $1,000 was invested with our 2004 recommendation, it would have reached $434,367!*

Currently, we are issuing “Double Down” alerts for three promising companies, making this an opportune moment for investment.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Apple, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.