“`html

Wells Fargo Stock Soars to Annual High, Driven by Federal Rate Cuts

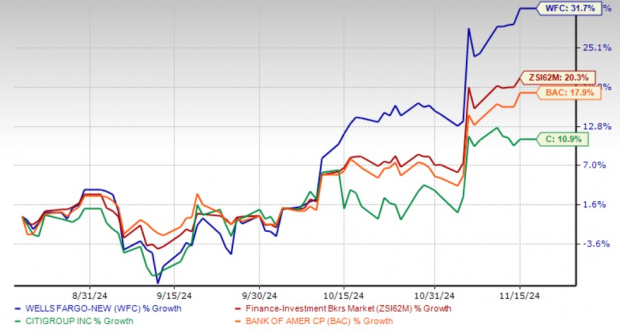

Wells Fargo & Company (WFC) reached a new 52-week high of $74.41 on Friday but closed slightly lower at $74.34, reflecting a notable 31.7% increase over the past three months.

The stock has surpassed the performance of the industry and its competitors, including Bank of America Corporation (BAC) and Citigroup Inc. (C), during this period.

Analyzing Three-Month Price Trends

Image Source: Zacks Investment Research

This surge in WFC stock can primarily be attributed to the Federal Reserve’s recent interest rate cuts, anticipated to boost near-term net interest income (NII) and net interest margin (NIM), thus promoting overall revenue growth. Coupled with efficient expense management strategies, the bank aims to bolster its earnings.

Key Factors Supporting WFC Stock Growth

Federal Rate Cuts to Enhance NII: Recent interest rate reductions by the Federal Reserve, including a 50-basis-point cut in September and a further 25 bps on Nov. 7, 2024, are poised to improve Wells Fargo’s NII as funding costs gradually stabilize and fall over time.

Wells Fargo’s NII exhibited a compound annual growth rate (CAGR) of 9.4% over the three years ending in 2023; however, it saw a decline in the first nine months of 2024 due to elevated funding costs. The NIM expanded to 3.06% in 2023 from 2.63% in 2022 and 2.05% in 2021 but contracted in the current year’s first three quarters.

The Fed’s interest rate cuts are projected to stabilize funding, which should enhance both NII and NIM moving forward.

Efficient Expense Management to Support Profits: Wells Fargo’s strategic cost management enhances its financial position. Since Q3 2020, it has implemented significant cost-cutting, including restructuring, branch closures, and workforce reductions.

Non-interest expenses have shown a negative CAGR of 1.1% over the last four years (ending 2023). Nonetheless, expenses rose in the first nine months of 2024 due to increased revenue-related compensation, particularly in the Wealth and Investment Management sector, alongside higher technology costs. Nevertheless, gross expense savings amounting to $10 billion were achieved between 2021 and 2023. The bank anticipates continued cost-saving initiatives into 2024, projecting non-interest expenses at $54 billion, down from $55.6 billion in 2023.

Robust Deposit Base Supporting Financial Stability: Wells Fargo’s deposit base continues to grow, with a three-year CAGR of 1.1%. Although total deposits slightly decreased in the first nine months of 2024 due to customers seeking higher-yield alternatives, this trend is stabilizing. The bank’s extensive retail clientele is also beneficial for maintaining deposit levels.

Strong Balance Sheet to Withstand Economic Fluctuations: The bank maintains a solid balance sheet. As of September 30, 2024, Wells Fargo’s long-term debt stood at $182.1 billion, alongside $111.9 billion in short-term borrowings. Its liquidity coverage ratio was a healthy 127%, exceeding the regulatory minimum of 100%. Total liquid assets reached $185.5 billion.

Additionally, Wells Fargo enjoys long-term investment-grade credit ratings of A+, A1, and BBB+ from Fitch, Moody’s, and S&P Global, respectively. This robust credit profile and ample liquidity enable the bank to fulfill its near-term obligations, even amid potential economic downturns.

Solid Capital Position and Impressive Distributions: The company’s commitment to maintaining a strong capital position underpins its capital distribution activities. As of September 30, 2024, its capital ratios exceeded regulatory standards—highlighted by a Tier 1 common equity ratio of 11.3% and a Total capital ratio of 15.5%.

Wells Fargo has a history of dividends, recently increasing its payout by 14% to 40 cents per share in July 2024. Over the past five years, WFC has raised its dividend five times, resulting in a five-year annualized growth rate of 10.84%, with a current dividend payout ratio of 30%.

Review of Wells Fargo’s Dividend Yield

Wells Fargo & Company Dividend Yield (TTM)| Wells Fargo & Company Quote

Wells Fargo also has an active share repurchase program, with the board approving a new $30 billion buyback in July 2023. In the first nine months of 2024, the bank repurchased over $15 billion worth of shares, leaving $11.3 billion under authorization as of September 30, 2024.

This strong capital position and healthy liquidity suggest that Wells Fargo’s financial activities will remain robust, enhancing investor confidence.

Challenges Facing Wells Fargo

Asset Cap Hinders Growth Potential: Despite the bank’s strong performance, WFC’s loan portfolio might struggle to grow due to an existing asset cap imposed by regulators. This cap will persist until the bank fully addresses compliance and operational risk management concerns.

In September 2024, Wells Fargo submitted a third-party review of its risk management strategies for Federal Reserve approval, indicating the bank’s ongoing commitment to compliance post a lengthy review process.

“`

Wells Fargo Faces Challenges Amid Changing Market Conditions

Strong Capital but Limited Loan Growth

Wells Fargo is currently navigating an asset cap that is expected to persist until at least 2025. This restriction likely means subdued loan growth in the near future.

Mortgage Banking Income Declines

The bank’s mortgage banking sector, which includes residential and commercial mortgage activities, has been experiencing trouble. For four years leading up to 2023, the compound annual growth rate (CAGR) for mortgage banking income plunged by 25.7%. Although there was a slight increase in the first nine months of 2024 due to a rise in refinancing, the outlook remains bleak, as mortgage rates continue to be high, resulting in low origination levels.

In 2023, Wells Fargo announced its exit from the correspondent business and scaled back its mortgage servicing operations. Most recently, in August 2024, the bank agreed to sell its non-Agency third-party servicing segment of its Commercial Mortgage Servicing (CMS) business to Trimont, further complicating the situation. With elevated mortgage rates and weak origination, the decline in mortgage banking income is expected to continue in the coming quarters.

Wells Fargo’s Stock Outlook

Despite the challenges, Wells Fargo is seeing benefits from deposit growth, a robust capital position, and a strong liquidity profile. The Federal Reserve’s expected interest rate cuts are likely to lower funding costs, potentially improving the bank’s financial conditions. Additionally, operational efficiency initiatives may bolster profits in the near future.

Analysts Remain Cautiously Optimistic

Recent analyst evaluations have shown a positive shift in the company’s growth potential. In the last week, earnings estimates for 2024 and 2025 have been revised upward in the Zacks Consensus Estimate.

Image Source: Zacks Investment Research

While WFC’s earnings are projected to decrease by 2.95% in 2024, a rebound of 3.52% is anticipated by 2025. Nevertheless, ongoing concerns, such as a reduced loan balance due to the asset cap and declining mortgage income, persist.

Investors should approach Wells Fargo stock cautiously at its current level, waiting for a more favorable entry point. The stock’s Zacks Rank of #3 (Hold) aligns with this perspective. For more investment insights, you can check the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

For Just $1, Access All of Zacks’ Recommendations

We’re serious.

A few years ago, we surprised our members by offering a 30-day trial to access all our stock picks for only $1. There’s no obligation to spend more after that.

While many have seized this opportunity, some hesitated, thinking there must be a catch. This initiative aims to introduce you to our various portfolio services, such as Surprise Trader, Stocks Under $10, Technology Innovators, and others, which secured 228 positions yielding double- and triple-digit gains in 2023 alone.

Download your free report on 5 Stocks Set to Double from Zacks Investment Research.

Bank of America Corporation (BAC): Free Stock Analysis Report

Wells Fargo & Company (WFC): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

To read more on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.