Wells Fargo Upgrades Albertsons Companies’ Outlook: Promising Future on the Horizon

Analyst Predictions Indicate Potential Growth

On October 18, 2024, Wells Fargo raised its outlook for Albertsons Companies (NYSE: ACI) from Equal-Weight to Overweight. This shift suggests confidence in the company’s future performance.

Projected Price Increase Ahead

As of September 25, 2024, analysts predict an average one-year price target for Albertsons Companies at $24.87 per share. This target shows a potential increase of 30.92% compared to the latest closing price of $19.00 per share. The price targets range from a low of $21.21 to a high of $28.61, reflecting varying analysts’ expectations.

The company forecasts an annual revenue of $79,976 million, marking a slight increase of 0.33%. Additionally, the expected non-GAAP earnings per share (EPS) stands at 2.95.

Institutional Interest Grows

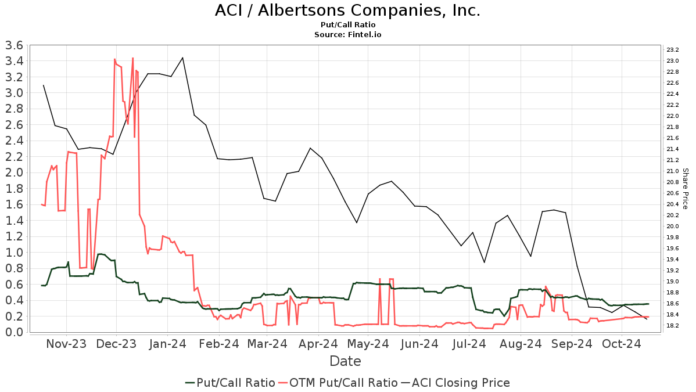

Interest in Albertsons Companies is rising, as 825 funds or institutions reported positions in ACI. This is an increase of 19 investors, or 2.36%, from the previous quarter. The average portfolio weight for these funds in ACI is 0.52%, which is up by 5.56%. Over the past three months, the total shares held by institutions grew by 6.07% to 471,450K shares. The put/call ratio stands at 0.35, signaling a bullish sentiment among investors.

Recent Changes in Shareholder Positions

Cerberus Capital Management remains a significant player, holding 151,819K shares for a 26.21% ownership, with no change in the last quarter.

Norges Bank has dramatically increased its holding to 14,090K shares, now representing 2.43% ownership, after previously reporting no shares. This indicates a complete shift in their investment stance.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) has reported an increase to 10,902K shares, translating to 1.88% ownership. Previously, they held 9,911K shares, marking a growth of 9.08%, though their overall portfolio allocation in ACI has decreased by 1.47%.

Barclays has also boosted its position, holding 9,039K shares, which accounts for 1.56% ownership. This is an increase from 6,011K shares, a notable rise of 33.49%, accompanied by a 21.79% increase in their portfolio allocation in the last quarter.

Meanwhile, Vanguard Small-Cap Index Fund Investor Shares (NAESX) increased its stake in Albertsons to 8,706K shares, a 1.50% ownership, from 4,045K shares, showcasing a significant 53.54% increase. Their portfolio allocation in ACI surged by 107.98% over the past quarter.

An Overview of Albertsons Companies

(Description provided by the company.)

Albertsons Companies stands as a key player in the U.S. food and drug retail sector, operating stores across 34 states and the District of Columbia through 20 well-known banners. These include Albertsons, Safeway, Vons, and others. The company is dedicated to enhancing community life, supporting food and financial initiatives totaling $225 million in 2019 alone. Notably, in 2020, it pledged $53 million to hunger relief and $5 million towards social justice initiatives.

Fintel serves as a comprehensive investment research platform catering to individual investors, traders, financial advisors, and small hedge funds.

Providing vital data on fundamentals, analyst insights, ownership statistics, options sentiment, and more, Fintel aims to support improved investment outcomes with its advanced quantitative models.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.