HomeStreet Gets Boost from Wedbush as Price Target Sees Big Upside

Fintel reports that on November 5, 2024, Wedbush upgraded their outlook for HomeStreet (NasdaqGS:HMST) from Neutral to Outperform.

Analysts Predict Significant Increase in HomeStreet’s Stock

As of October 22, 2024, the average one-year price target for HomeStreet stands at $16.06 per share. This forecast ranges from a low of $15.15 to a high of $17.32, marking a potential increase of 63.36% from its latest closing price of $9.83 per share.

The projected annual revenue for HomeStreet is $338 million, representing an impressive increase of 99.22%. The anticipated annual non-GAAP earnings per share (EPS) is forecasted at 4.35.

Investors Weigh In: Fund Sentiment Analysis

Currently, 255 funds or institutions report positions in HomeStreet, showing a decrease of 11 owners, or 4.14%, over the last quarter. The average portfolio weight of all funds dedicated to HMST is now 0.12%, up by 0.03%. Institutional ownership has increased by 1.67% over the last three months, totaling 16,168K shares.

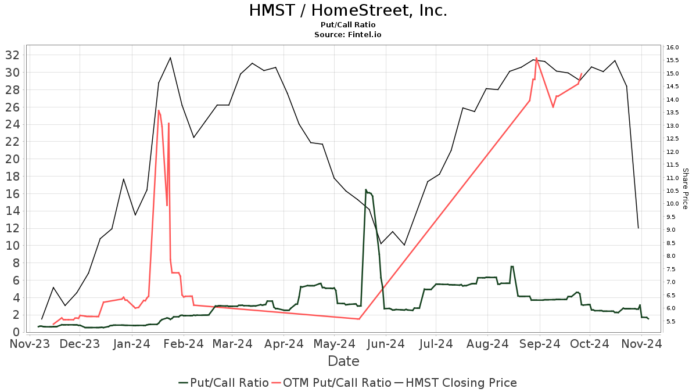

The current put/call ratio for HMST is recorded at 1.55, indicating a bearish sentiment among traders.

The current put/call ratio for HMST is recorded at 1.55, indicating a bearish sentiment among traders.

Philadelphia Financial Management of San Francisco holds 1,494K shares, currently accounting for 7.92% of the company. They recently increased their ownership from 1,107K shares, which marks a 25.88% rise and a 4.87% increase in portfolio allocation over the last quarter.

Maltese Capital Management shows a different trend, holding 1,010K shares for 5.36% ownership. Previously, they owned 1,072K shares, indicating a decrease of 6.07%. Their portfolio allocation in HMST decreased by 31.50% over the last quarter.

Endeavour Capital Advisors holds 706K shares, translating to 3.75% ownership. This is a significant increase from their previous filing of 331K shares, reflecting a growth of 53.18% and an increase of 62.84% in portfolio allocation over the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares holds 562K shares, which represents 2.98% ownership with no change in the last quarter. Similarly, Ameriprise Financial, with 555K shares representing 2.95% ownership, increased its holding from 450K shares, marking an 18.93% rise despite decreasing their portfolio allocation by 83.37% in the past three months.

Understanding HomeStreet’s Business Landscape

HomeStreet Background Information

(This description is provided by the company.)

HomeStreet, Inc., headquartered in Seattle, Washington, is a diversified financial services company offering a range of services to consumers and businesses in the Western United States and Hawaii. The company primarily focuses on real estate lending, along with mortgage banking and commercial and consumer banking. HomeStreet’s key subsidiaries include HomeStreet Bank and HomeStreet Capital Corporation. HomeStreet Bank is a proud member of the FDIC and maintains its commitment to being an Equal Housing Lender.

Fintel serves as a comprehensive investing research platform for individual investors, traders, financial advisors, and smaller hedge funds. Our extensive data collection covers fundamentals, analyst reports, ownership data, fund sentiment, and more to aid users in their investment decisions.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.