“`html

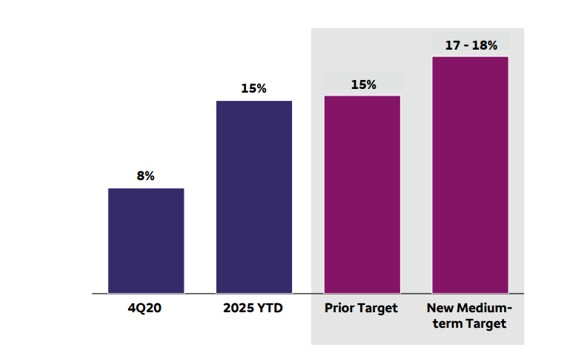

Wells Fargo & Company (WFC) announced a new target for return on tangible common equity (ROTCE) of 17-18%, up from its previous aim of 15%. This announcement reflects the bank’s increased confidence in profitability as it shifts focus from regulatory issues to sustainable growth.

This change is attributed to several factors including the removal of the Federal Reserve’s asset cap, allowing Wells Fargo to increase deposits, expand its loan portfolio, and enhance its securities holdings. The bank also reported a 50% increase in trading-related assets since the end of 2023, and a 19% rise in investment banking fees for the first nine months of 2025.

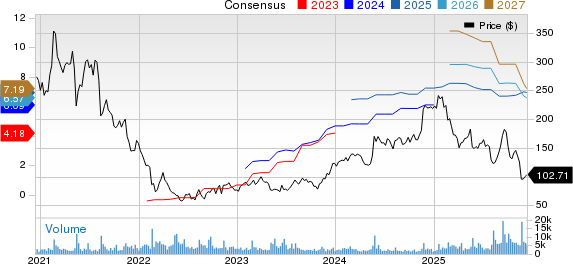

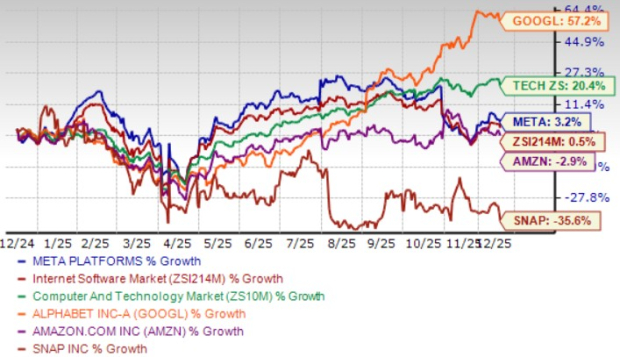

Wells Fargo also plans to manage its common equity tier 1 (CET1) ratio down to 10-10.5%, which will optimize capital usage. The bank’s shares have gained 26.1% year-to-date as of now, compared to an industry growth of 32.9%. The forward price-to-earnings (P/E) ratio for WFC stands at 12.79, below the industry average of 14.74.

“`