Energy Sector Soars

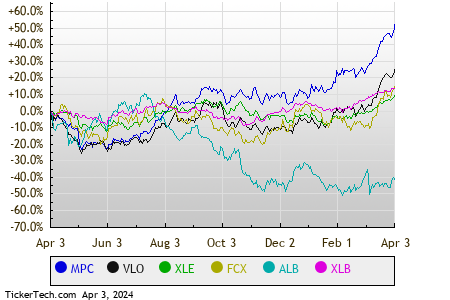

As the midweek bell rings, Energy companies are leading the charge, basking in the midday glow with a respectable 1.0% uptick. Marathon Petroleum Corp. (Symbol: MPC) and Valero Energy Corp (Symbol: VLO) are striding confidently, boasting gains of 3.2% and 2.9%, respectively. In the realm of energy exchange-traded funds (ETFs), the spotlight shines on the Energy Select Sector SPDR ETF (Symbol: XLE), flaunting a 0.8% surge today and an impressive 16.76% increase year-to-date. The year has been even brighter for Marathon Petroleum Corp., up a staggering 47.55%, and Valero Energy Corp, dancing joyfully at 41.06% year-to-date. Collaboratively, MPC and VLO ordain about 8.3% of the holdings in XLE, creating a harmonious symphony for investors.

Materials Sector’s Ascend

Following the Energy sector, the Materials sector is painting a pretty picture with a 0.7% climb. Amidst the grand canvas of large Materials stocks, Freeport-McMoran Copper & Gold (Symbol: FCX) and Albemarle Corp. (Symbol: ALB) are stealing the spotlight, showcasing a rise of 2.2% and 2.1%, respectively. The Materials Select Sector SPDR ETF (XLB) is not one to be left behind, marking a 0.6% gain in today’s midday hustle and an 8.97% increment on a year-to-date basis. Freeport-McMoran Copper & Gold, reveling in a 16.56% surge year-to-date, stands tall, while Albemarle Corp. faces a slight downturn at 10.33% year-to-date. FCX and ALB, participants with a 8.2% stake in XLB, dance in synchronization, charming the hearts of investors.

Market Pulse Check

Glancing at how the S&P 500 components sway within various sectors in the afternoon trading on this Wednesday, harmony seems to reign. Six sectors are spiritedly up, while three find themselves in a momentary downward spiral. It’s a ballet of market forces, a symphony of financial movements.

| Sector | % Change |

|---|---|

| Energy | +1.0% |

| Materials | +0.7% |

| Technology & Communications | +0.6% |

| Industrial | +0.6% |

| Healthcare | +0.2% |

| Financial | +0.2% |

| Services | -0.2% |

| Utilities | -0.3% |

| Consumer Products | -0.8% |

![]()

This article was brought to you by the musings and observations of the author. Please note that the thoughts shared here do not necessarily resonate with those of Nasdaq, Inc.

Also see:

Closed End Funds List

ETFs Holding CHCO

ETFs Holding RGLS